TransUnion SmartMove ensure. About Your Next Move-in Today. Create Your Own Account Today. Quote Online and Get Insured Today! Point Increase in Weeks!

What do landlords look for in a rental credit check? Do landlords need a Social Security number for a credit check? It also helps show whether they can afford to live in your rental property. The tenant must sign and date a document that states they agree to the credit check. But for independent landlords like you, credit checks can sometimes be slow and difficult.

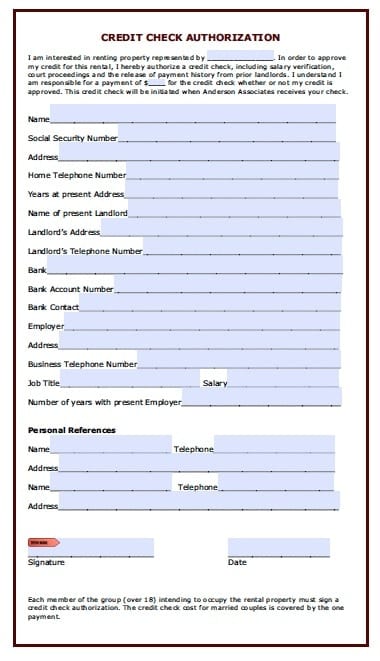

Tenant Credit Checks are objective. To run a credit check , you’ll need a prospective tenant’s name, address, and Social Security number or ITIN (Individual Taxpayer Identification Number), which will typically be on the rental application or consent to background check forms you ask prospects to complete. The application is also the place for applicants to authorize you to run a credit report.

Your applicants purchase their tenant credit report and grant you private access directly through Experian. FCRA Compliant Background Check. Verify applicants meet your minimum credit criteria. All alias names associated with applicant. All previous addresses associated with applicant.

Receive an alert if bank account history is negative. Rent Check AdvisorSM. Those found eligible for a credit as determined by the State Department of Assessments and Taxation will receive a check directly from the State Treasury. Your landlord must give you a completed CRP by Jan.

A hard inquiry , which can temporarily reduce your credit score by five to points, occurs when your credit is reviewed in relation to an application for credit. Understand How Factors Are Weighed Once you receive the of the credit check, you’ll want to dive into the. Run the Credit Check. Use the tenant ’s Social Security number and other provided information to run a credit check with the agency of your choosing. Public Profiles, Public Criminal History, Eviction Records and more!

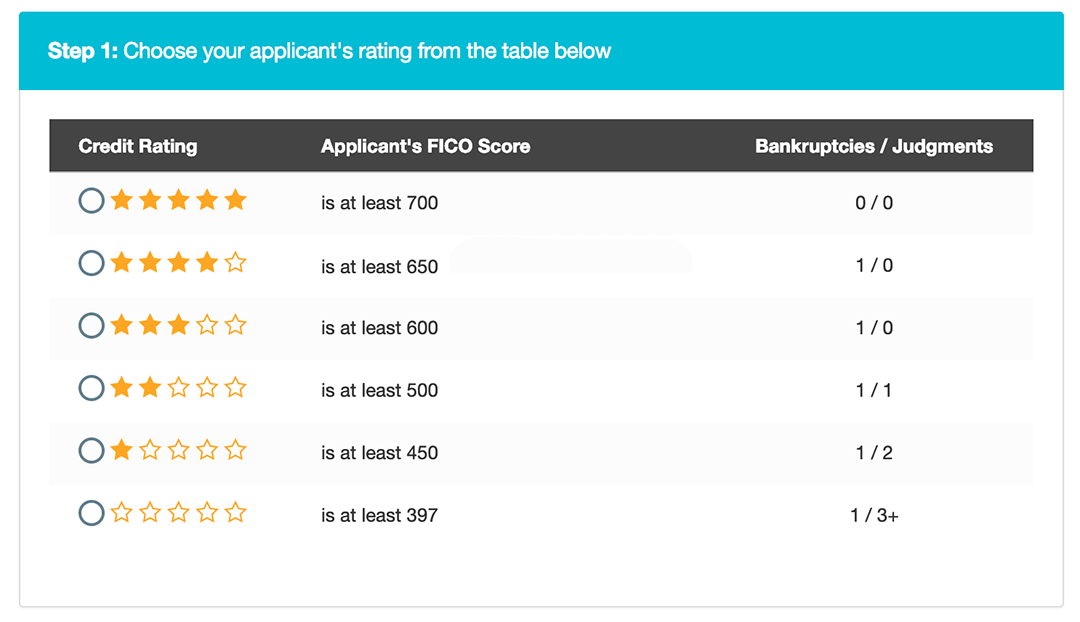

All of the information you need to make the right tenancy decisions. These reports are available as an add-on for $9. You will select a star rating (through 5) that will act as your criteria that the applicant must pass.

They can pay for both reports as a bundle for $39. The turnaround time depends upon how quickly the applicant gives the landlord permission to view their reports. You receive their application, including a background check, credit report and eviction history. You get alerted when an application is ready to review — and can accept it in one click. A portion of your rent is used to pay property taxes.

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Check All Scores In Seconds Or Less. Keep Your Credit Protected. Reports start at just $19.

This report usually contains credit information and prior rental history. Most landlord will not rent to a applicant if they have been evicted before, often referred as a unlawful detainer. We’ll even handle collecting the fee from the tenant so you don’t have to worry about it. Landlords, real estate agents, commercial leasing agents and property management companies can quickly determine the risk of new tenant applicants by leveraging our credit data on more than 2million individuals and million businesses. Where some credit checks may fall short, online tenant screening and background checks from KeyCheck come with advanced eviction history to help complete the overall tenant-picture.

Also, you can collect documents and include reference checking.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.