How to extract Pan from GST? The Next letters is the PAN number of the taxpayer or the company. The Next digits are for Entity code and the Last digit is a check sum number. The next ten digits will be the PAN number of the taxpayer.

First two digit is you state code. The thirteenth digit will be assigned based on the number of registration within a state. If details are available with us, then you will find details. The digits consist of state code, PAN Number of the owner of business, Entity code, blank code and lastly the check digit.

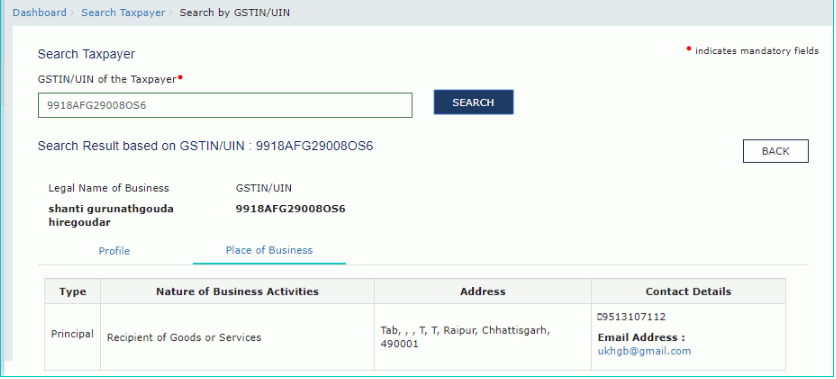

STATE CODE – = PAN NUMBER = Business vertical number in the same state. Here is the GSTIN number of the Company you are looking for. A GSTIN is a unique, 15-digit PAN identifier allocated to each registered person under GST.

A person can use the PAN number of the registered taxpayer to get the information about the name of the trade and the state in which the business is conducted. You can receive details about the trade name of the company by the of GST. It is a 10-digit unique alphanumeric number. It is granted to Individuals, Company, Association of Persons, Body of Individual, Hindu Undivided Family, Trusts, Government Agencies, Co-operative Society and also those whose income are taxable under the.

Make sure you should enter the initials of state with characters of the business so you find the most relevant answer. Government has provided new PAN based search service to get the GSTN, State, and Status. To get the the details of the company using gst number search using pan number , first enter the pan number of gstin you want search.

GSTIN or Goods and Services Tax Identification Number is your unique business identity with the GoI (Government of India) that contains digits alpha-numeric PAN based code. Similarly each state is given an identification number. Lodge your Grievance using self-service Help Desk Portal. GST Number Definition.

Since the digit GSTIN i. Earlier this facility was not available. The digits after the state code are the PAN number of the taxpayer. The 13th digit will be assigned based on the number of registration within a state. The 15th digit will be the check code, it may be alphabet or number. It is derived by a mathematical formula on the basis of first characters.

Checksum is used in various areas to check the validity of a number without searching in the database. Know PAN Number , Sales Tax Dealer Name and Address, Sales tax Registration Date based on TIN or CST Number. Know your pan service is a nothing but a service of pan verification by name. AO – Area Code, AO Type, Range Code and AO Number. Applicants for PAN are required to provide the AO code in their pan application.

Knowing the differences and meaning of these three letter words is important for any Entrepreneur or Business Owner. Permanent Account Number ( PAN ) PAN Card is a Permanent Account Number that contained 10-digit alphanumeric characters and is assigned to all taxpayers in India. Once PAN of partnership firm receive apply for registration under GST. If both are matching, then PAN captured in the DSC is correct.

What is that hash value? To overcome this issue, we use an algorithm called sha256. As GSTIN will be used for the purposes mentione it thereby assumes importance as identifier at the transaction level.

The th digit denotes the registration number of the taxpayer with the same PAN number. The th digit is the check digit – can be a number or an alphabet. For persons who are not required toc, the PAN number shall work as a IEC code.

Share the details on the form above and make payment on next page to get your New Registration and ARN number. The GSTIN number shall come in a few days. Also, ensure that there is no blank space at the end of name entered.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.