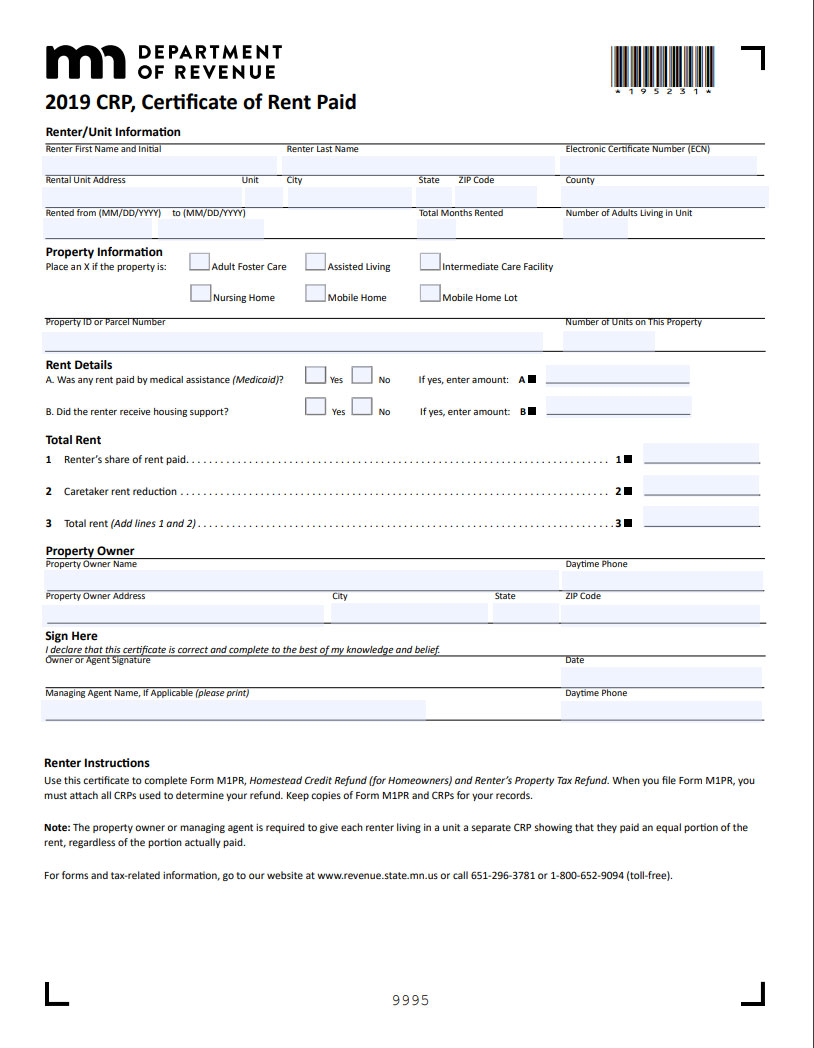

Property owners and managing agents who are registered in e-Services as a business now have the option to bulk upload renter information and submit CRPs to Revenue electronically. Currently, this is only available for registered e-Services users. A managing agent acts on behalf of the property owner.

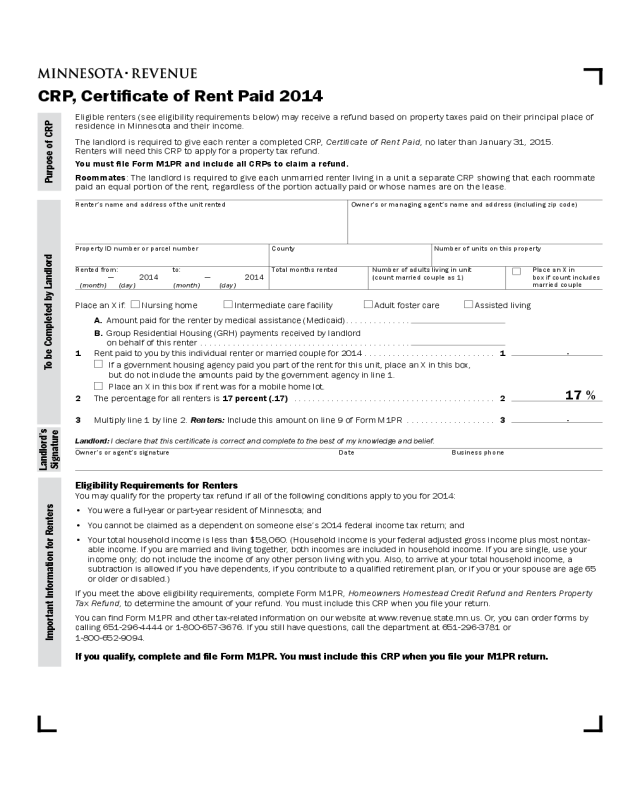

Married couples must receive separate CRPs showing they each paid an equal portion of rent. What is MN property tax? When are property taxes due MN? This form must be filed by January 31.

Some CRPs may have been completed with a mistaken amount on line B. OWNER OR MANAGING AGENT TO FURNISH RENT CERTIFICATE. Minnesota Statutes 290A. If you own, use your Property Tax Statement.

There are several screens related to the CRP, so it is important that you continue through the screens and answer all of the questions. CRP instructions below. Look for a page titled Other Forms You May Need. Check the first box, Property Tax Refund (Form M1PR).

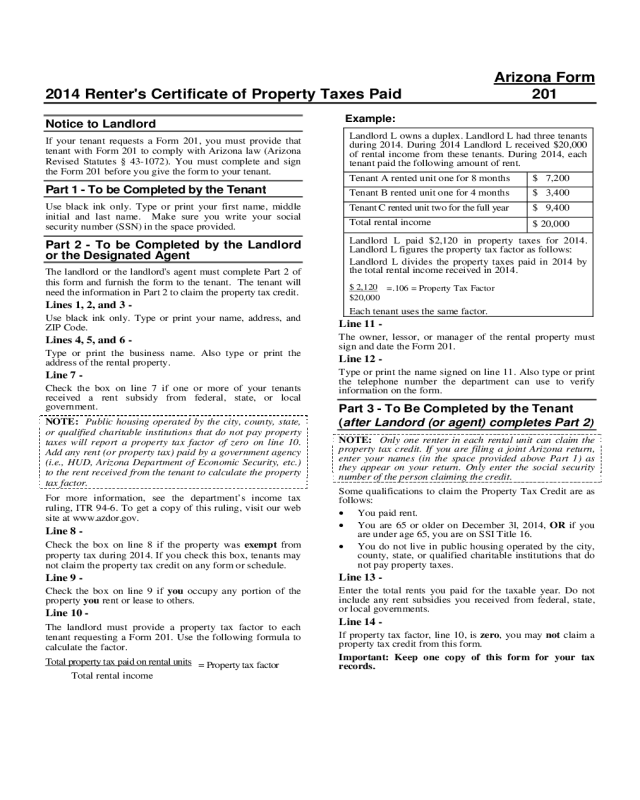

Only attach rent certificate if filing a homestead credit claim Do NOT sign your rent certificate. Schedule M1PR is filed separately from the individual income tax form. Take full advantage of a digital solution to create, edit and sign contracts in PDF or Word format online. If there are several roommates in the apartment, the landlord must furnish the certificate of rent paid to each of them. The system must be 2. How many renters receive refunds, and what is the total amount paid ? For more information, see.

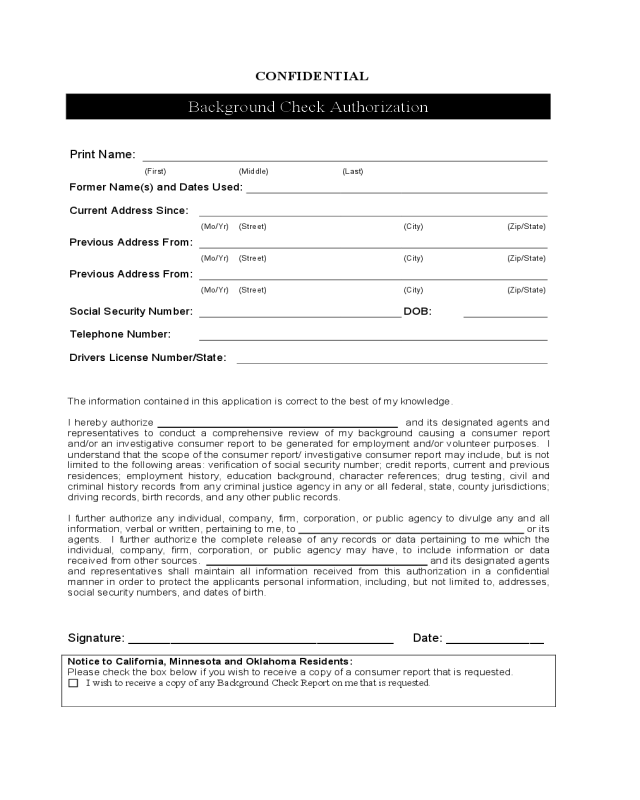

A tenant must follow the other terms of the lease while paying rent into escrow. Tenant Remedies Action. Available for PC, iOS and Android. Start a free trial now to save yourself time and money! Rent Certificate Form Centrelink.

This law does not apply to tax-exempt properties or members of a manufactured mobile home park cooperative. Fill out the top part of the form (name, address, SSN, date of birth). Deducting rent on taxes is not permitted by the IRS. However, if you use the property for your trade or business, you may be able to deduct a portion of the rent from your taxes. Landlord Information.

Do not include security deposits or late fees. Number of occupants in this rental unit – do NOT count spouse or children under 18. Bring your provider’s name, address, and tax ID or Social Security Number. You can file for a tax credit refund any time before August of each year. Each year, the cost of doing business rises including employer- paid health care contributions, FICA, Medicare, salary and compensation-related costs, rent and leases, fuel and utilities, and IT services.

Try contacting the landlord that gave it to you. Although outmoded and offensive terms might be found within documents on the Department’s website, the Department does not endorse these terms. This course will cover the procedures to generate CRPs in Yardi Voyager including the distribution process and requirements.

This information is used in conjunction with information entered in Screen MNPR to calculate Form M1PR as a renter and is included in electronically filed returns. A Housing Authority will pay a portion of the rent directly to the property. Once you have completed entering your information, to determine the amount of your Property Tax Refund on your return, click on MN Refund (or Amount Due) in the upper right corner of the screen.

In the tax summary box, select.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.