Browse trusts templates and examples you can make with SmartDraw. The five main types of trusts are living. What is a trust business structure?

Structure of PLife REIT The following diagram illustrates the relationship between PLife REIT, the Manager, the Trustee and the Unitholders: Refers to the properties acquired by the Trust , whether directly or indirectly held through the ownership of special purpose vehicles. You can edit this template and create your own diagram. Creately diagrams can be exported and added to Wor PPT (powerpoint), Excel, Visio or any other document. Use PDF export for high quality prints and SVG export for large sharp images or embed your diagrams anywhere with the Creately viewer.

Combining trusts with limited partnerships makes for a powerful family asset protection device. However, combining a trust with a limited partnership is a more complicated structure than using either alone. Combining the family limited partnership with the living trust can provide a superior estate plan.

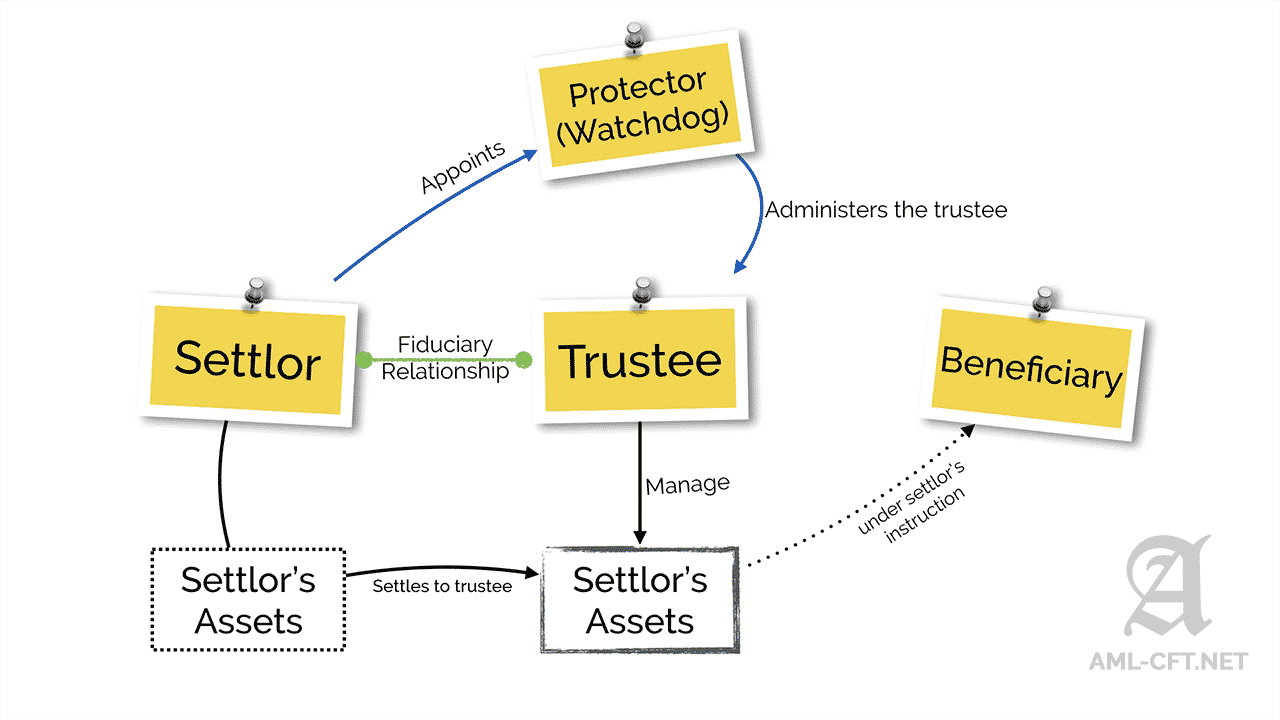

A trading trust is usually an entity that holds property (capital) for certain beneficiaries. This type of business structure is formed when a gift or settlement is made to a trustee (a person or a company) on behalf of a yet-to-be-formed trust. A trust is not a separate legal entity. A summary of how the National Trust ’s governance structure works Here’s a brief summary of our governance structure and the role of the various groups involved.

An AB trust is created by establishing a living trust with an AB provision. The trust remains revocable while both spouses are alive. Thus, the couple may withdraw assets or cancel the trust completely before one spouse dies.

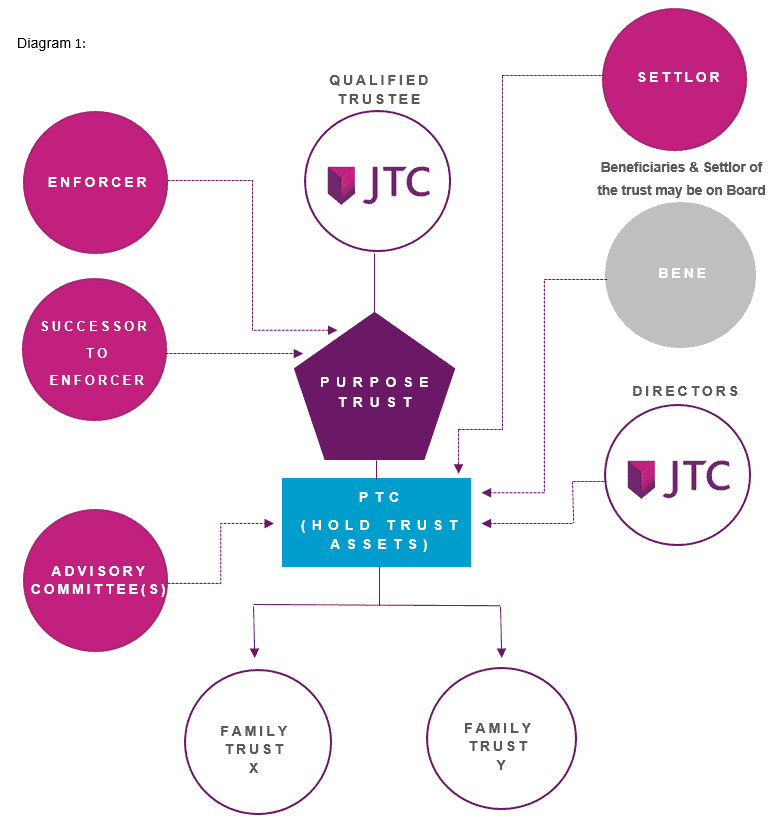

Trust Structure The following diagram illustrates the relationship between MNACT, the REIT Manager, the Property Manager, the Trustee and the Unitholders. However, in states that collect separate estate tax, traditional AB Trust planning can cause part of the B Trust to be taxed when the first spouse dies. Trusts are a popular investment structure , but are often poorly understood. Briefly, the trust is formed by executing a deed which documents the establishment of the trust.

The A Trust is also commonly referred to as the Marital Trust , QTIP Trust , or Marital Deduction Trust. The B Trust is also commonly referred to as the Bypass Trust , Credit Shelter Trust , or Family Trust. In engineering, a truss is a structure that consists of two-force members only, where the members are organized so that the assemblage as a whole behaves as a single object.

It can refer to the main fund where assets are pooled and collectively managed in a master. Trust Governance Structure Diagram Text version. The Bishop Wheeler Catholic Academy Trust is committed to promoting and safeguarding the. A Dynasty Trust is a trust that continues for approximately 1years or longer and provides payments to future generations, without any additional estate or generation-skipping transfer taxes. This is different from the standard estate plan whereby husband and wife usually leave all of their assets outright to their children equally when the.

The grantor, who puts his property into the trust , assigns a trustee to administer the trust on behalf of a beneficiary. There are several types of living trusts. This trust structure prevents any generation skipping tax at the death of a child for an estate up to $00000. A More Complicated Solution if Parents Have More Than. Disadvantage of operating with a unit trust structure is that it cannot distribute capital or revenue losses to its beneficiaries.

Hence, when a trust incurs a loss beneficiaries are not able to offset that loss against any other assessable income that they may derive from other sources such as salary, interest, dividend etc. An aircraft trust is set up to give the airplane ownership to a trustee who meets the FAA registration requirements on behalf of the true owner. In the trust , the true owner is known as the trustor or trust beneficiary. The title and registration are held in the trustee’s name. COMPARISON OF FAMILY TRUST vs OTHER STRUCTURES This chart is intended to provide a quick guide to factors bearing on the selection of trading and investment structures.

Each structure is evaluated by reference to the same criteria, in order to allow for a ready comparison. Structure of the Trust The Trust Boar its Committees and our Local Governing Boards (LGB) and their Committees follow our Trust Approach to Governance and Scheme of Delegation. Our multi academy trust is a single legal entity, a charitable company, with a board that is accountable for all of the academies within our Trust. Similar in some ways to a corporation, a revocable living trust is an “entity” created for the purpose of managing or distributing a person’s property. Under your direction, assets are transferred or renamed from you as the “titled” owner, to you as the “trustee” owner, under the name of your revocable living trust.

While many will consider holding investment assets in a trust , they overlook the fact that for an SME business owner the business is usually the family’s single. The roof truss structure and design is integral to roof structural integrity and shape. This article and series of illustrated diagrams shows you all the parts of a basic roof truss, king truss and queen truss.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.