Input the amount from step into the Withholding look-up tool (XLSX 58KB), as per instructions in the tool. This is great for comparing salaries, reviewing how much extra you will have after a pay rise or simply keeping a quick eye on your tax withholdings. When you start a new job or get a raise, you’ll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isn’t a simple matter of multiplying your hourly wage by the number of hours you’ll work each week, or dividing your annual salary by 52. What is tax withholding calculator?

How do you calculate fortnightly earnings? How does the federal government collect your income tax? You can personalise this tax illustration by choosing advanced and altering the setting as required. After changing the advanced tax calculator setting, click on calculate to recalculate your tax deductions based on the latest Australian Tax Tables. If you are an employer or another withholding payer, the tax withheld calculator helps you work out the tax you need to withhold from payments you make to employees and other workers including working holiday makers.

If you input your salary as a weekly or fortnightly income , a little more tax will be withheld. Otherwise, your weekly or fortnightly payments will be divided by the exact number of payments in the year. See How Easy It Really Is! Us Deal with the IRS. Get Peace of Mind Support Guarantee!

The calculations provided should not be considered financial, legal or tax advice. Enter your income and location to estimate your tax burden. The ATO publish tables and formulas to calculate weekly , fortnightly and monthly PAYG income tax instalments that can vary from the annual tax amounts. The reason is to make tax calculations simpler to apply, but it can lead to discrepancies.

Once again, if your employer uses ATO tax tables to calculate your pay, you will be overpaying $in tax if you earn $80per year and getting paid fortnightly : ATO fortnightly tax deductions - $844. Use the simple fortnightly tax calculator or switch to the advanced fortnightly tax calculator to review NIS payments and income. If you make $50a year living in New Zealan you will be taxed $745. That means that your net pay will be $42per year, or $4per month.

Your average tax rate is 17. This includes taxpayers who owe alternative minimum tax or certain other taxes, and people with long-term capital gains or qualified dividends. How to use the advanced tax reform calculator. The calculator above can help you with steps three and four, but it’s also a good idea to either double-check the calculator by using the payroll tax rates below, or save time and effort by using a reliable payroll service. Fortnightly Tax Reform Calculator.

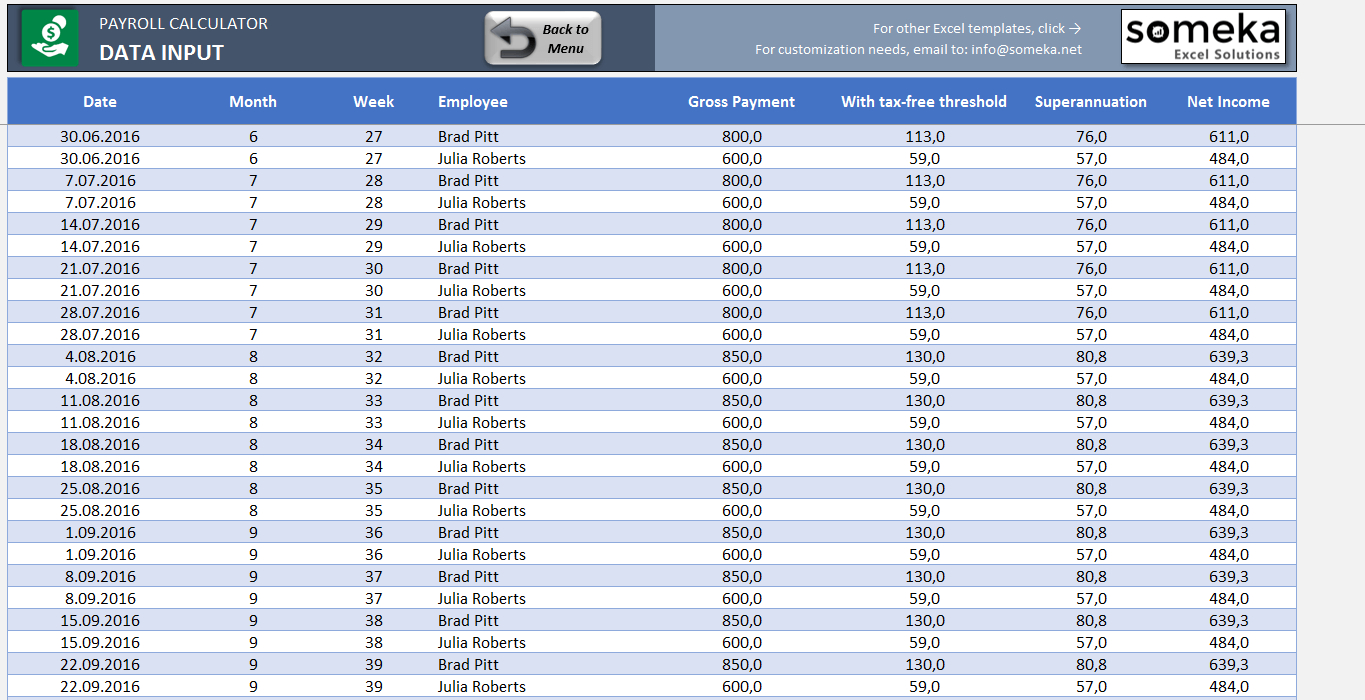

Use the fortnightly tax table if you pay salaries on a fortnightly basis. Calculate your employee’s total fortnightly earnings – add any allowances and irregular payments that are to be included in this fortnight’s pay to the normal weekly earnings, ignoring any cents. Employers and employees can use this calculator to work out how much PAYE should be withheld from wages. Appointment for Acting Commissioner of Tax - Small gains to Report 14. Overview of New York Taxes New York state has a progressive income tax system with rates ranging from to 8. Our Tax Calculator uses exact ATO formulas when calculating your salary after income tax.

ATO tax withheld calculator or tax tables provided by the Australian Taxation Office (ATO), which your employer uses to calculate PAYG tax , rounds your income and taxes to the nearest whole figure, hence you may have some discrepancies with your actual pay on your payslip. Which tax year would you like to calculate ? Income Tax Calculator. It is mainly intended for residents of the U. The that the calculator give you are calculated with consideration to the most recent income tax and social security information available. A free calculator to convert a salary between its hourly, biweekly, monthly, and annual amounts. Adjustments are made for holiday and vacation days.

Experiment with other financial calculators , or explore hundreds of individual calculators covering other topics such as math, fitness, health, and many more. Health Surcharge is $8. Superannuation paid by your employer (standard rate is of your gross earnings). Medicare Levy (only if you are using medicare).

This simple PAYE calculator is perfect for checking what percentage of your pay is going to tax , student loans and KiwiSaver. More importantly, it will tell you exactly how much of your hard earned dollars you actually get to take home! Goods and services tax (GST). Claiming depreciation calculator. Property tax decision tool.

Estimate your Working for Families Tax Credits.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.