Are tax refund loans a bad idea? What is a homestead refund? How to claim a Texas homestead credit? Policy statements that provide added interpretation, details, or information about Minnesota tax laws or rules.

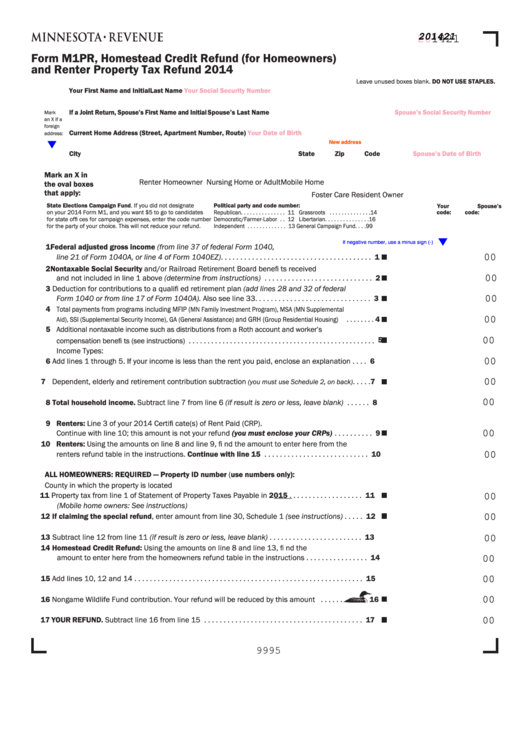

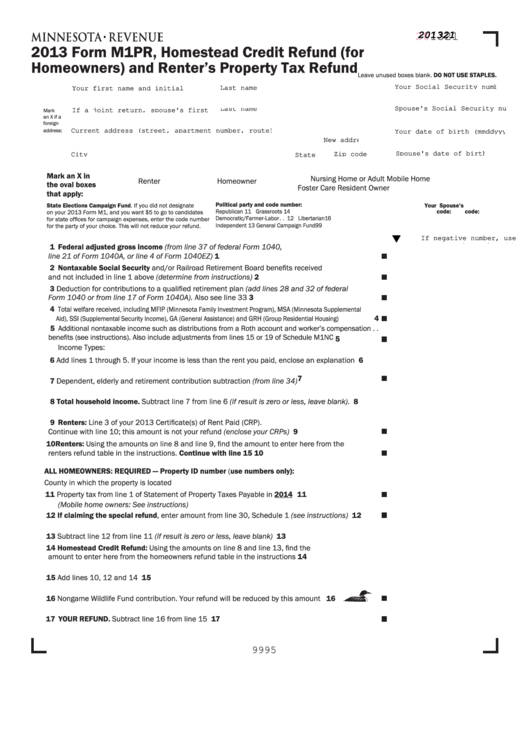

See the Form M1PR instructions for filing details. The change affects those that received or paid alimony. Homestead Property Tax Credit.

Your refund percentage is based on your total household income. All Major Categories Covered. The homestead credit refund is a state-paid refund that provides tax relief to homeowners whose property taxes are high relative to their incomes. The program was previously known as the homeowner’s property tax refund program, or PTR, and sometimes popularly called the “circuit breaker.

If you are a homeowner you may also be eligible for a special property tax refund. This refund has no income limit and the maximum refund is $000. Just remember, you are not entitled to a cap in value increase the year after a purchase. For most homeowners, the benefit is distributed to your municipality in the form of a credit , which reduces your property taxes. The refund is based on a portion of the property tax paid on a Kansas resident’s home.

The homestead property tax credit is a North Dakota property tax credit that reduces the property taxes of eligible individuals. If your amended Schedule H or H-EZ has increased the amount of your homestead credit , you will receive a refund for the additional amount. An additional exemption of $10for over or disabled taxpayers applies in some areas.

Timely-filed current-year Homeowner refunds are typically issued by the end of September. Qualified renters receive a partial refund of their rent. For a husband and wife who are living together, only one may apply for the credit. If your return is incomplete or necessary information is not enclose your refund will be delayed or your return will be sent back to you.

Homeowners who qualify for the homestead tax credit and who are either age or older or who are disabled are entitled to additional property tax relief. The taxable assessed value of currently-owned homestead properties can be “frozen” as of the date of the homeowner’s th birthday or the date of disability. If a person who is age or older or who is disabled purchases a homestead property, the taxable assessed value of the residence can be frozen as of the date of purchase.

This may not happen every year - the payments are not guaranteed. I should have been more specific! Form M1PR requires you to list multiple forms of income, such as wages, interest, or alimony. The maximum refund is $820. Special property tax refund.

You may file Form M1PR and claim a refund for up to one year after the original due date. The typical processing times for homestead refunds vary depending on the way that the claim was filed. An e-filed claim will take approximately one full week from the day that the acknowledgment was received. Discuss this matter with your attorney or closing agent so they can negotiate on your behalf. They’re called “homestead” exemptions because they apply to primary residences, not rental properties or investment properties.

The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used as the owner’s principal residence. You must live in the home to qualify for the tax break. See Section 9-1Tax-Property Article of the Maryland Annotated Code. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for taxes and fees, processing nearly $37. Enforce child support law on behalf of about 020children with $1.

Description: Property owner must certify to the assessor that they no longer own the property or have ceased to use the property as a homestead claimed for a homestead tax credit.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.