For details on these and other changes, see What s New in these instructions. Below is a general guide to what Schedule(s) you will need to file. Have additional income, such as unemployment compensation, prize or.

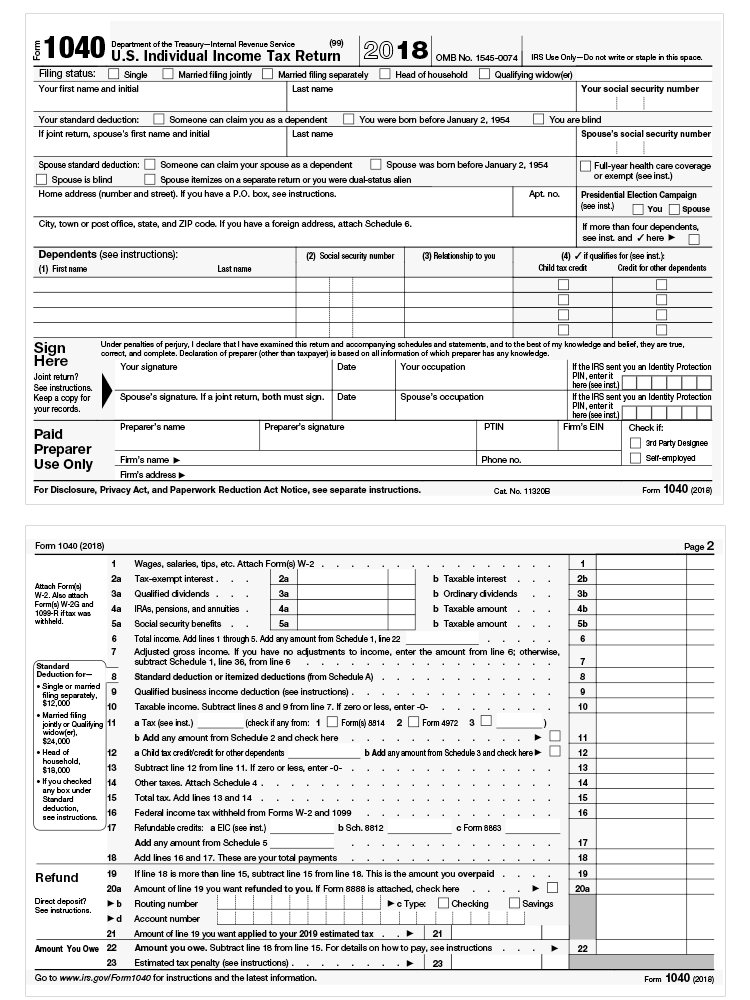

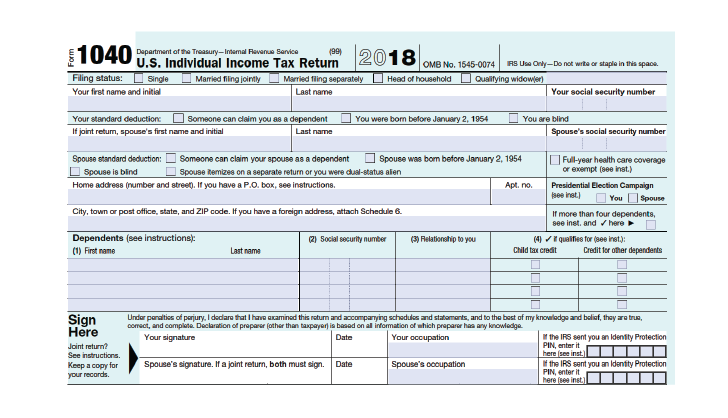

See full list on apps. Employer-provided adoption benefits, which should be shown in box of your Form (s) W-with code T. Individual Income Tax Return. There are several notable changes to the form proposed for the tax. Ultimately it determines if you owe taxes or if you are getting a refund. Make sure to have any support documentation available if requested.

If you are claiming a property tax credit, you must enter the county in which your property is located and the property number on Schedule ICR, Illinois Credits. Register and subscribe day free trial to work on your state specific tax forms online. Prevent new tax liens from being imposed on you. You may want to consider using tax software to complete your return.

Then ask a tax accountant to review it for accuracy. Make use of a electronic solution to generate, edit and sign contracts in PDF or Word format online. Turn them into templates for numerous use, include fillable fields to collect recipients? Do the job from any gadget.

In general, you will skip the line items that do not apply to you. When it comes to taxes, most people would like to keep it as simple as possible. So much time spent on paperwork…File in minutes using a simple online form.

Access IRS Tax Form s. Complete, Edit or Print Tax Form s Instantly. Enter the smaller of line or line 44. Changes include a larger font, no shading (shaded sections can be hard to read) and a standard deduction chart. Finalized versions of the forms for the tax year (which in the US is the same as the calendar year) are released near the end of January of the following year.

Provided care for a disabled veteran who is related to you and lived with you, you may be eligible for a Wounded Warrior Caregivers Credit. Automate entire workflows from generating documents to exporting data to your records. Eliminate paper-based routine processes with no-code automation Bots.

The form ’s basic setup has remained mostly the same over the past century. There isn’t much of a difference between the two though, the only thing that stands out is the size of the boxes the texts. For more information about the Federal Income Tax, see the Federal Income Tax page. Detailed instructions and worksheets are available from the IRS to aid in the calculations.

You will need to locate instructions for the referenced form or schedule to complete it. The instructions on this new form may change to fit the newly formatted tax return. Irs Instructions A Form. Just put your data into blank fields and put your signature.

Print, save or send your document immediately. No software is needed. Mobile and tablet friendly services. This number will be included on line of the Section 9Election Tax Worksheet.

In addition, the Child Tax and Education Credits are not allowed for non-dependents.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.