Free, no obligation qutoes. Will I qualify for a commercial real estate loan? What are current real estate loan rates?

Small Business Administration (SBA) financing is subject to approval through the SBA 5and SBA 7(a) programs. What is commercial property mortgage? Subject to credit approval. Some restrictions may apply. Available to customers with an established Wells Fargo business checking or savings account, for their owner-occupied property.

Commercial Real Estate Equity Loan. No lender closing costs. No escrow, title policy, or appraisal fees.

In the world of business real estate financing, lenders expect the borrower to repay the entire business advance earlier than the due date. They do this by including a balloon repayment stipulation. This means that the borrower pays on his 30-year mortgage as usual for a few years with principal and interest payments, and then he’ll have to pay off the entire balance in one fell swoop, or one balloon payment. But a balloon loan could be a recipe for disaster, especially if the borrower is not.

See full list on mortgagecalculator. The loan is then scrutinized by underwriters, and these are seriously picky people. They want to meet you (and sometimes your business associates) before deciding if they should lend you money. Once the loan application has gained.

Even before you apply for the advance, inquire about the necessary documentation. Corporate documents 2. Personal financial recordsThe more documentation require t. If your interest rate is percent with two points, the real cost of borrowing the money is percent. In some instances, these charges and hidden fees can add up to tens of thousands of dollars, so you need to fin.

Non-bank lenders (such as silent investors, for example) are usually less strict about their eligibility requirements, and many are willing to loan you money without including the early balloon repayment stipulation. However, they do carry slightly higher interest rates. There are some other disadvantages to non-bank commercial property borrowing, namely the high e. An investment property loan would allow you to purchase a property to renovate and resell for a profit. Simplified application process. Mortgage loan interest rate in Russia.

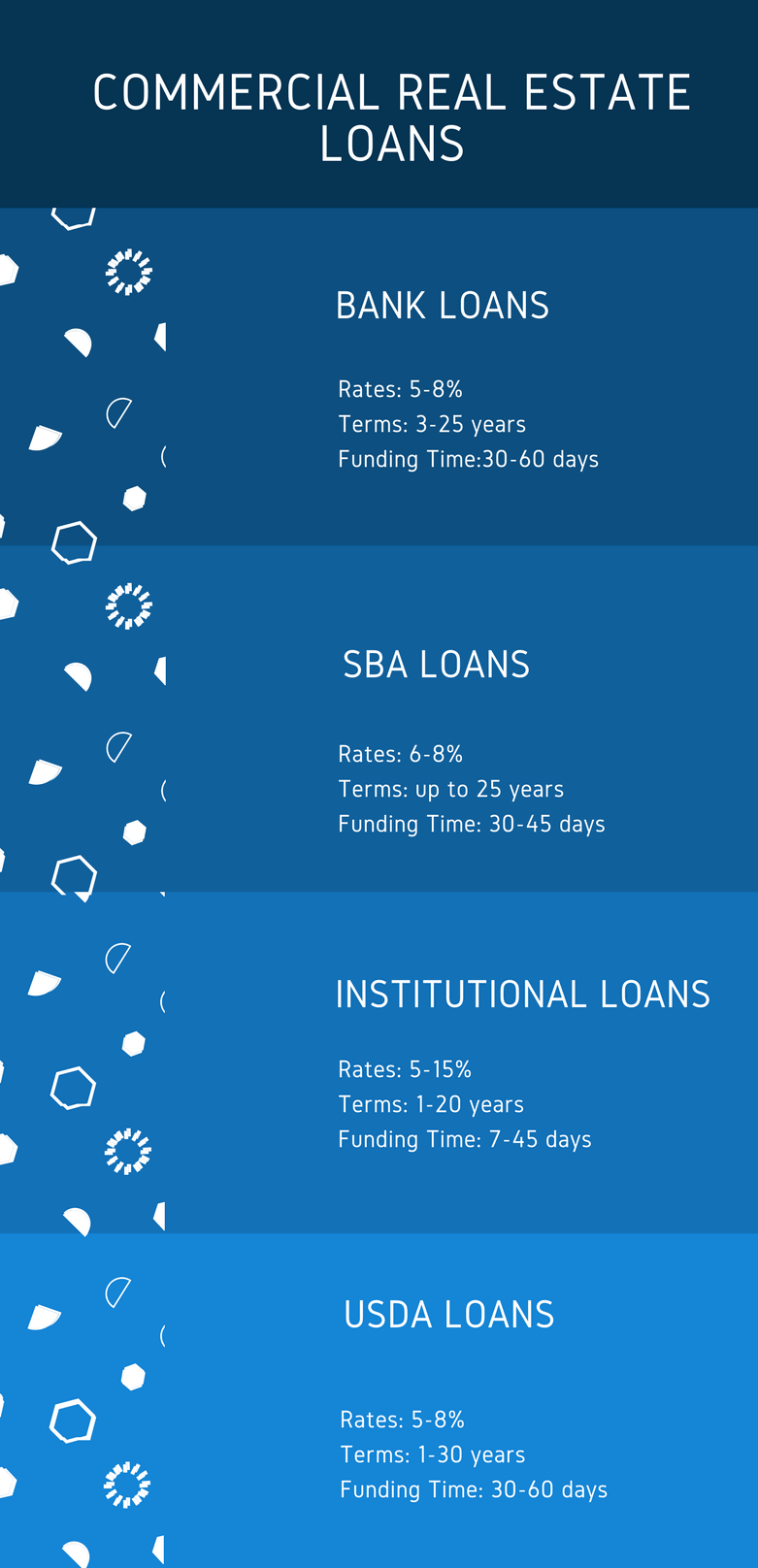

Real Estate, Landlord Tenant, Estate Planning, Power of Attorney, Affidavits and More! A permanent loan must have some amortization and a term of. SBA Loans are written by traditional and non-traditional lenders but are guaranteed by the SBA.

Lenders usually require that the property be owner-occupie meaning that your business will have to occupy at least of the building. A purchase loan, as the name suggests, is designed for purchasing property. This type of financing comes in large loan amounts with long repayment terms (up to years).

The 1percent commercial loan for real estate almost always requires that you already own the. SBA Financing for Purchase, Refinance or Construction. This program can be used by an existing businesses not just. A traditional commercial property loan typically finances anywhere from — of an asset’s loan-to-value ratio.

As a result, borrowers will often be expected to cover anywhere from — of the property’s fair market value. Loans for purchase and refinance, including cash-out. That sai there is usually no loan maximum.

Obtaining a commercial loan is a similar venture to that of acquiring a private loan , with the primary difference being that the mortgage in question goes towards the cost of a licensed commercial property rather than a residential home or living space.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.