The IRS would like people to know more about this tax. Income Subject to Tax. The tax applies to the amount of wages, self-employment income and railroad retirement (RRTA) compensation that is more than a threshold amount. If your income is equal to or more than $4100.

See full list on fool. It applies to taxpayers above a certain modified adjusted gross income (MAGI) threshold who have unearned income including investment income , such as: Taxable interest. Nonqualified dividends. Medicare surtax, to fund Medicare expansion. His excess amount is $200 or $220less $20000.

Barney and Betty are married and they file a joint return. Who has to pay irmaa? If you had too little tax withhel or did not pay enough estimated tax , you may owe an estimated tax penalty. For more on this topic, see Publication 50 Tax Withholding and Estimated Tax.

IRMAA amounts are based on a beneficiary’s. For instance, if you make $300per year, you and your employer each pay the standard 1. Even if you are self-employe the 2. To help fund the Affordable Care Act (also dubbed Obamacare), there was a 3. Most people receive premium-free Part A. The tax is paid on the lesser of (1) the taxpayer’s net investment income, or (2) the amount the taxpayer’s AGI exceeds the applicable AGI threshold ($200or $25000). Depending on your income for MLS purposes, the MLS rate is , 1. The possibilities include freelance writers who provide articles on tax tactics for websites and print publications that cater to attorneys, accountants, enrolled agents and financial planners, among others. Let’s pivot to the surcharge of 3. Earlier columns touched on it.

Employers are responsible for withholding the 0. This one delves deeper into it. Navigate Health Insurance. NOTE: When the Internal Revenue Service (IRS) provides us with the tax filing status of married filing separately, assume the couple lived together at some point in the tax year.

The law provides higher IRMAA levels. Now, look at that phrase modified adjusted gross income — IRS jargon that only an accountant could love. If you file your taxes using a different status, and your MAGI is greater than $800 you’ll pay higher premiums. The tax applies to wages from employment, self-employment income and railroad retirement income, but if you are receiving W-income, the tax will most likely be withheld from your wages. Your MAGI is the total of your adjusted gross income and tax -exempt interest income.

The tax is automatically deducted from your paycheck each month and is a tax on your earnings, including wages, tips, certain Railroad Retirement Tax Act (RRTA) benefits, and self-employment earnings that fall above a certain level. But your monthly bill could be between $146. You withhold the surtax from employee wages, but there is never a matching payment required by the employer. Social Security tax and the 1. You may have dreamed of a tax -free retirement.

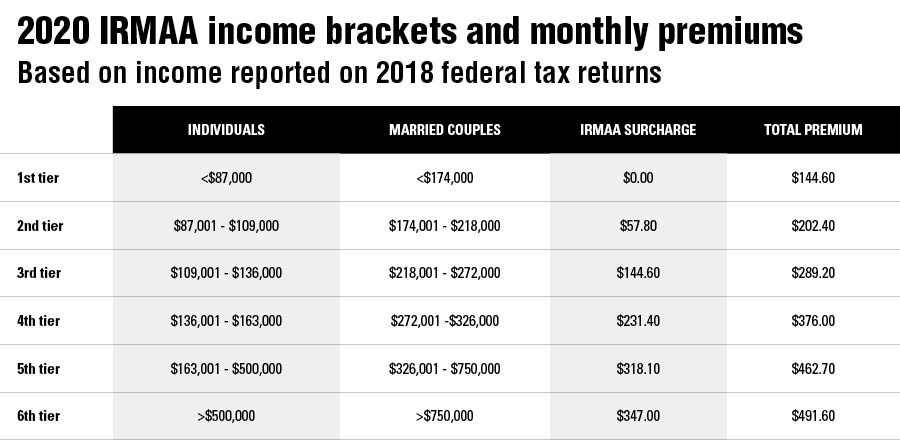

The main point of the levy surcharge is to encourage residents to purchase private health insurance at a young age and use private hospitals and other benefits to reduce the. FICA tax is a combination of a 6. A handy reference table of the tiers follows. You do not consider a loss from self.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.