If a supplier has applied for an ABN you can offer to hold payment until they have obtained and quoted their ABN. What is the tax withholding for an ABN? If tax is not withheld because an exception applies, sufficient evidence of that must be held. This means keeping records which: 1. See full list on atotaxrates. A Voluntary Agreement can only apply to individual contractors with an ABN who are not employees, for which the tax withholding rate will be either of 1. Generally if a rate is not known at the time of payment, the rate of must be used.

GST (if any) is excluded from the withholding calculations. For a Voluntary Agreement to be effective, the relevant Tax Office form must be fully and correctly completed. See downloadable PDF link here. Taxpayers pay the tax as they earn or receive income during the year. Taxpayers can avoid a surprise at tax time by checking their withholding amount.

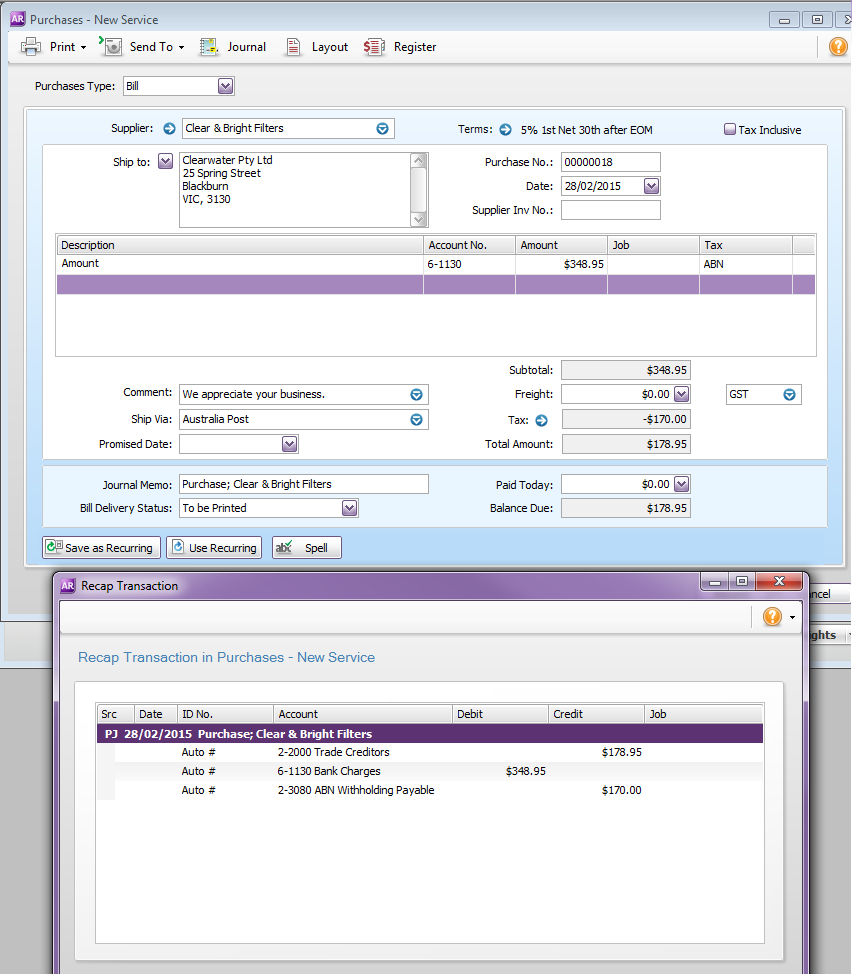

If the ABN quoted on the invoice is not valid or the details do not match the supplier, you must withhold tax at the rate of from the payment. Currently, I enter the expense as $348. They can quote their ABN on an invoice, or some other document that relates to the goods and services they provide. Certain suppliers are not required to quote an ABN to a payer. ABN is provided you’re required to withhold ‘ no ABN withholding tax.

You can find further information about no ABN withholding on our website. A sole trader business structure is taxed as part of your own personal income. Proposed exceptions An exception is provided where an employer “honestly believes their employees are acting as contractors” and an ABN has been provide even if the Tax Office doesn’t agree with the employer’s position. Most states also permit “single-member” LLCs, those having only one owner. There is no maximum number of members.

A few types of businesses generally cannot be LLCs, such as banks and insurance companies. The legislation is here. Check your state’s requirements and the federal tax regulations for further information. Ask questions, share your knowledge and discuss your experiences with us and our Community.

Medicare tax withholding of 1. As a result of the increased surcharge, the effective tax rate for individuals in the Rs. No ABN means you need to withhold just as you would with any supplier that fails to provide an ABN (or provides a Statement by a supplier showing they don’t need one). Any amount withheld because of failure to provide an ABN goes on the.

Reconciliations, certificates and monthly reporting Make sure you understand your non-resident withholding tax (NRWT) deduction and reporting obligations. This applies to all residents, non-residents and working holiday visa holders. If the supplier does not provide an ABN and the total payment for goods and services is more than $(excluding GST) you generally withhold the top rate of tax from the payment and pay it to us. Queensland Shared Services. Client with only a withholding payer number and no ABN cannot lodge tax declarations or payment summaries.

Tax is deducted at the top marginal tax rate. This is the withholding tax amount that has been. Withholding if ABN not provided. For help with PAYG (non ABN ) withholding tax , contact QSS taxation.

Non-resident withholding taxes are a final tax on certain Australian sourced income that is not subject to income tax. Australian expatriates or foreign investors who are non-resident for Australian tax purposes pay these rates of withholding tax on certain Australian sourced investment income. Mr Frydenberg said the Budget is “back in the black”, announcing a budget surplus of $7. In these circumstances, no withholding is payable.

Under no circumstances can you withhold in excess of this rate. Instalments towards your own tax once you are in the pay as you go instalments system. Income tax return: - To report your personal and business income and claim deductions.

Identify the penalty rate to be applied if a supplier does not provide an ABN.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.