What happens if I apply for an ABN? Is partnership required to pay superannuation? What is an example of a partnership? What do you need to know about an ABN? A successful application.

Amounts you take from a partnership are not wages for tax purposes. PAYG) tax on payments you get. Is this the first time in business for the partnership ? Is the partnership owned or controlled by Commonwealth State Territory or Local Government?

Opens a modal dialog. ABN and their ABN details. Apply for a TFN for business Companies, trusts, partnerships, deceased estates and many other organisations can apply for a tax file number (TFN) online. Once you have your ABN, you can deal with us online using myGovID and Relationship Authorisation Manager (RAM ). Partnership HealthPlan of California (PHC) is a non-profit community based health care organization that contracts with the State to administer Medi-Cal benefits through local care providers to ensure Medi-Cal recipients have access to high-quality comprehensive cost-effective health care.

Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. By submitting this form, I declare that register- abn. Even if your business isn’t going to register for GST, you still need an ABN. Your business will use its unique number to identify itself when dealing with the government, other businesses and the public.

Many business owners run more than one business. Thankfully, you don’t always have to do this. It is the simplest and cheapest business structure. You can employ other workers, but you cannot employ yourself.

A business name application should take you around minutes to complete online. New business application. You may apply for an EIN online if your principal business is located in the United States or U. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN).

You are limited to one EIN per responsible party per day. The “responsible party” is the. This guide explains how to apply for a business name if the holder is a partnership. Other business name holder types will result in different screens and questions being asked. Read this handy guide first.

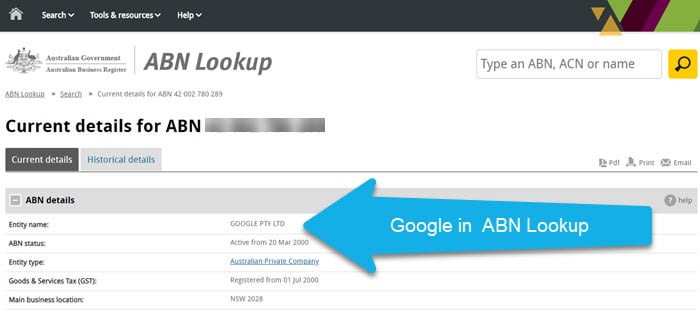

Business or company registrations. When it comes to starting a business , you want to make sure you’re registered correctly, and that begins by applying for an ABN. This is the first step to legally creating your business and must be done before you begin trading.

Your application will need to include a nominated supervisor, who must be a partner or employee of the business and hold an individual contractor licence or qualified supervisor licence. Know how to apply for Tax ID EIN Number for your business. Here is the answer for your questions.

If you operate a partnership , company or trust. Most businesses can apply for a TFN when they apply for an ABN. You’ll need a separate TFN for your business. Use your individual TFN when you deal with the ATO.

If you don’t have one, you can apply for an individual TFN on the.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.