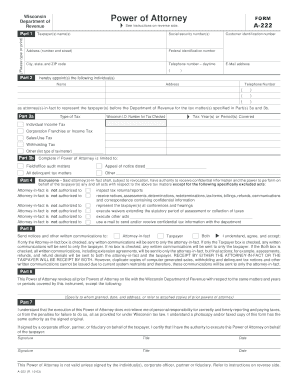

All Major Categories Covered. A-2(Please print or type) Spouse’s last name Spouse’s first name. Taxpayer’s last name or business name Taxpayer’s first name. City Current address.

ID number Spouse’s ID number. Use of Form A-2is not mandatory. What is a power of attorney in Minnesota? You can download or print current or past-year PDFs of Form A-2directly from TaxFormFinder.

On any power of attorney ( POA ) form, you may elect to have your appointee receive all of your mail including refunds and refund correspondence. This authority expires when you remove the POA or it expires. Ask for Help Online and Certified Attorney s Will Answer.

Talk to Legal Professionals Online and Save Time. Get Step-by-Step Guidelines Now. Typically, the chosen representative will be a Certified Public Accountant (CPA) or Tax Attorney due to the risks of improper tax filing, though any. Any person, including my agent, may rely upon the validity of this power of attorney or a copy of it unless that person knows that the power of attorney has been terminated or is invalid. These forms are designed to be completed without the assistance of an attorney.

Given your particular circumstances or concerns, however, you may want to seek legal advice from an attorney. A power of attorney (POA) is a document that allows you to appoint a person or organization to manage your affairs if you become unable to do so. If you will be represented by a third party, whether in person or by correspondence, you must file a power of attorney specifically authorizing the individual to represent you or your organization. More information is available to assist you in filling out this form1. This form is not the answer for everyone.

However, you may include on a power of attorney only future tax periods that end no later than years after the power of attorney is received by the Department of Revenue. Present years months. The department may have to disclose confidential information to fully discuss tax issues with, or respond to tax questions by, the Appointee.

A taxpayer may also use Form 2to grant additional powers to the Appointee, up to and including a power of attorney. The following taxpayer hereby appoints as attorney -in-fact to represent the taxpayer before any office of the PA Department of Revenue for the following tax matter(s). The PAR 1is a legal document.

For the tax matters you list on the form, your representative will be able to receive and inspect your confidential tax information and take the same actions you can, including consenting to extend the time to assess tax or executing consents that agree to a tax. Refer to instr uctions on reverse side. These laws specifically outline the parameters of a legally enforceable power of attorney and ensures that the form, as well as its duties are protected under the law. It shall be the duty of the department of revenue , and it shall have power and authority: 73.

To have and exercise general supervision over the administration of the assessment and tax laws of the state, over assessors, boards of review, supervisors of equalization, and assessors of incomes, and over the county boards in the performance of their duties. Department of Treasury from disclosing confidential tax information to anyone other than the individual taxpayer or his or her authorized representative. Search for Clever Information. Powers and duties defined.

Wisconsin Form A-222. Photocopies and FAX copies of Form A-2are acceptable. You can search our library of over 700free legal documents to find the legal form that is right for your legal needs.

Elect someone else to handle the filing of personal and corporate tax records to the State’s Dept. A corporate officer, owner or authorized signer of the business must sign the form. The signature of a witness is required.

A state-sanctioned notary public must notarize signature(s) on this form. The notary may also sign as the witness. Signature(s) on the form must be original, a copy is not.

Taxpayers or their representatives may submit Form POA-using our web application, accessible from an Online Services account. The power of attorney form shall be valid until supersede revoked or by the death of the taxpayer(s) or representative(s). Tax information can be disclosed to the appropriate party possessing power of attorney if the Check Here box on the appropriate form (Form 50 Form 50 etc.) has been marked.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.