Should you take renters tax credit in Wisconsin? Are renters eligible for credit in Minnesota? Can I claim homestead credit in Wisconsin? Not available if you or your spouse claims the veterans and surviving spouses property credit. Special conditions may apply.

Visit the Wisconsin Instructions for more information. Basically, the lower your income, and the more rent you pay, the bigger your credit will be. If you rented a $5apartment and heat wasn’t included with your rent, for example, you could claim a. Wisconsin – Wisconsin offers credit to renters with less than $26in household income.

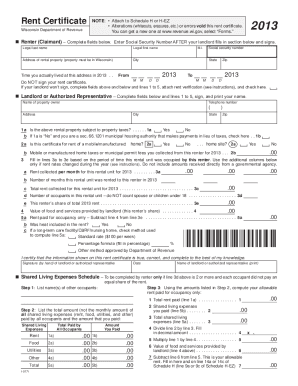

Similar to Minnesota, you’ll need to obtain a rent certificate from your landlord before taking the credit. Income and Rent Limits. Individuals must be a legal Wisconsin resident for the entire year to quality.

This legislation would give a refundable tax credit for rental costs above of the household income up to the local fair market rent. If your rent includes heat, multiply the amount by. If heat is not include multiply your rent by. Finally, add lines 9b and 9d and write the total on line 10.

WHEDA offers resources to people seeking a place to rent as well. The Wisconsin Housing Search website (WIHousingSearch.org) is a free online housing location service. Adjusted rent – If line includes charges for: Enter on line heat, gas, electricity, furnishings, and board. Visit Nonrefundable Renter ’s Credit Qualification Record for more information.

We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. Certification (Form 948). We have a Success Rate for Accepted Offers.

Call For A Free Analysis Of Your Tax Debt Resolution Options. Renters may qualify for tax breaks in several U. For general information about Wisconsin Tax Credits , visit the Dept. In California, renters who make less than a certain amount (currently $46for single filers and $82for married filers) may be eligible for a tax credit of $or $12 respectively. Housing credit in the Program is allocated through an annual competitive process in which projects are evaluated and scored according to the. It particularly benefits low-income residents of high- rent , high-income locales like.

City of Antigo in Langlade County. Homestead Tax Credit Resources. Schedule H tax credit application with your tax return. Eligibility Requirements Include: D. What Is a Tax Deduction?

Subtract tax deductions from your income before you figure the amount of tax you owe. Nearly a third of renters in Milwaukee are severely rent. Michigan’s homestead property tax credit is how the State of Michigan can help you pay some of your property taxes if you are a qualified Michigan homeowner or renter and meet the requirements.

Senior Suites of Bellwood (Bellwood) The Illinois Affordable Housing Tax Credit (IAHTC) encourages private investment in affordable housing by providing donors of qualified donations with a one-time tax credit on their Illinois state income tax equal to percent of the value of the donation. Film Incentive Tax Credit - Learn about the tax incentives credits for motion pictures produced in Massachusetts. Harbor Maintenance Tax Credit - This credit is for taxpayers who paid the federal harbor maintenance tax (HMT).

Historic Rehabilitation Tax Credit - Learn how to receive a credit for the rehabilitation of a historic structure. The enhanced property tax credit is a flat percentage of 58. If the credit is more than the state tax liability, the unused credit may be carried forward for the next five (5) taxable years.

If you rent from a facility that does not pay property taxes, you are not eligible for a Property Tax Credit.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.