See full list on revenue. Wherever You Are In The World. It can be efiled or sent by mail. Individual Income Tax Return , including recent updates, related forms and instructions on how to file.

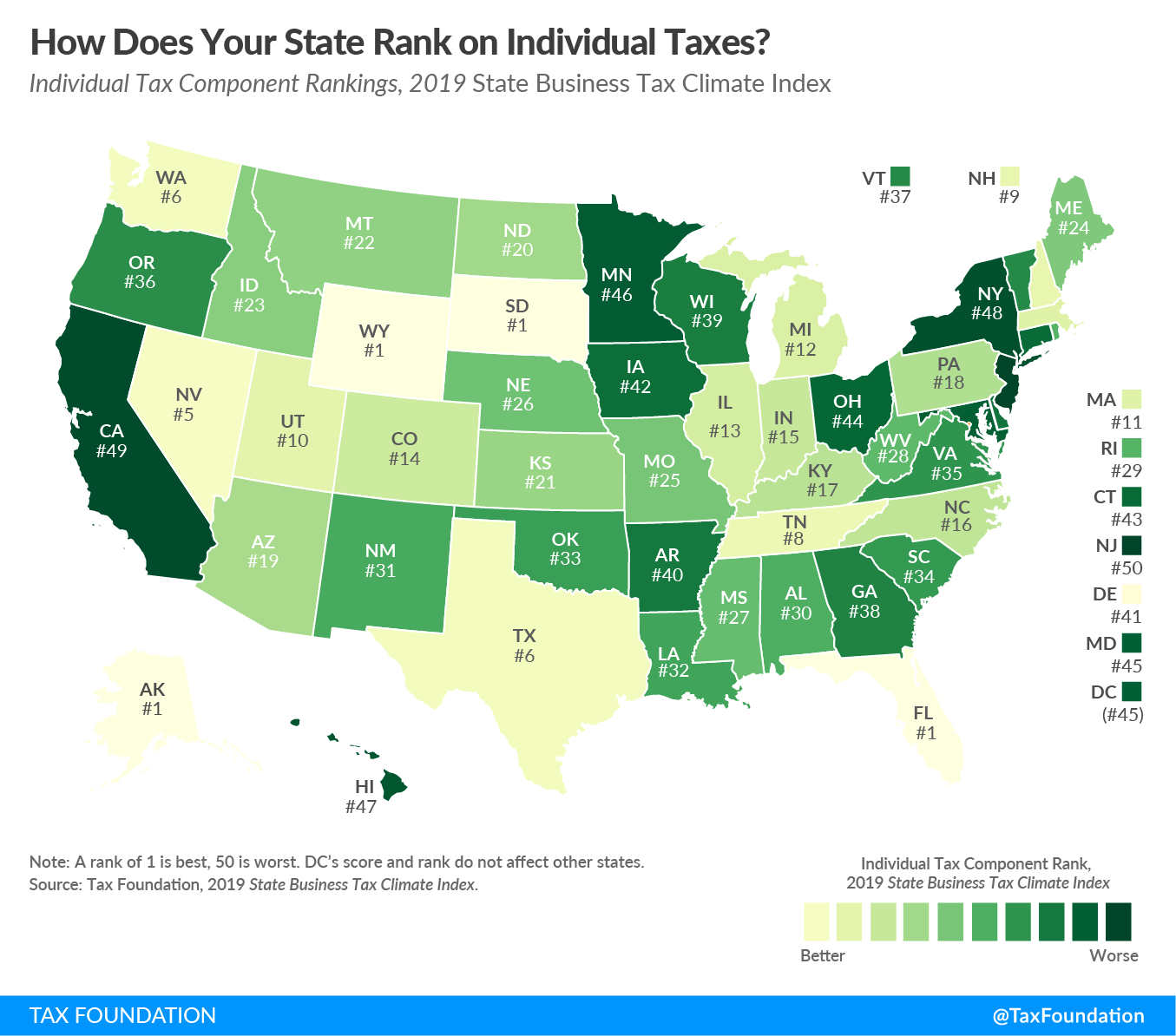

Access IRS Tax Forms. Wisconsin has a state income tax that ranges between and 7. There is a statewide income tax in Wisconsin. That tax is applied based on income brackets, with rates increasing for higher amounts of income. Notice by taxpayer of federal audit adjustments and amended returns. Credit for sales and use tax paid on fuel and electricity.

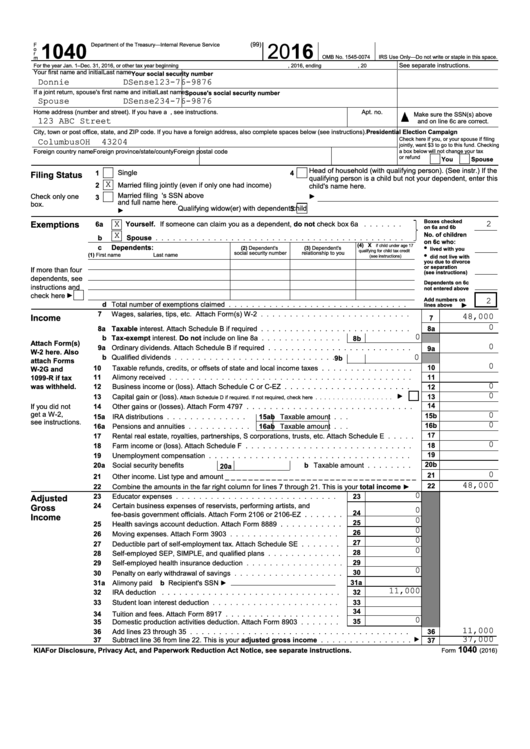

Claims for refund and other amended returns. However, you can request the form be sent to you. Compensation received by. IRS Use Only—Do not write or staple in this space. Single Married filing jointly.

Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) If you checked the MFS box, enter the name of spouse. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Partnerships: tax years beginning on or after Jan.

S corporations: tax years beginning on or after Jan. For your convenience, Tax-Brackets. Select Form on the WI e-file selection page and then select Schedule H. File electronically whenever possible. Returns are processed slower when not assembled in the proper order. Be sure the pages are in the proper order.

Includes tax due and extension payments. Call center services: Available. Self-service options: Available. For specific State Tax Return deadlines click on the State (s) below. Instead the Standard Deductions Increased Significantly.

Technically, employers etc. Register and Subscribe now to work with legal documents online. Forms and 1NPR are Forms used for the Tax Amendment. If the due date for filing a return falls on a Saturday, Sunday or legal holiday, the return is due the next business day.

If available, your prior year information has been included for reference. Please return this Tax Organizer along with all. Delivery Information.

Exemptions were eliminated from tax returns as a result of tax reform. Instea the standard federal deduction has increased significantly. Click on Learn More below to see some of the areas that may be impacted on your return.

Some post offices will be open longer and offer late postmarking on Tax Day. W-agencies must disregard the entire amount of any federal income tax refund as income in the month received and as an asset for months following the date of receipt for Refugee Assistance program.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.