Medicare Supplement Plan N offers a new affordable Plan in Pennsylvania. Medigap Plan N allows yous to keep your Doctor and Medigap N pays the. Difference is Part B Deductible. Which is Best for You?

Like every other type of insurance, there are pros and cons. A single insurance plan:MA plans offer all your insurance needs through a single insurance company plan. This is a huge disadvantage. Ask anyone who’s had to manage three sets of documents – from a government-appointed contractor for original Medicare, a private insurer for Part and a private Medigap insurer – and the benefit of dealing with a single entity becomes clear. You might even call it an…advantage!

I’ll have more about them in a bit. Lower costs:The greatest appeal of MA plans likely is their low costs. More and more MA plans are charging zero premiums after a p. See full list on pbs. People with original Medicare are covered for services from any doctor, hospital and other caregiver in the country that accepts Medicare.

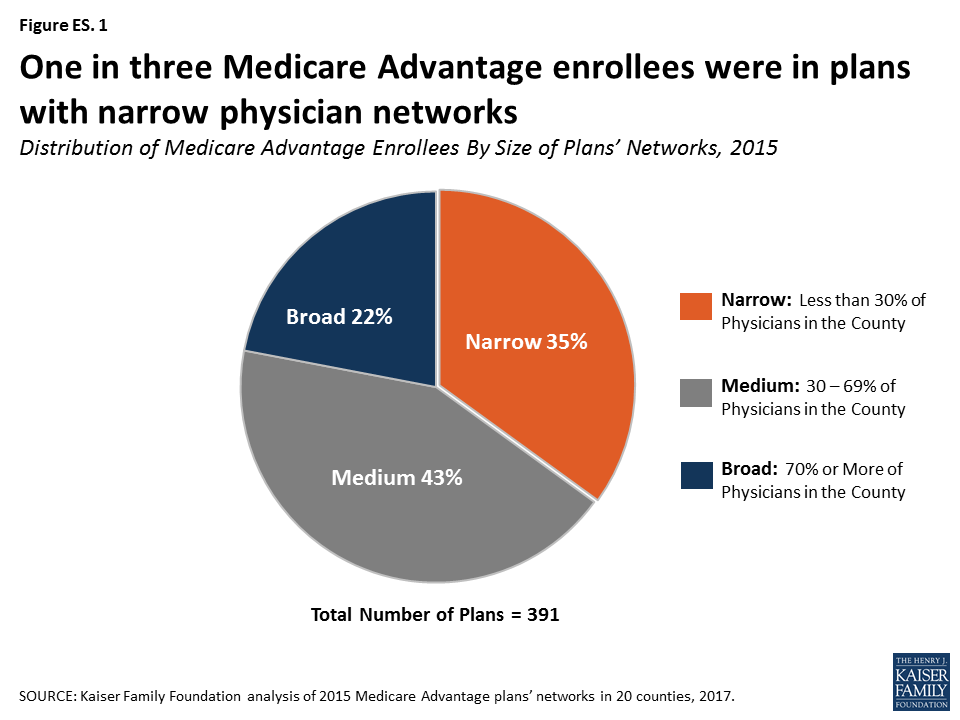

MA customers, by contrast, are usually restricted to getting care from doctors and organizations included in their plan’s provider network. Plans with broader networks and larger geographic service areas are known as PPOs, or preferred provider organ. Managed care:One reason MA plans can offer more benefits and often charge less is because they can save money on medical expenses through their business agreements with members of their provider networks.

The bigger source of savings, however, is that MA plans are managed care plans. Original Medicare is what’s called a fee-for-service program. If you want a procedure that Medicare approves, it will be covered by original Medicare. MA plans, by contrast, would look for low-cost providers of such procedures.

They usually require enrollees to get pre-authorization from their plan before approving coverage and may require less-expensive treatment alternatives. Included in their concerns is the very clear preference by federal health regulators for MA plans over original Medicare. Under President Trump, the preference for MA plans has become even more pronounce in large measure because of his administration’s preference for private insurance programs in favor of government-run efforts. Medicare’s online Plan Findercan help people compare thingspremiums and projected plan expenses. But it is not designed to make useful comparisons with non-monetary aspects of MA plans.

Even when I knew a specific plan was offering new non-medical benefits, they often weren’t included in Plan Finder or not clearly explained. Realistically, the only way to get a detailed understanding of MA benefits is to call individual insurers, and this is what insurers prefer anyway, so they can directly impress you with the virtues of their plans. Aetna and other insurers are beefing up their consumer communication programs. We don’t want beneficiaries to get into a plan and not understand it and not be satisfie” Ciano said.

Consumers can get non-biased Medicare advice from the State Health Insurance Assistance Program(SHIP). SHIP counselors traditionally have been more equipped to help people with questions about original Medicare than private MA and Part D drug plans. However, it also happens that if a medication is on the list now it might be removed later. Another possible downside of the plan it the extent of its service area. But bear in mind that managed care plans drop providers from their networks if they start costing the plan too much money.

Advantage plans are offered through private insurance. Managed care has become very popular in recent years as a way of insuring oneself. The patients are allowed to use these network providers with whom the plan has special rates.

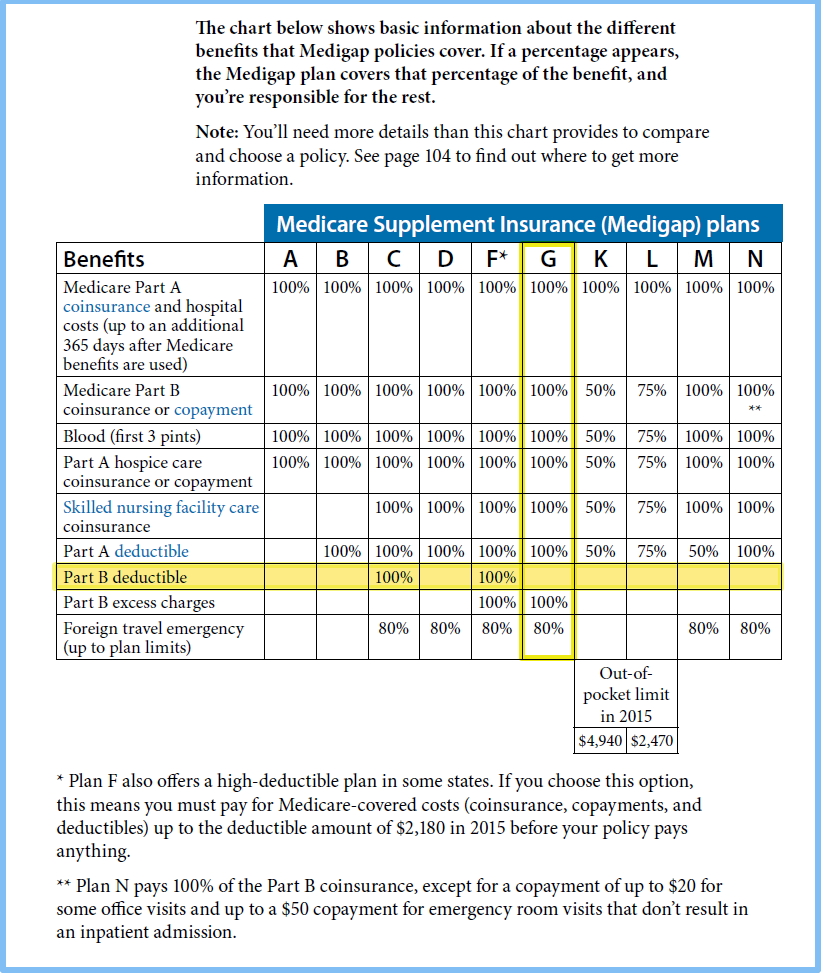

Medigap plans can usually require “underwriting” before giving you a price quote if you join late, which is the evaluation of your medical history and potential care liabilities. These plans can cost. Limited service providers. You may be limited to provider networks and you also can’t enroll if you have ESRD.

Complex plan offerings.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.