Get Advice From A Licensed Medicare Agent! Get Matched With Multiple Carriers. Receive a Customized Free Quote. For the extra coverage you need. How can your income affect your Medicare premiums?

Enroll for the added benefits. Does my income affect my monthly premiums for Medicare? How to deduct your Medicare premiums? How much is your Medicare Part B premium? MAGI adds back some of these adjustments.

It is best to consult with an accountant on this calculation. Unlike Medicai Medicare eligibility is not based on income. However, the income you report on your taxes does play a role in determining your Medicare premiums. Beneficiaries who have higher incomes typically pay a premium surcharge for their Medicare Part B and Medicare Part D benefits.

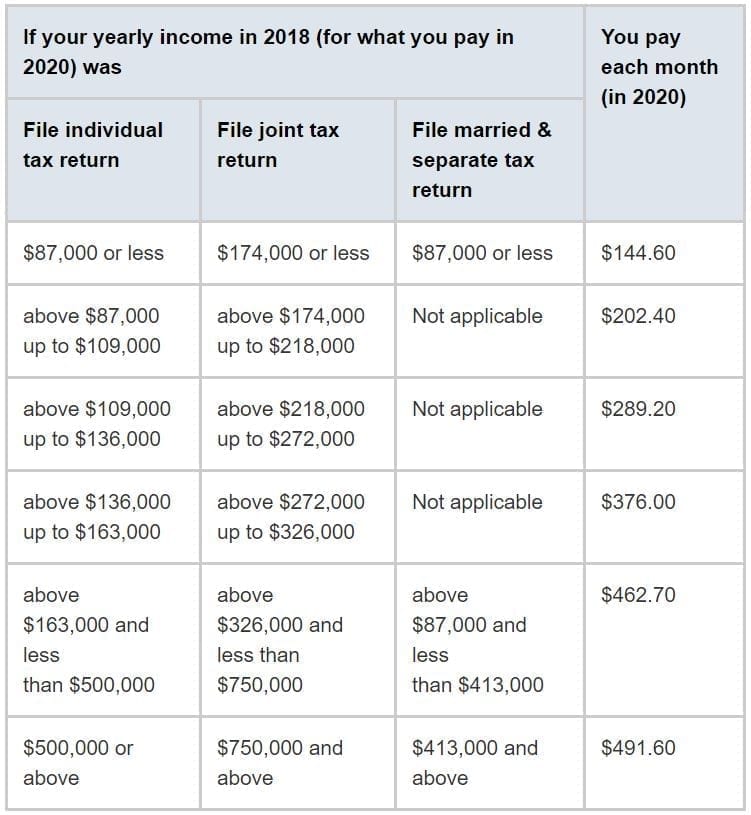

If your MAGI is above $80($170if filing a joint tax return), then your premiums will be subject to the income-related monthly adjustment amount (IRMAA). At higher incomes, premiums rise, to a maximum of $ 491. MAGI exceeds $500for an individual, $750for a couple. However, your income can impact how much you pay for coverage. If you make a higher income , you’ll pay more.

Your MAGI is your total adjusted gross income and tax-exempt interest income. In most cases, this information is your income two years prior to the year for which you must pay an income-related premium. Each year the Medicare premiums , deductibles, and copayment rates are adjusted according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $144. This is the most recent tax return information provided to Social Security by the IRS.

Medicare uses the modified adjusted gross income reported on your IRS tax return from years ago. Most people pay the standard Part B premium amount. Determine your eligibility or calculate your premium Use this calculator to get an estimate of when you’re eligible for Medicare and your premium amount.

This calculator provides information for many but not all situations. No need to visit multiple websites, see all of your plan options here! Speak With A Licensed Insurance Agent Today! Also known as Medicare Part C. Alternative to Original Medicare.

Helps paying out-of-pocket costs. Medicare savings programs are available to help pay premiums , deductibles, coinsurance, and other costs. People can appeal them. As stated earlier, the standard Part B premium amount that most people are expected to pay is $144. Also, a previous version of this story misstated the income level used to.

The Modified Adjusted Gross Income is different from your Adjusted Gross Income , because some people have additional income sources that have to be added to their AGI in order to determine their IRMAA-specific MAGI. A sliding scale is then used , based upon the amount of your modified adjusted gross income , as well as the manner in which you file your tax return. Those who are subject to the higher Part D premium will receive a letter from Medicare that indicates the premium amount to be pai along with the reason for the higher premium determination. Instantly See Prices, Plans and Eligibility.

The Non-Govt Way to Get the Best Health Insurance.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.