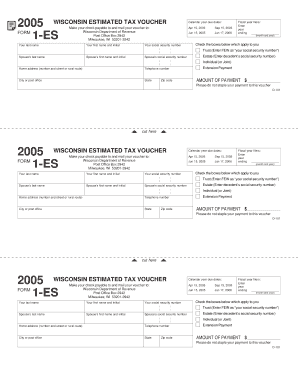

Do not print a blank voucher to complete by hand. Enter your data on this voucher online. The numeric string of numbers will then change to reflect. See full list on revenue. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds.

Available for PC, iOS and Android. Start a free trial now to save yourself time and money! The ScheduleU instructions provide information on ex - ceptions to the interest charge.

Wisconsin tax form es. For your convenience, Tax-Brackets. The advanced tools of the editor will guide you through the editable PDF template.

Be sure to verify that the form you are downloading is for the correct year. Press Done after you fill out the form. Now you may print , downloa or share the form. You can get this form from our website at revenue.

Department of Revenue office. Note: Some materials are available as paper versions and can be ordered by completing an online request form. Before requesting a paper version of a form or publication, review the appropriate forms or publications list to ensure it is available as a. Review state tax filing information and supported state tax forms.

Supported state tax forms. Business A-Z Professions List Corporations. Prepare and e-file taxes for free when you qualify. These forms are designed to be completed without the assistance of an attorney. Given your particular circumstances or concerns, however, you may want to seek legal advice from an attorney.

This form allows a party to record only that portion of the Judgment affecting the title to real estate with the Register of Deeds in the county in which the property is located. WISCONSIN IDENTIFICATION CARD (ID) APPLICATION. If a form is not available electronically, you will be provided instructions for requesting a paper copy.

Form ES Instructions. Indicates a required field. Clicking line c, Calculate estimates regardless of amount will populate the taxpayer name and place a zero amount due.

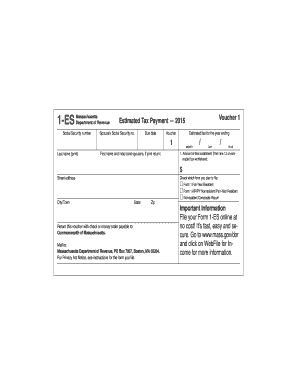

State income tax form preparation begins with the completion of your federal tax forms. Most state tax forms will refer to. For more information, see Technical Information Release 16-and Non-Resident Income Tax Regulation, 8CMR 62. Non-residents who have elected to partici pate in a composite return must make estimated payments on in come not included on a com-posite return.

You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Sch OS, Credit for Net Tax Paid to Another State. Click on each of the vouchers so that it has a tab in the display window. When that date falls on a weekend or holiday, filers get until the next business day to submit their state returns.

Except as provided in subd. Washington is one of seven states which do not levy a personal income tax. Washington state and local governments generate revenue primarily from sales tax and property tax.

W 49-: 1-(0-0) Coan 201: Taylor 135: Taylor 48: Sat. The form you are looking for is not available online. Social Security office.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.