Additional Information. Wire transfer services are one of the fastest and safest ways to transmit money around the world. Our wire transfer services make one-time and repetitive overseas payments simple and efficient.

With our extensive foreign correspondent bank network, outbound funds transfers can be executed to most foreign beneficiaries worldwide. See full list on wellsfargo. A foreign draft is a draft drawn on a bank in a country outside of the U. Checks drawn on foreign banks from a wide range of countries and denominated in either a foreign currency or U. A Cash Letter in a provisional credit to your account for the check submitted. With a Collection Item, funds are not available to you until we have collected on the foreign check. We offer an extensive range of foreign currency risk management tools that can help customers reduce uncertainty and manage the risks and opportunities associated with fluctuating currency values.

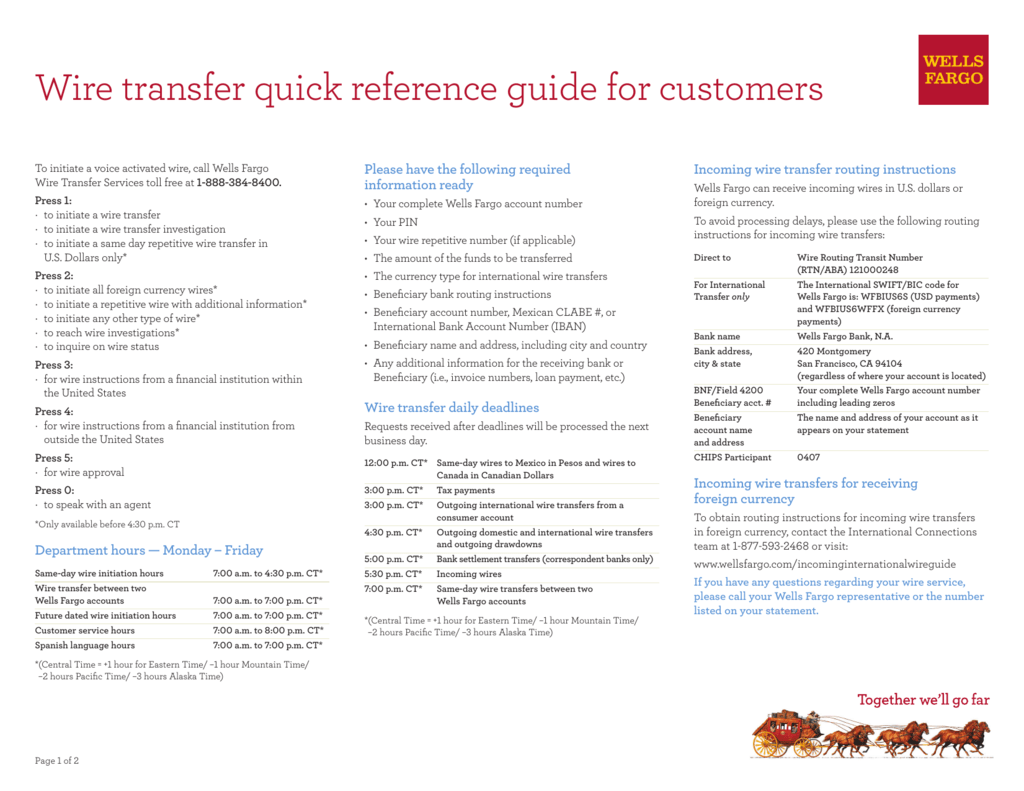

Contact a Foreign Exchange Specialist for assistance with Forward Contracts, Options, and other services designed to assist business customers in protecting profit margins. Central Time⁹ won’t be processed until the next business day. The initial wire transfer fee will be written in on the Wire Transfer Request Form online. For receiving wire transfers in U. Wells Fargo international wire transfer times.

Check the details for your specific account type. I receive incoming International wire transfers times a month, and each time they hit me for $16. Other Ways to Reduce Wire Fees Transferring Money to Student Accounts : When sending money to a student, many smaller banks and credit unions will actually waive or reduce any incoming wire transfer fees. Incoming international fee. Outgoing domestic fee.

Banks use SWIFT network for exchanging messages required for performing international wire transfer. Usually, the receiving bank (in Canada) and the sending bank (in other country) need to have a direct arrangement in place to start the swift transfer. This is generally a flat fee that your bank will charge you to make the transfer. Sometimes, banks or specialist providers claim to offer ‘ fee -free’ transfers.

But a transfer that genuinely has no fees is, shall we say, unlikely. Arranging a transfer in person, in the bank, usually costs more. Bank wire transfers can be used to send large sums from your bank account to another. What’s more, the fees.

But fees can vary from $to $or more. Tax payments and outgoing international wire transfers from a consumer account. You have the right to cancel a wire transfer within minutes of completing the remittance transfer , and obtain a refund of all funds paid to us, including all fees , unless funds have already been picked up by your beneficiary or deposited to their account. We receive - incoming international wires from some of our customers.

Our balance is never below $100as we require a large capital cushion for various reasons. Fifth Third Bank while the lowest fee for any type of incoming wire transaction is $at. Here is the comparison of the fees charged by top banks in USA for domestic and international wire transfers. Apart from the wire transfer fees , if the transfer involves currency conversion, banks make money on currency conversion as well by giving retail conversion rates to you.

Each intermediate bank will take their cut, typically of around $- $20. Finally, the destination bank will often charge an incoming wire fee to deposit money in the recipient’s account. Contact Treasury Management Fees vary No charge Fees vary 0. Each bank or credit union has their own rules and regulations on sending and receiving wire transfers. Not all financial institutions offer both domestic and international transfers , though. As you’ll see below, a number of banks don’t offer.

Depending on the country, we may ask you to provide an IBAN when you send an international wire transfer. If someone outside the U. IBAN, you should provide our SWIFT code, CHASUS3 and your account number. We don’t use an IBAN to receive incoming international payments.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.