What is total revenue equal to? How is total revenue calculated? Toptal accepted a $ 1. The company is said not to have raised additional funds since its seed round because it has been profitable. The notion being that such investments come with overt pressure to achieve rapid hypergrowth and raise more money than is actually necessary, wonderfully termed the “foie gras effect. This aversion has merit: one of the most comprehensive post-mortem studieson startup failure, by the Startup Genome Report, found that across 2startups, premature scaling was the principal reason for those that failed.

It’s normal for investors to expect a measure of. See full list on toptal. Revenue-based financing was noted in the NYT article as a remedy to founders who need to raise initial seed financing but want to have their businesses’ future path plotted by their own volition. Some investors who have received attention for this are Indie. Earnest Capital, the latter which uses a form of note called the SEAL.

A high-level overview of the terms of such investments can be as follows: 1. Not structured as a loan, but a liability with an obligatory payback. The liability can convert into straight equity upon an event, such as a future fundraising round. The return is stipulated as a capped multipleof the original investment (e.g., a $50investment with a 3x cap in a $150total payback obligation). Payback begins at a future date and is variable based upon a percentage of an income statement metric.

Once repai the investor maybe left with a residual equity position in proportion to the initial investment. When I discussedventure capital portfolio strategy, the three core themes were to 1) buck the trend when appraising new concepts, 2) treat every investment in isolation and 3) go-for-broke on ones that start succeeding. I now want to revisit this to dig deeper into the portfolio management angle and see whether it’s possible to get attractive portfolio returns across a wider selection of investments. If we return to the famous Correlation Ventures data, we can have a look at how a hypothetical venture portfolio would play out if one were to invest nntimes and receive the expected outcomes.

The multiple return (“DPI”) from this fund (the “benchmark”) would be 2. In our case, the conservative 50x “unicorn bracket” weighting has a delta of basis points on the overall. Using my interpretation of the rules of Indie. Unlike traditional venture investing—which will have just one node—this revenue-based model gives rise to different financial scenarios, dictated by the first node of whether the startup raises additional funding rounds.

Capped repayments on principal from investments that did not convert to equity. Residual equity positions (˜ of initial capital) that remain in businesses that have repaid principal. Now, with the theory covere let’s have look at how this might play out in reality. So, hold the press, venture capital portfolio strategy is still indeed a game of home runs and that doesn’t look like it’s changing. If anything, the distortion looks to be warping further, with even bigger deals and bigger funds.

This culture, though, has alienated some parts of the chain who want to build commercially viable enterprises but not in the hypergrowth model that runs the risk of premature scaling. Due to the lack of funding alternatives to venture capital, many entrepreneurs have ended up signing up for something that they have ultimately come to regret. Some do this through informal loans with no interest attache let alone any equity upside. This sign of both generosity and stoicism can often make that financial obligation far more important to repay in the eyes of an entrepreneur, over p. The top competitors average 92. Total Revenue = Quantity Sold x Price Take, for example, a leather craftsman who sells boots for $1per pair.

If he regularly sells pairs per month, his total revenue is $ 0($1x = $000). This formula becomes especially useful if the craftsman is considering lowering his prices to $per pair in order to boost sales. It is important to note that revenue is distinct from earnings or profits, which takes expenses into account. Obviously, however, high total revenue is desirable for any company. Farlex Financial Dictionary.

In most freelance marketplace you can’t make very high income because there are people from 3rd world doing the same tasks for 2-times cheaper. How to Build a $1Million- Revenue Business With Zero Offices. Revenue is also known as sales, as in the price-to-sales ratio - an alternative to the price-to-earnings ratio that uses revenue. Andreessen Horowitz and others invested $1.

But Du Val carefully avoided raising money after its initial seed roun which meant that — contractually — he didn’t owe anyone anything. Du Val insists he has no obligation to award anyone equity, saying it’s a smart move not to raise money — basically, a contract’s a contract. But some employees say he tricked them into thinking he would raise money, and others insist that they were, at the very least, misled. Convertible notes and similar good-faith equity contracts are becoming more common because they enable founders to raise money more quickly.

But on the flipside, they sometimes make promises that businesses never intend to keep. This number is not the same as the profits or the earnings of the company. Use total revenue in a sentence “ Our total revenue for the year was more than last years and that made me very happy because we were growing. It is the total income of a business and is calculated by multiplying the quantity of. The income earned by a seller or producer after selling the output is called the total revenue.

In fact, total revenue is the multiple of price and output. The behavior of total revenue depends on the market where the firm produces or sells. If a boutique priced a blouse at $and it sold seven, that puts total gross revenue for that product at $350. Total revenue is the sum of all sales, receipts or income of a firm.

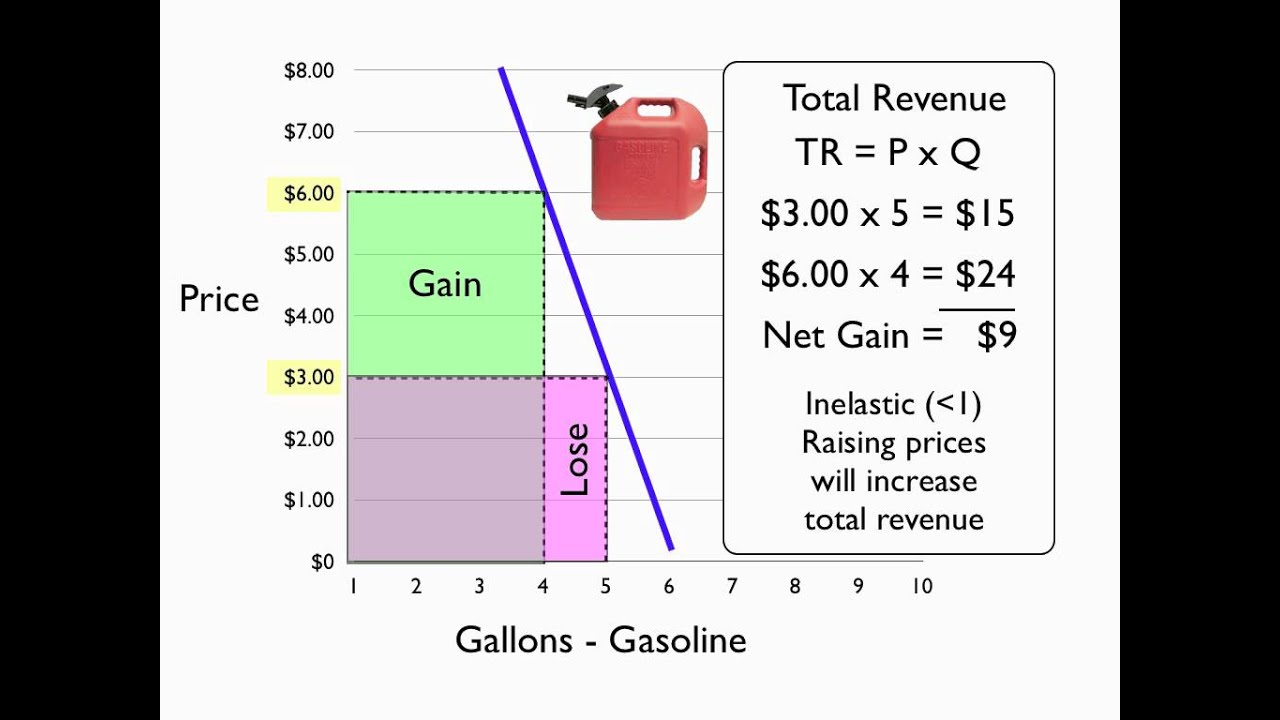

The key concept in thinking about collecting the most revenue is the price elasticity of demand. This is calculated before any discounts are applied. Imagine that the band starts off thinking about a certain price, which will result in the sale of a certain quantity of tickets. The three possibilities are laid out in Table 1.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.