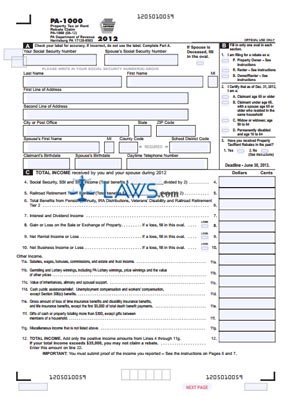

TABLE B - RENTERS ONLY. Enter the amount from Line. Maximum Rebate amount for your income level. Owners use Table A and Renters use Table B. Do landlords pay taxes?

What is the tax form for rental income? How do you report rental income? To request an RPA, you need the following information: Your Information.

Reporting rental income and expenses In most cases, a taxpayer must report all rental income on their tax return. If a taxpayer has a loss from rental real estate, they may have to reduce their loss or it may not be allowed. List your total income, expenses, and depreciation for each rental property on the appropriate line of Schedule E. Hawaii – Hawaii renters who make less than $30per year and who paid more than $0in rent for their principal residence may be able to take a tax credit.

Indiana – Indiana renters may be eligible to deduct $0in rent paid on their principal residence to reduce your taxable income rather than a credit that directly reduces your. Downloa fax, print or fill online more fillable forms , Subscribe Now! No Installation Needed. Convert PDF to Editable Online. Deduct rental expenses in the expenses section of Schedule E. State of Maryland and who meet certain eligibility requirements.

You report rental income and expenses on Schedule E, Supplemental Income and Loss. After checking eligibility requirements, download or request an application. Opens In A New Window. If qualifie complete the application and be sure to include either the required documentation for property taxes or rent paid for the claim year. For property held by you for personal use, you must subtract $1from each casualty or theft event that occurred during the.

The income tax laws provide for certain tax benefits on rent pai depending on whether the tax payer is self-employed or a salaried person. The law also requires you to deduct tax from the rent being pai under certain circumstances. Though we technically are not claiming rent on our taxes, the amount of rent , property taxes, or long term housing costs paid by you throughout the year is used to help calculate your benefit.

Form Rent Certificate is a Wisconsin Other form. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar-for-dollar reduction of tax liability. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. On this form, you list your property’s rental revenue, expenses, and depreciation.

If you have more than three rental. The relevant expenses can be entered in the lines from to 26. Payments can include fees for one-time services such as fixing a burst pipe to ongoing fees like lawn care or housekeeping for your rental units. Fill, sign and download Rent Rebate Form online on Handypdf.

The deadline to apply on rent and property taxes paid in. The Renters ’ Property Tax Credit Program provides relief for renters who spend a large portion of their income on rent and do not receive federal or state housing subsidies or live in public. Tax Due – state sales tax due. HRA or House Rent allowance also provides for tax exemptions.

The different Sections of the Income Tax Act help the salaried individuals, and the self-employed people and professionals, to make their rent expenditures cheaper, and more desirable. Do NOT submit disks, USB flash drives, or any other form of electronic media. Electronic media cannot be processed and will be destroyed.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.