Courts – You may be able to obtain the necessary legal form directly from your local court. Our website has all of the printable forms a landlord or property manager will need including free printable fill in the blank Lease Agreement Forms , Rental Agreement Forms , Rental Application Forms , Notice To Vacate and Eviction Forms , Background Check Authorization Forms , Free Property Checklist Forms and Free Rent Receipt Forms. This letter can be prepared by a tenant to give to a landlord or vice versa. The bottom line when this form is in use is that the lease will be ended. New landlords (and tenants ) can find the terminology of the real estate and property management world to be overwhelming.

There are many conflicting usages of words in. Do landlords pay taxes? How do you pay taxes for rental property?

As a landlord or property manager, inevitably you will come across a legal situation that requires a legally binding form. At least, you will need to have a binding lease with your tenants. Whether you are needing Eviction Notices, Check In Sheets, Leases, Applications, or Deeds, we have the right form for you and customized for your needs. The landlord can avoid any misunderstanding and headaches regarding that by simply sending a notice to make your tenant move out.

ForuW- Is landlord required to give Wto tenant. Every state has different legal requirements for leases, and it can often be difficult for busy property managers to stay updated on the constantly changing requirements in their area. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

Register and Subscribe now to work with legal documents online. Rental Income Tax Forms for Property Owner, Partnership or LLC. If this is your first time filing rental income taxes or if there has been a recent change in the ownership structure of your rental properties, you may have a number of questions about the types of forms you need to remit to the IRS.

You must include them in your rental income. You can deduct the expenses if they are deductible rental expenses. For example, your tenant pays the water and sewage bill for your rental property and deducts it from the normal rent payment. The Taxpayer paid for renovations and a building expansion as requested by the Agency and as permitted under the terms of the lease.

Under current law, it is the payment for services that triggers. Same holds true for commercial with one slight twist. The above assumes this is a question in the US. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly.

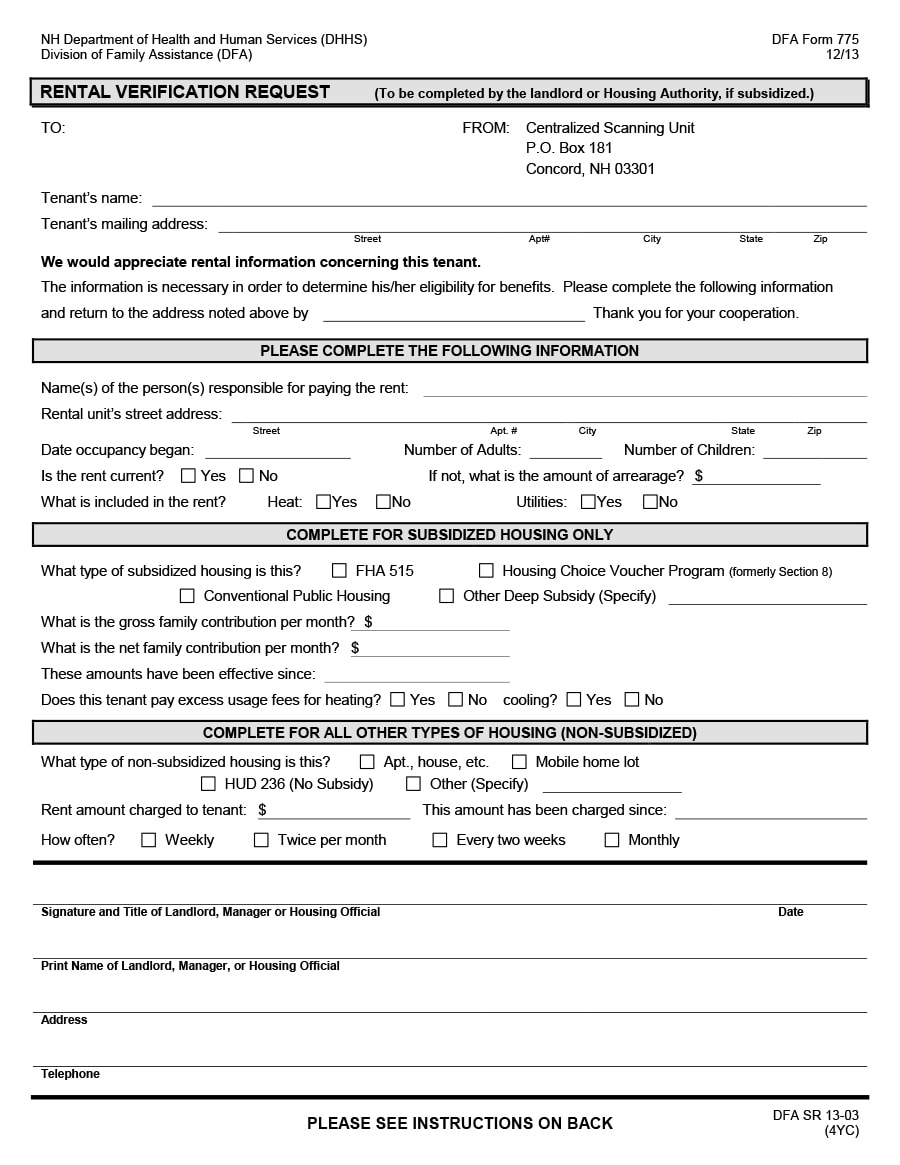

When landlords understand how to properly file taxes on their rental properties, they can get quite a few rental property tax deductions , reducing the total amount owed to the Internal Revenue Service. Tenant and Rental Information. Verification of Rent Paid.

The tenant uses information from Form LC-1to complete the Renter Rebate Claim. Landlord Information. I used the free do it yourself landlord forms I downloaded form this website.

What Our Visitors Are Saying! I was able to print the free online landlord tenant forms and use them to manage my rental properties. I am very impressed at the forms information that was provided to me. These facts, as well as whether the lease meets the requirements to be considered an IRC Section 1short-term lease of retail space, will determine the income tax treatment of these.

Generally, the tenant treats a tenant allowance received from the landlord as ordinary income. An example of a retaliatory rent increase would be a landlord increasing a tenant ’s rent because the tenant complained about a potential. This deduction is a special income tax deduction, not a rental deduction.

Depending on their income, landlords may be able to deduct (1) up to of their net rental income, or (2) 2. Fill Out Security Deposit Letter.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.