What You Should Know. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android.

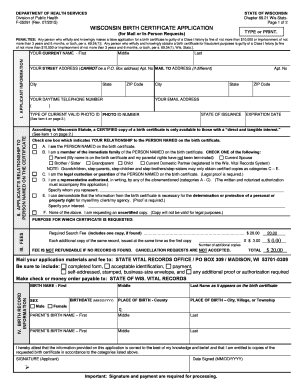

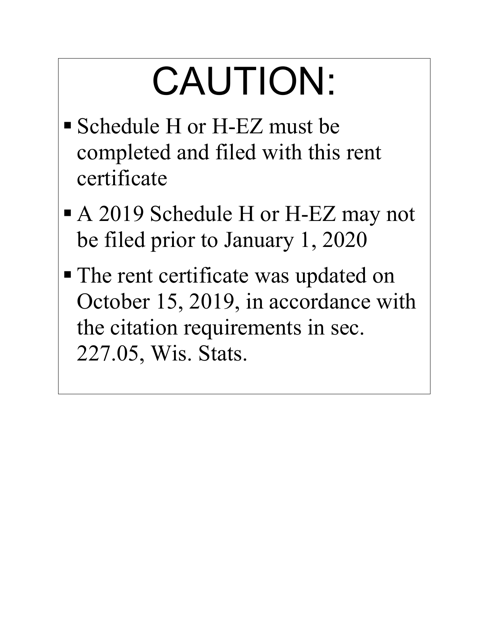

Start a free trial now to save yourself time and money! Wisconsin income tax return and homestead credit claim together. Only attach rent certificate if filing a homestead credit claim Do NOT sign your rent certificate. Use a separ ate rent certificate for each home for which you are claiming homestead credit.

The landlord fills out the form based on rent received not owed. If you have questions on the Homestead Credit you can go to Claiming Homestead Credit. Property taxes do not have to be paid in order to claim homestead credit. Landlord refuses to sign the rent certificate.

Turbotax keeps asking for a date signed. Business Development Credit (Sch BD): Based on wages paid to an eligible employee, training costs, and personal and real property investment. All Major Categories Covered.

The UW-Extension does a great job explaining the benefit , and all the ways you must qualify. Spouse’s legal last name Spouse’s legal first. Solved: WI homestead credit : It asked for the renters information noted on form.

Schedule H and H-EZ instruction booklet. Similar to Minnesota, you’ll need to obtain a rent certificate from your landlord before taking the credit. How much can I get back from the Homestead Credit ? If you qualify, the amount of credit depends on your income and your rent or property taxes. The maximum Homestead Credit is $168. How can I claim the Homestead Credit ? I declare that this certificate is correct and complete to the best of my knowledge and belief.

Keywords relevant to wisconsin rent. A homestead could be a room, A homestead could be a room, apartment, mobile or manufactured home, house, farm, or nursing home room. Instructions for Renter (Claimant) Complete all fields except the social security number. Then give to your landlord to complete and sign.

Our news center will let you know about Renting Tips And Apartment Ideas. It can be filed electronically or by paper. There are a whole host of boxes you’ll have to check to be able to claim this credit (see this document), but if you qualify, you can receive a credit worth up to $168. The credit , on the other han will be computed so long as. For those under age 6 you must have earned income to qualify for Homestead Credit.

Rent Certificate is something that needs to be prepared outside of PTO and signed by the landlord. The term rent paid is that amount paid by the tenant to a landlord to occupy a residence. Virgin Islands (USVI) is the only credit reduction state. If you paid wages that were subject to the un-employment compensation laws of the USVI, your credit against federal unemployment tax will be reduced based on the credit reduction rate (for example, 27) for that credit reduc-tion state.

Shared Housing - If two or more individuals share ownership and occupy the homestead or are contracted to pay rent and occupy the rental property, each may file a homestead property tax credit. Securely download your document with other editable templates, any time, with PDFfiller. No software installation.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.