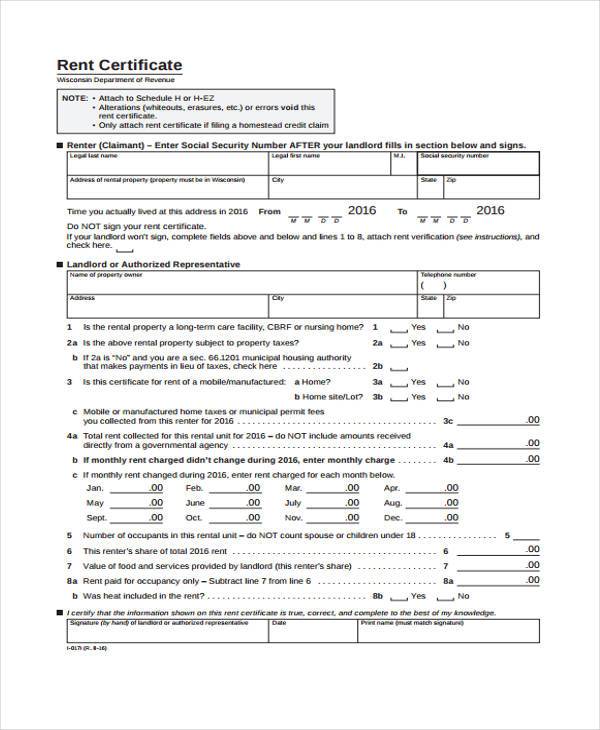

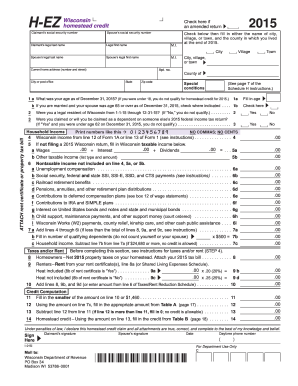

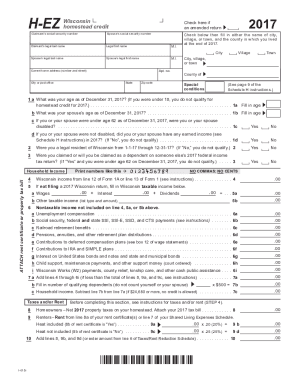

If you qualify for homestead credit , you may be able to use Schedule H-EZ to file your claim. See page of the Schedule H instructions. Filling in Schedule H-EZ Use black ink. Only attach rent certificate if filing a homestead credit claim Do NOT sign your rent certificate.

Is the homestead credit a refundable credit? Wisconsin homestead credit. Start a free trial now to save yourself time and money! What You Should Know. Table shows the homestead tax credit available to claimants at various levels of income and property taxation.

Application Requirements A claimant must meet each of the following eligibility conditions to qualify for the homestead credit : 1. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Instantly Find and Download Legal Form s Drafted by Attorneys for Your State. Register and Subscribe now to work with legal documents online. Under penalties of law, I declare this homestead credit claim and all attachments are true, correct, and complete to the best of my knowledge and belief.

All forms are printable and downloadable. On average this form takes minutes to complete. Form W-for reporting wages paid to your employees. Available for PC, iOS and Android. Form W-for sending Copy A of Form (s) W-to the Social Security Adminis-tration (SSA).

See the definition of household income. Jose Figarella SRS, CNE. Check here if the taxable value of your homestead includes unoccupied farmland classified as agricultural by your assessor. Multiply line by line 5. This credit is designed to soften the impact of property taxes and rent on persons with lower incomes. For individuals who pay rent, only a portion of the rent they pay is recognized the same as property taxes.

Either Schedule H-EZ or Schedule H. You can search our library of over 700free legal documents to find the legal form that is right for your legal needs. Home equity loan interest. Delinquent taxpayers and unemployment insurance contributors, denial and revocation of licenses, 50. Property taxes do not have to be paid in order to claim homestead credit. There are a whole host of boxes you’ll have to check to be able to claim this credit (see this document), but if you qualify, you can receive a credit worth up to $168.

Here are some of the highlights: Income Tax. Stehno, that the homestead rights of a spouse continue after her real property interest is terminated. These credits were provided to ap-proximately 150households. The court decide in U. No Installation Needed.

Convert PDF to Editable Online. Securely download your document with other editable templates, any time, with PDFfiller. No software installation.

See instructions on page for additional information. Access Any Form You Need. Complete, Edit or Print Your Form s Instantly.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.