File your income tax return. Jon Coupal, president of the Howard Jarvis Taxpayers Association, filed the ballot initiative. Are renters eligible for credit in Minnesota? Also announced was a bill to raise the.

Caution: This is not a tax table. If you are married filing separately you do not qualify for this credit. Check the box Qualified renter.

We wanted to give you an overview of the new laws and provide resources so you can easily comply with each new law. The state credit is a percentage of the federal credit. Credit (EIC) but with different income limitations. You may qualify if you have earned income of less than $1162. Real home prices have risen in most markets (as much as ), making housing less affordable in the U. California Tenant Rights to Livable Premises.

Request a Quote Online Today! Insurance That Fits Your Needs. Do NOT rely on this information alone in determining your eligibility for the credit. Find the Right Policy for You.

Consult the instructions for your tax return or your tax adviser for more information. Yes if you pay rent to your brother for a room and you meet the other qualifications, you can claim the credit. Some states offer a credit for renters. It is based off how much estimated rent landlords charge to cover property taxes. To see if your state honors this credit , contact your state’s department of revenue.

The renter ’s credit will be available for single filers with adjusted gross incomes of $46or less (previously, $40or less) and for joint filers with adjusted gross incomes of $82or less (previously, $81or less). See “Voluntary Contribution Fund Descriptions” for more information. All you need is a 60-day notice.

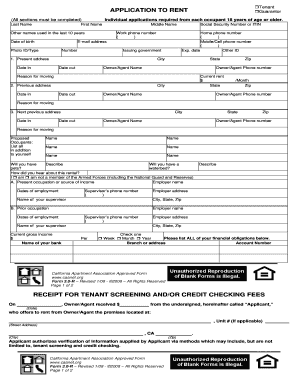

In the paragraphs below, we summarize the most significant of these laws for the state’s rental property owners and managers. Renters need to earn 3. APPLICATION FEE – Applicant has submitted the sum of $_____ which is a non-refundable payment for a credit check and processing charge, receipt of which is acknowledged by Management. Such sum is not a rental payment or deposit amount.

Frequently Asked Questions General Questions. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Enter Your Zip Code to Get Started! Learn How to Protect Your Home.

Steve Glazer, D-Orinda, would incrementally raise the state tax credit for renters over the next five years — and give a. Harris today introduced legislation to provide rent relief for working families struggling to pay their bills. TCAC allocates federal and state tax credits to the developers of these projects. Corporations provide equity to build the projects in return for the tax credits.

This applies to most housing situations where the tenant is renting from a landlor but there are some exceptions. Finding a home nearby is easier than you think. In such a situation, a tenant has other actions they can take rather than moving out, however, this article simply addresses this specific recourse that a tenant has when the situation is so dire as to cause a health.

Households with Children provides a snapshot of the prevalence of children and school-age children (ages 6-17) in various household types. The data includes single-family owners, single-family renters , multifamily renters , and multifamily owners, as well as information on apartment households based upon the year their apartment home was built. Having good credit can help you rent an apartment, and paying rent on time can help you build good credit.

If you don’t pay your rent on time, it is becoming more common for that to be reported.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.