As a landlor you can make your job much easier by setting specific rules for your tenants to follow. These rules, if set down within a rental agreement or lease , will give you legal recourse should your tenants fail to follow them. To make sure all your bases are covered , your rules should address the following specific areas.

State-Specific Landlord-Tenant Laws and Regulations. These rental laws govern the way a landlord and tenant can interact and do business. What are the tax rules on rental property?

Are landlords required to register rental property? People often rent out their residential property as a source of income , particularly during the vacation-heavy , warm summer months. Different tax rules apply depending on if the taxpayer renting the property used the property as a residence at any time during the year.

To help taxpayers avoid a sweat at tax time, the IRS wants taxpayers to know the facts about reporting rental income. Perhaps one of the most common rules of thumb used by rental property investors is commonly known as the rule. But because it’s not truly a “rule,” I like the “test” better.

Essentially, this rule of thumb looks at the monthly rent divided by the value in a percentage form. For those who just got confuse let’s make this super simple by considering an example. In this example, the property does not pass the test, but it does meet the test exactly. This definitely falls short of the test. Or what if the property rents for $5per month but is worth $12000?

See full list on biggerpockets. For that, investors often rely on the rule of thumb. Operating expenses are all of the expenses involved with running a rental property, except the loan payment.

But what are operating expenses! So imagine a property that rents for $0per month. The previous couple rules of thumb were designed to help rental property owners. For them, the rule can be helpful in determining just how much to pay for a property. The rule says that half of this ($000) will be spent on expenses.

The rule states that the most you should pay for a potential flip is of the after repair value, or ARV, which is what it would sell for when it’s all fixed up, minus the repair costs. According to the rule, the most someone should pay for this property would be $16000. But there are problems with the rule. This works well in many markets, but it has some severe limitations. For example, the rule doesn’t work as well for a property where the ARV is low, su.

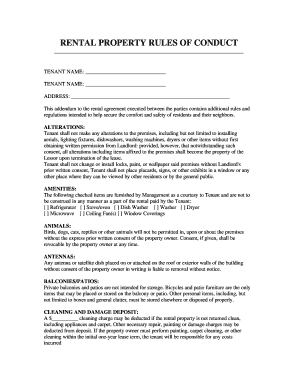

For example, your tenant is a painter and offers to paint your rental property instead of paying rent for two months. A Lawyer Will Answer in Minutes! Questions Answered Every Seconds. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Another standard clause in most lease agreements that needs to be discussed with tenants is your right of entry as the landlord.

In this case, the house is still considered a. If you use the place for more than days or. So if you rent your vacation home for. These expenses are deductible under the usual rules. You can only subtract the rental portion from rental income.

The personal portion is deductible on Schedule A and subject to the usual rules. As a rental owner or property manager, the last thing you want is for your guests to destroy the relationships you’ve spent time building with the residents of neighboring properties. So use this as an opportunity to highlight rules regarding anti-social behavior such as excessive noise late at night.

Property owners with modified adjusted gross incomes of $100or less may deduct up to $20in rental real estate losses per year if they actively participate in the rental activity. You actively participate if you are involved in meaningful management decisions regarding the rental property and have more than a ownership interest in the property. Depreciation commences as soon as the property is placed in service or.

Safestan Landlord Reviews is dedicated to renters looking for safe and reliable landlords. Help build safer, secure and reliable home rental environment.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.