How do you add a pod to a bank account? What does pod mean in banking terms? Are pod accounts taxable? Is pod and beneficiary the same thing?

So if you have bank accounts or CDs at a particular bank that together are worth $2500 you’ve maxed out your FDIC coverage at that bank. If you opened another account in your name, it wouldn’t be covered. The money remaining in the POD account will then be paid to the beneficiaries named by the.

The immediate transfer of assets is. If an account holder died with outstanding debts, creditors can seize money from the POD account before it passes to the beneficiary. Your financial institution can provide you with a form for each account. It is usually set up when the bank account holder gives the bank directions to transfer the funds to another person upon the death of the account owner.

While the account holder is still alive, they will still be able to access the bank account even if a POD arrangement has been set up. The owners of many bank accounts , especially savings accounts and certificates of deposit (CDs) name payable-on-death ( POD ) beneficiaries for the accounts. That means that when the account owner (or the last surviving owner, in the case of a joint account ) dies, the POD beneficiary can simply claim the money from the bank.

He can name his beneficiary on the account, and she can access the money by presenting the original death certificate to the bank or institution where the account is held. Generally all that is required to get the money or control of the account is for a beneficiary to show the bank manager or the brokerage firm an original death certificate. The person you name has no rights to the money until you. For a cost of exactly nothing, you can add POD beneficiaries to your bank accounts and CDs.

But the account agreement says that when the sole owner or last joint owner dies, the bank pays the balance in the account to a named death beneficiary. These accounts are often called Totten trusts or POD (pay on death) accounts. The prospect of passing assets without documents, executors, courts, and lawyers sounds like a slam-dunk. Louisiana allows certain financial institutions (e.g. banks, savings and loan associations, credit unions) to provide accounts with payable on death ( POD ) or survivorship designations. POD and TOD accounts are like going down a sliding board.

These statutes relieve the financial institution from liability for distributing the assets to the survivor named on the account (the POD designee). While a POD designation normally takes precedence over a will, many states have laws that allow your heirs and creditors to challenge the validity of a POD designation in court. Pay-on-death (“ POD ”) or transfer-on-death (“TOD”) accounts offer an easy way to keep money – even large sums of it – out of probate.

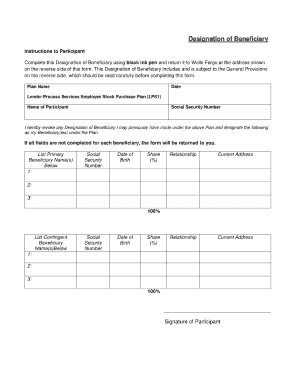

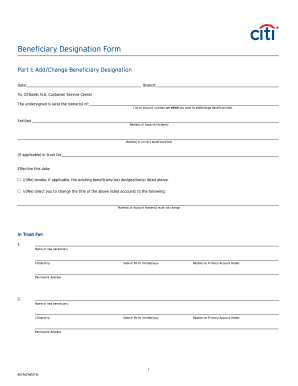

Setting up a POD designation is simple. You notify your bank , credit union, or investment advisor that you want to name a beneficiary for the account. Simply ask your banker for their payable on death ( POD ) beneficiary form.

POD on a bank statement means payable on death. You can name a POD beneficiary on any of your deposit accounts , and when you do, that person receives the funds held in the account after your death. North Carolina Code - General Statutes § 54C-166. If a person or persons establishing a withdrawable account executes a written agreement with the savings bank containing a statement that it is executed under this section and providing for the account to be held in the name of the person or persons as.

Payable on Death ( POD ) accounts. Brooks , California Attorney As an estate planner and probate practitioner, it is commonplace to see people take advantage of payable on death designations on their bank accounts , and other assets, by. If the account holder established someone as a beneficiary or POD , the bank will release the funds to the named person once it learns of the account holder’s death. After that, the financial.

Revocable Trust Account. A deposit account owned by one or more people that identifies one or more beneficiaries who will receive the deposits upon the death of the owner(s). POD accounts can be set up for savings accounts , checking accounts , money markets, and savings bonds as well as certificates of deposit.

The bank account becomes payable on death , or POD , which means the account becomes payable to the recipient upon the death of the account holder. When setting up this type of account , it is important to keep in mind that you may name more than one person. An account holder may choose to list both of their children as equal beneficiaries. A member has passe and her account was a POD account , with beneficiaries listed. The executor of her estate has come in, asking to transfer the funds to the estate.

Do we pay out the beneficiaries, or do we follow the executor, and transfer funds to the estate account ? Can an LLC have a POD. A PoD designation is added to an account using a signature card or similar form provided by the financial institution. Here’s the link to Capital One’s POD beneficiary form. I was told that when I opened my accounts with this bank , I requested that her name be made beneficiary or POD on all accounts with them and any future accounts.

I got a copy of the document to put in a ledger book I have made up for her so that when the time comes she will have the proof she needs to get any funds we want her to have. This map is intended to provide state specific information regarding statutory requirements for the opening of bank accounts for minors. Please click on a state for detailed information.

For questions, please contact the State Banking Department or CSBS Staff.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.