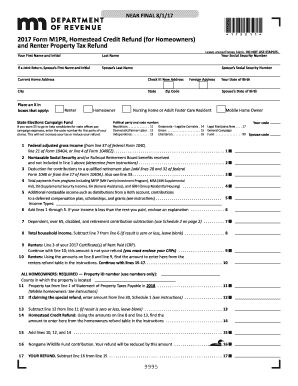

Renter Homeowner Nursing Home or Adult Foster Care Resident Mobile Home Owner. Form M1PR, Homestead Credit Refund (for Homeowners ) and Renter’s Property Tax Refund. Leave unused boxes blank.

Your First Name and Initial Last Name Your Social Security Number. Policy statements that provide added interpretation, details, or information about Minnesota tax laws or rules. Do I need a tax credit to rent a dwelling? When do renters have to file credit? Include any separate amounts the renter paid to you for items such as parking, a garage, utilities, appliances, or furnishings.

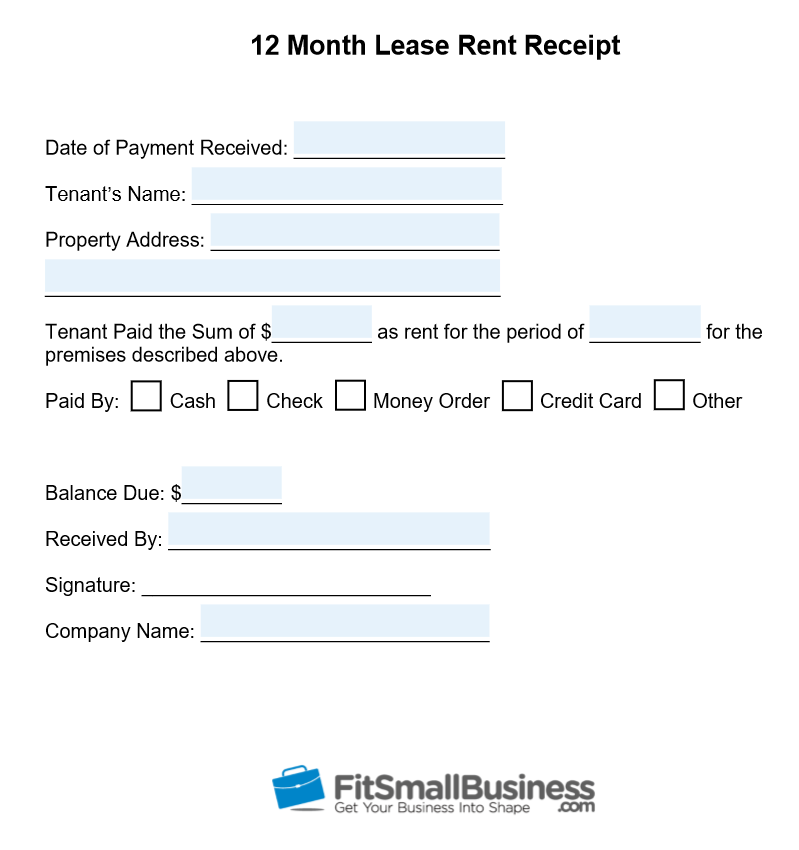

Adjusted rent – If line includes charges for: Enter on line heat, gas, electricity, furnishings, and board. Renters have until October of the year in which the credit is sought to apply, but it is advantageous to file as early as possible. Tenant and Rental Information. Verification of Rent Paid. Landlord Information.

To claim the renter ’s credit for California, all of the following criteria must be met: The taxpayer must be a resident of California for the entire year if filing Form 54 or at least six months if filing Form 540NR as a part-year resident. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!

Certification of Rent Paid. Spouse’s Social Security Number 5. Multiply Line by. Do NOT submit disks, USB flash drives, or any other form of electronic media. Electronic media cannot be processed and will be destroyed.

Follow the on-screen instructions. This is the same online filing system you may have used in the past. Line – Nonrefundable Renter ’s Credit. If you were a resident of California and paid rent on property in California which was your principal residence, you may qualify for a credit that you can use to reduce your tax.

Answer the questions in the Nonrefundable Renter ’s Credit Qualification Record to see if you qualify. A residential rental application is a document that allows a landlord to make an assessment of a potential tenant’s employment, backgroun credit , and prior leasing history (through references) to make the decision of allowing him or her to lease their property. Zillow Rental Manager offers an easy online rental application and screening process.

The landlord may request a fee (usually between $and $75) for performing a. If you file a New York State personal income tax return, complete Form IT-21 Claim for Real Property Tax Credit , and submit it with your return. How to claim the credit. If you are not required to file a New York State income tax return, but you qualify for this credit , just complete and file Form IT-2to claim a refund of the credit. This included rent paid for flats, apartments or houses. It did not include rent paid to local authorities or the army.

Rent tax credit ended on December. Virginia Tax Credits. Review the credits below to see what you may be able to deduct from the tax you owe. Download: Adobe PDF, MS Word (.docx), OpenDocument.

Typically after the tenant has viewed the property and a verbal agreement has been made the rental application is completed. Different tax rules apply depending on if the taxpayer renting the property used the property as a residence at any time during the year. Michigan – Renters in Michigan may qualify for the Homestead Property Tax Credit based on the difference between the property taxes you pay (or are deemed to pay as a renter ) and your “total household resources. LIHTC Income and Rent Limits.

The Renter Rebate Claim can be filed electronically through your tax software or directly in myVTax. Paper Returns You may file a Renter Rebate Claim even if you are not required to file an income tax return. What Is a Tax Deduction?

Subtract tax deductions from your income before you figure the amount of tax you owe.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.