What is a schedule an IRS Form? A hospital facility is one that is required to be license registere or similarly recognized by a state as a hospital. This includes facilities operated either directly or indirectly through disregarded entities or joint ventures. Instructions for these schedules are combined with the schedules.

AM - Admin, ExpressTaxExempt. Form 9Schedule H , Hospitals - Overview. See separate instructions. Access IRS Tax Forms. Make them reusable by generating templates, add and fill out fillable fields.

Save blanks on your laptop or mobile device. Downloa print and send your samples in no time. Form9for instructions and the latest information. Open to Public Inspection. Get fillable and editable templates and add required information.

Powerful tools, reliable service! Print, send and share in no time. Name of the organization Employer identification number.

Part I Financial Assistance and Certain Other Community Benefits at Cost. Hundreds of thousands of injections are given each year to prevent and treat diseases and save lives but some of these injections are unsafe and spread deadly diseases like hepatitis B and C and HIV every one of these infections is completely avoidable the World Health Organization recommends syringes that cannot be reused and. Is the organization required to complete ? Under what circumstances would a typical church file a 9or other one of those forms 9would typically be filed for unrelated business income tax some of you I do prepare them for it is what we see quite often is rentals of your facilities in some cases advertising any any unrelated business income that exceeds $0per. The time needed to complete and file this form and related schedules will vary depending on individual circumstances. For Paperwork Reduction Act Notice, see the separate instructions.

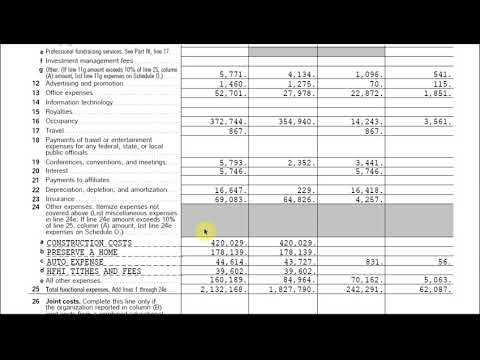

Research (from Worksheet 7). Cash and in-kind contributions for community benefit (from Worksheet 8). VINCENT RANDOLPH HOSPITAL, INC. Schedule H collects information about a hospital organization’s charity care and other community benefit activities as well as additional data related to tax-exemption.

Hospital Facilities (list in order of size, from largest to smallest—see instructions ) How many hospital facilities did the organization operate during the tax year? Internal Revenue Service. It presents board members an opportunity to demonstrate that the organization they represent continues its original mission of community service. Grants and Other Assistance to Organizations, Governments, and Individuals in the United States.

Supplemental Information on Tax-Exempt Bonds. Compensation Information. Total sales everywhere (see instructions ) 3. Yearly versions of this Tax Form. The IRS has made subsequent revisions to Schedule H , Part V, Section B to conform questions more closely to Sec.

If Yes, complete Schedule H If Yes, complete Schedule I. SectionPriorityof the Form Level Comment Recommendation. Part V, Section A, Line 2a Medium State law currently controls whether an individual is an employee of the filer and has caused confusion. Line 2a should address the use of a professional employer organization (PEO) or management company in the instructions so that it is clear whether the directives from Part VII, Section A are, or are not, applicable to the number of employees to be reported in Part V, Line 2a.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.