PREIT ( PEI ) Declares $0. It is engaged in the ownership, management, leasing, acquisition, redevelopment, development and disposition of retail shopping malls. In general, profits from business operations can be allocated to retained earnings or paid to shareholders in the form of dividends or stock buybacks. Even if you have actually never thought of being an advertiser in the past, you can find out “the ad biz” faster than possibly any other approach of digital advertising that’s available. All you require is a great product to market, a person to pay you to offer it, and also a place to place your ads.

Appears straightforward? Eligible Canadian dividends that you have received will be grossed up by. You will also be given a 10. For example, if the dividend was $1.

There is typically dividend per year (excluding specials). The next Pepsico Inc. There are typically dividends per year (excluding specials), and the dividend cover is approximately 1. FFO), the measure of cash flow used by real estate investment trusts (REITs). For ETFs, the annual dividend is for the trailing twleve months. NYSE: PEI closed above both the base and conversion lines on rising volume.

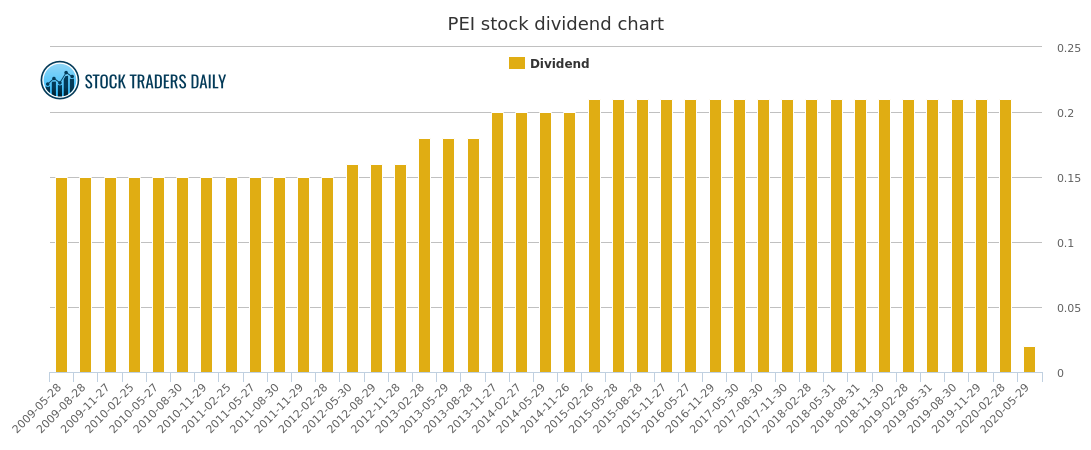

This entry is riskier because the flat bottom of the cloud may offer some stiff resistance. Entry will be just above Friday’s high, with the initial stop just below Friday’s low. View PEI net cash flow, operating cash flow, operating expenses and cash dividends. Below are the most recent cash dividends paid by PEI.

Zacks News for PEI No Record found. Review NRZ dividend yield and history, to decide if NRZ is the best investment for you. Cumulative distributions of 7. NOTE: the ex- dividend date is one business day prior to the record date). You may enter multiple symbols, separated by spaces or commas, up to a maximum of 1characters. Obviously, that’s a troubled business, but PEI is in the late stages of reconfiguring and redeveloping its properties to reflect current consumer trends.

These preferreds are cumulative, meaning that PEI remains on the hook for any missed dividends. PIE is cash flow positive and is still paying it $0. This program has closed and applications are no longer accepted.

Dividend Declaration Date. If no new dividend has been announce the most recent dividend is used. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing.

Find market predictions, PEI financials and market news. Fitch Ratings released a report in June that showed the dividend recapitalisation market spiking during April and May after a lull that began in November. Insider Trading information for PEI is derived from Forms and filings filed with the U. Securities and Exchange Commission (SEC). Please Note: An FPI is exempt of filing insider holdings with the SEC. Explore commentary on Pennsylvania Real Estate Investment.

Fortis later paid $3. While the 2-year Treasury is yielding only 1. Stocks Rankings for PEI. Short Volume is a data set that can be used to understand investor sentiment.

When an investor makes a short sale, they do so with the belief that a security will decline in price. PEI is an international trade association whose members manufacture, distribute and service petroleum marketing and liquid handling equipment.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.