Real Estate, Family Law, Estate Planning, Business Forms and Power of Attorney Forms. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Can an irrevocable trust be broken by the owner of the trust? Does a revocable trust become irrevocable when?

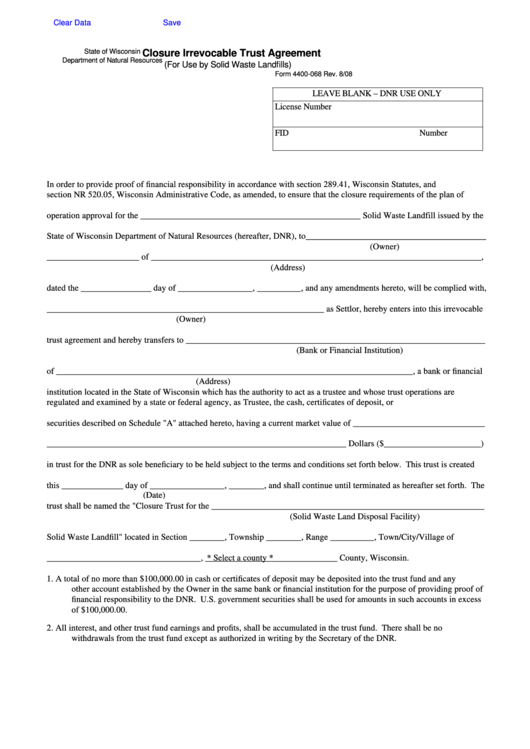

How to revoke an irrevocable trust? How exactly does one go about revoking a revocable trust? Irrevocable trusts are those trust that may not be re-claimed by the creator, or settlor, of the trust. An irrevocable trust may also be created through the death of the grantor of a revocable living trust. Creators of irrevocable trusts are commonly called grantors.

Unlike a revocable trust , an irrevocable trust is treated as an entity that is legally independent of its grantor for tax purposes. When one or more inter vivos revocable trusts eligible under B2-2-0 Inter Vivos Revocable Trusts hold title to the mortgaged property (alone or with another eligible inter vivos revocable trust ), only an individual who is both grantor and primary beneficiary of one of the trusts may be a. Once the grantor places an asset in an irrevocable trust , it is a gift to the trust and the grantor cannot revoke it. A Lawyer Will Answer in Minutes! Questions Answered Every Seconds.

Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. The trust document names the trustee and one or more beneficiaries. How does an LLC protect assets? An LLC is formed pursuant to state law. With these trusts , the person creating the trust will often retain certain rights, such as income payments for life.

This document , regularly included in an advance directive, lets you appoint someone ( plus a backup) to make medical choices on your behalf when you’re unable to do so. Revocable living trust Drawn up correctly, this makes it easy to keep control of your finances today, let a trusted person step in if necessary, and ensure fewer problems for. Most states require that. Income Tax Return for Estates and Trusts , for each taxable year where the trust has $6in income or the trust has a non-resident alien as a beneficiary. A revocable trust is flexible and can be dissolved at any time.

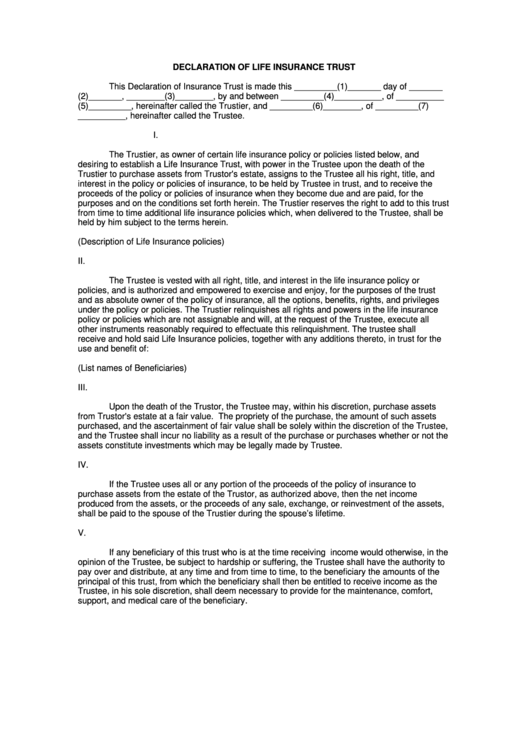

The trust created in this instrument may be referred to as THE IRREVOCABLE SPECIAL NEEDS TRUST for the benefit of _____ (hereinafter referred to as the “Beneficiary”). SCOPE OF AGREEMENT This is an irrevocable trust for the sole and exclusive benefit of the Beneficiary. By following the terms of the trust , you carry out the settlor’s written wishes and the purpose of the trust. To comply with this duty, you need to read and understand the trust terms, including the duties and powers set forth in the trust document.

The sample trust forms are also available on an accompanying disk for the print version. Irrevocable Trusts : Analysis With Forms is regularly updated to remain current with all laws affecting irrevocable trusts. You can even find living trust forms online to guide you through the process of how to write a living trust and be done in minutes.

The trust ’s income tax return would show that the income was distribute and the trust would issue a K-form to the beneficiary, who would then report the income. Sometimes family trust names contain the actual family name (for example, Smith Cooper Family Trust ), or sometimes they are more obscure (such as Bear Care Family Trust ). Both revocable and irrevocable trusts include their own unique tax requirements. Because the grantor of a revocable trust still maintains ownership of the property in the trust , they will be. By doing this they can change the conditions by pouring the assets into a trust with different terms. This process might include creating a new trust.

Another option would be to use another pre-existing irrevocable trust as the recipient of the trust assets. Creating an irrevocable trust is a serious decision. Even though you’ll give up control over the trust property, you do have control over the rules that govern the trust and you can determine the uses of the trust assets.

You determine who serves as trustee and name the beneficiaries. For married couples of higher net worth, irrevocable trusts are often drafted so that the trust is divided into two parts upon the death of a settlor. So, when the settlor dies, half of the assets go into an “A” trust for the benefit of the surviving spouse. Often a trust is revocable until the settlor dies and then it becomes irrevocable.

Beneficiaries of an irrevocable trust have rights to information about the trust and to make sure the trustee is acting properly.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.