An example of an input tax is the value added tax. What does input tax mean? When a business then taxes its customers, this is considered an output tax.

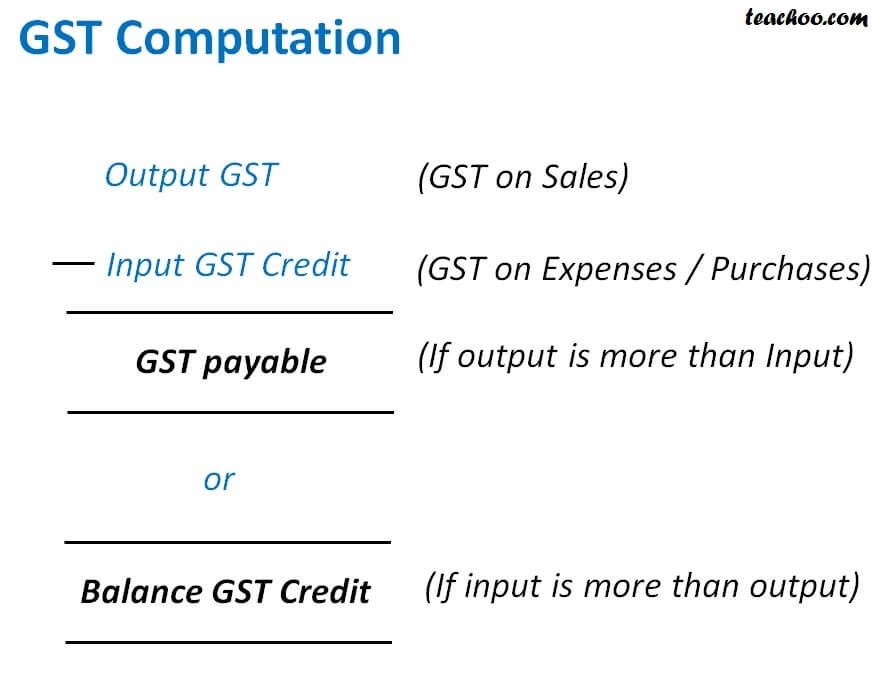

The business pays the federal revenue authority the difference between the output tax and input tax if the amount is positive , or it can apply for a tax refund if the amount is negative. So for example, in relation to the manufacturer above, the input tax on the purchase of raw materials is 5 and the output tax on the sale to the retailer is 92. If inputs exceed outputs, the company can claim a refund from HM Revenue and Customs.

Every country follow its own sales tax , purchase tax procedure. Government can levy the taxes and changes the procedure from time to time as per the tax plan for the nation. There are two tier in tax jurisdiction i. Details of input tax calculation should be properly documented.

Before this, sale tax was collected. Value added tax is charged on purchase and sale. Owe back tax $10K-$200K? See if you Qualify for IRS Fresh Start (Request Online).

A registered dealer assigned with TIN is entitled to claim input tax credit. The tax percentage rates vary from country to country and are determined when you define the tax codes. Which means a seller can deduct taxes he paid during his purchase in total taxes collect from the sales transaction. It is charged on the selling price of the goods. It is paid at the cost price of the goods.

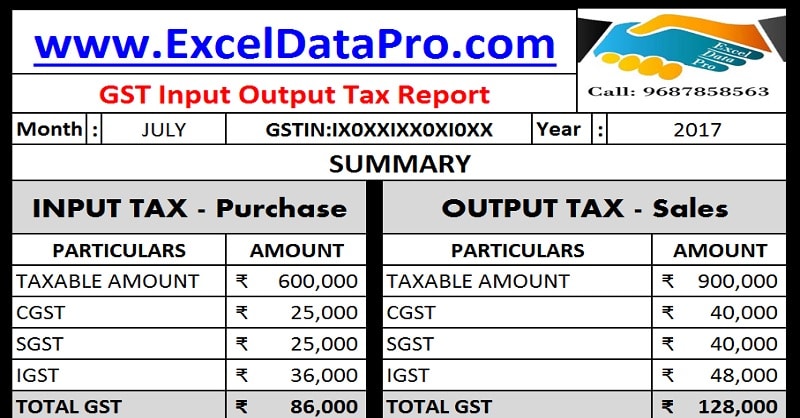

Theo is a chocolate manufactured and sold in the US. Amounts inclusive of sales tax. If amounts of sales and purchases are expressed with tax amounts that is inclusive of sales tax then output and input tax figures can be determined by multiplying a tax fraction to sales and purchases figure. That is where the computation and confusion comes in. I included sample spreadsheet computation here to provide more details.

Of course this does not represent the business world because there are other things to consider (like valid expenses, withholding taxes , etc.). If the output tax exceeds the input tax , the business must pay the difference to the government. On the other han if the input tax exceeds the output , the government refunds the difference to the business. VAT Exempt Goods for Rs.

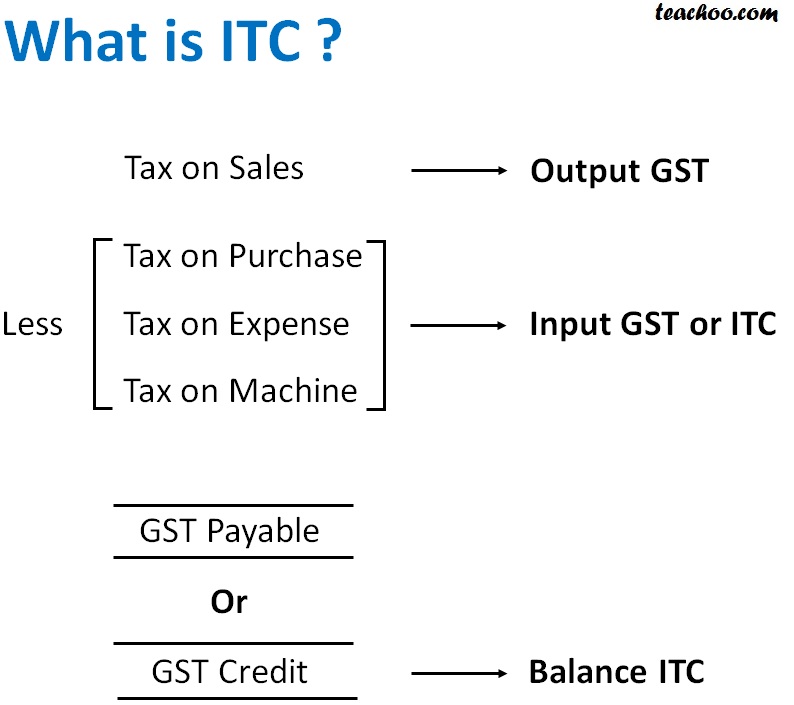

The difference between output tax and input tax is payable to relevant authority. If input tax is greater than output tax the company can claim back such difference amount. This means as a recipient of inputs or input services (e.g. a manufacturer), you can deduct the amount of tax paid on inputs or input services against the tax on your output. The final amount must be reported to your regional tax office.

Tax categories of GL accounts can be checked in t-code FSS whereas settings of tax codes can be verified in t-code FTXP. Input tax = 350x 0. Through the virtual platform, you can still learn the latest information on tax and accounting issues affecting investment companies, and even earn CPE credits (available through the conference platform until November 6). Hear the latest from fund sponsors, auditors, and SEC staff. Expert Small Business Accountants.

Monthly if input tax is generally higher than output tax because a major portion of the turnover is exempt. Now only entries under the goods and services tax are required to be taken on record for either supply of goods or services. To record offsetting of output tax against standard input tax attributable to government transactions. Sales tax accounting involves asset, revenue, and liabilities accounts such as Sales Revenue, Cash, and Sales Tax Payable.

Accounting for sales tax is not too complex if you understand the basics of accounting from our previous lessons. This article will refresh those basic accounting concepts and give you examples of small business sales tax.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.