Tax Return Will Be Filed Right. Dependents, Qualifying Child for Child Tax Credit, and Credit for Other Dependents. Total Income and Adjusted Gross Income. Instructions for Schedule 1. Brown are filing a joint return. First, they find the.

See full list on apps. For most people, it covers all you need to fill in your tax return , but the more technical and less commonly used information is available at ato. Most refunds are issued within business days of lodgment. Register and Subscribe now to work with legal documents online. You also have the option of saving your return as a PDF before filing if you want to see how the underlying tax forms have been filled out.

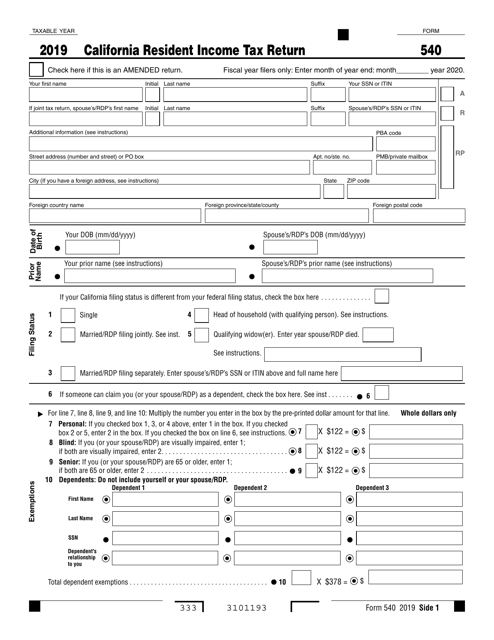

To amend from separate tax returns to a joint tax return , follow the Form 5instructions to complete only one amended tax return. Tip: To e-file and eliminate the math, go to ftb. To figure your tax online, go to ftb. This includes those who file a tax return to get a refund even though they are not required to file a tax return.

Individual Tax Forms. Type or print in blue or black ink. Include Schedule AMD) 1. Filer’s Full Social Security No. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly.

Wherever You Are In The World. Your Taxes Done With Ease. Single Married filing jointly. Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) If you checked the MFS box, enter the name of spouse.

Line Multiply amount on Line times tax rate of (.01) and enter amount on Line 4. TENNESSEE DEPARTMENT OF REVENUE. To successfully complete the form, you must download and use the current version of Adobe Acrobat Reader. Exemptions For line line line and line 10: Multiply the number you enter in the box by the pre-printed dollar amount for that line. Nebraska Schedules I, II, and III (all three schedules are on one form) I - Nebraska Adjustments to Income for Nebraska Residents, Nonresidents, and Partial-year.

Do not use staples, tape or glue. If you have an EXTENSIO N check here and attach a copy: EXTENSION. If this is an AMENDED return , check here: In the space provided below, statewhy you are filing an.

In addition to completing this summary form, each tax credit has a schedule or form that is used to determine the amount of credit that can be claimed. Taxpayers who used this form in the past must now use Form D-40. Please select the appropriate link from below to open your desired PDF document. If you need to file for an extension, use Form 504-I and then later file a Form 511. Filing Status Check only one box.

For technical assistance on fillable forms, see Forms Technical Information. A $tax credit is allowed for each individual reported on the return who is age or over. Also, a $tax credit is allowed if an individual is legally blind.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.