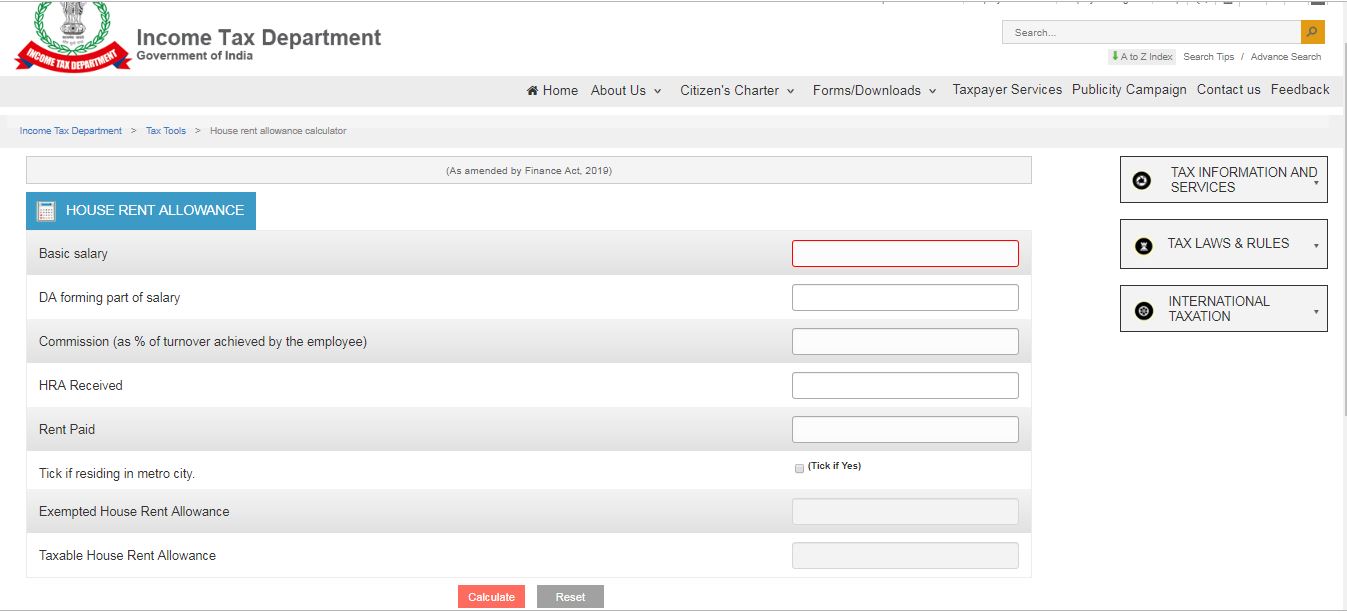

If you receive HRA , you can use this calculator. Here is the HRA Tax Exemption Calculator that will help you to calculate HRA and save your tax. Find popular FAQs on HRA calculation. Who can claim HRA exemption?

What is house rent exemption? In General, this HRA forms part of the salary. Use the HRA Exemption Calculator to calculate your HRA. As per income Tax act, for calculation House rent allowance least of the following is available as the deduction.

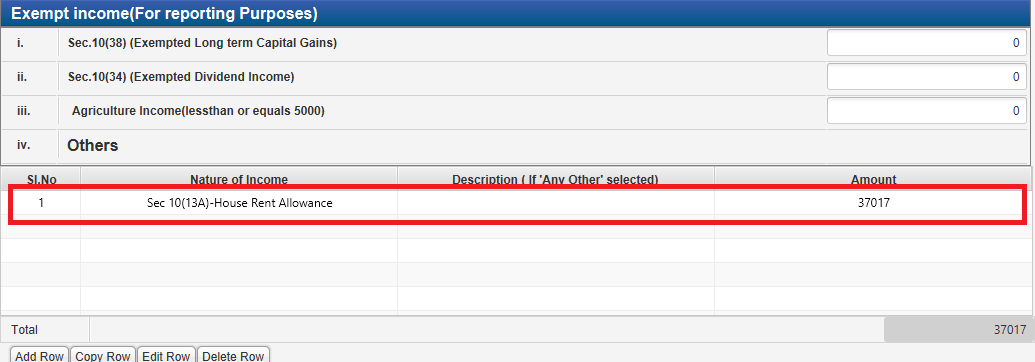

Our article HRA Exemption , Calculation ,Tax and Income Tax Return explains it in detail. The exemption on HRA is calculated as per 2A of Income Tax Rules. As per Rule 2A, the least of the following is exempted from salary under Section 10(13A) and does not form part of the taxable income. The Income Tax Department NEVER asks for your PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts through e-mail.

House Rent Allowance ( HRA ) – Factors Deciding Exemption. Get the accurate amount of HRA that can be deducted from taxable income, both for persons living in metro and non-metro cities. It is a part of your salary provided by the employer for the expenses incurred towards rented accommodation.

So the HRA Exemption is Rs. HOW TO CLAIM HRA EXEMPTION. This exemption is not applicable from A. The tax exemption of house rent allowance is not available in case you choose the new tax regime. HRA health plan for one employee (or spouse).

No ACA coverage restrictions. Regulated by the provisions of Section 10(13A) of the IT Act, the house rent allowance serves to be quite beneficial to salaried employees in India. As per law, only salaried employees can claim HRA and self-employed individuals are exempt from doing the same. HRA , as an exemption is provide only if the employee is living in rented. But the amount considered for tax exemption on HRA will be calculated in Three ways, and the least amount will be taken for tax exemption.

You can calculate your HRA. HRA Calculator utility allow you to know how much exemption on HRA will you get. HRA taxable and HRA Exempted can be calculated by using the latest HRA calculator.

HRA exemptions under Section 10: Any individual who lives in a rented house can also avail tax exemption under section 10. Many components are taken into account while determining income tax. Three major components are gross taxable income, HRA exemption , and transport allowance. EPFO cuts rate on PF deposits to 8. As Income Tax Department has laid down a circular via CBDT (Central Board of Direct Taxes) that where the annual rent paid is more than ₹ 00per annum, it is mandatory to report the PAN of landlord to the authority to claim exemption. Salaried employees are eligible for HRA exemption for the income tax that they are required to pay each financial year.

Salary for HRA exemption purpose include Dearness Allowance (DA) if the terms of employment so provides. Higher Exemption is not for all Metro Cities: Please note that there is a widespread mis-conception that the higher percentage of of salary as per clause (c) above is available for all metro cities. Excel Based Income Tax Software for F. As you are aware that Income Tax calculation is one of the most complex tasks for the common man (especially for salaried). When you receives salary slip, you can see one column showing HRA amount. Full form of HRA is house rent allowance.

Salaried can take benefit of HRA as an exemption of Income-tax under section GG, (if you are not getting HRA separately in your pay).

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.