In order to close out the estate of a loved one who has die the executor or administrator must gather all assets to then pay off all debts prior to distributing remaining assets to beneficiaries. The probate courts assign a trustee to review and approve all elements. An accounting is part of the overall probate process. The executor has a fiduciary duty to the estate , and must account for all expenses, as well as managing estate assets.

This may be a formal or informal accounting depending on the request. Regardless, the fiduciary has a responsibility to provide an accounting when requested. What is the accounting process of an estate?

Can I request an accounting for my mothers estate? How does estate accounting work? Can an executor request a reconciliation of an estate? Producing a final accounting in any estate is a process that begins as soon as the decedent dies.

Throughout the estate administration, the executor must keep the Inventory of Assets updated and track the estate bank account activity. When someone dies, his or her property is handled by someone appointed as an executor and the executor must keep accurate accounting records as the estate is wrapped up and distributed in keeping with the wishes expressed in the will. It may alter the rules re accounting.

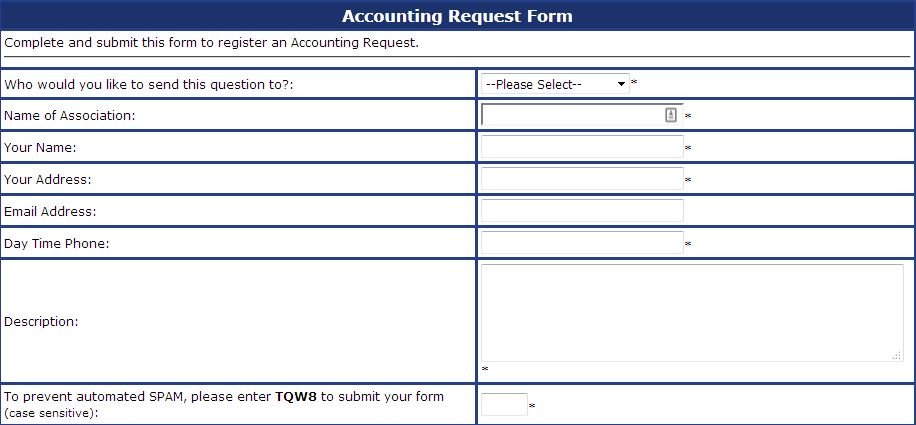

Assuming you are entitled to an account, make a formal request for an accounting in writing. You should send it certified mail, return receipt requested. The request should state that, if the trustee fails to account within days, you will petition the court for an accounting.

As was pointed out, the cost of preparing and providing the accounting are administrative expenses of the estate and would come off the top, before distributions are made to the beneficiaries. If the response to a demand from the executor or personal representative is not satisfactory and the amount of money at issue is substantial, in order to protect your rights. By filing objections to the accounting , the beneficiary obtains the right to appear in front of the judge to dispute what the executor or trustee has done.

We are a Veteran Owned Business, providing discounts for Veterans, First Responders, Elementary and High School teachers. One of your first steps is to take an inventory of the estate assets, and prepare and file an inventory form with the court. This lists all the property that is in the estate , and establishes the starting value of the estate.

Every beneficiary and every fiduciary should understand Compelling Accountings and Defending Accountings. Even when a personal representative succeeds in getting an heir or beneficiary to sign a waiver that forfeits their right to an inventory and accounting , it is important to know that the waiver can be renounced afterward and an. How to Request an Accounting of an Estate.

First, all beneficiaries have a right to request a formal accounting of an estate. After updating the estate account and completing the final Inventory of Assets, it was time to complete the final accounting. As mentioned in the article Closing an Estate in a Formal Probate Process, the attorney sent me three schedules that made up the final account.

A petition for trust accounting is a legal document which may be filed in a civil court of equity in a county or state, in accordance with Rules of Civil Procedure for that location (jurisdiction). A person (for example, a beneficiary) or entity, which has a legal interest in the trust, may file the petition. I (We) certify that this is a true and accurate accounting of the assets of this estate for the period describe and if this is a final account, that to the best of my (our) knowledge all taxes have been paid and provided for. Date Fiduciary Date Fiduciary Date Fiduciary RECEIPTS: ABC Bank, interest. At any time after the expiration of months after the date that the court clerk first issues letters testamentary or of administration to any personal representative of an estate , any person interested in the estate may demand an accounting from the independent executor.

As a beneficiary, but not an executor, of an estate , you can request an accounting from the executor from time to time. Having it will allow you to pay debts, transfer assets to beneficiaries and otherwise manage the affairs of the estate. Petition for Administration. There are plenty of instances where the deceased didn’t create a will.

Before terminating a trust, you as trustee will need to prepare a final account and obtain assent from all remaindermen. These are your last steps, usually completed after distributing the final income amounts, paying the last expenses, and filing the final tax returns. Final accounting should be done for non-probate and probate trusts. The accounting as part of the probate proceding typically covers matters relating to the assets in the estate at time of death, not prior to time of death. Those pre-death issues are separate.

If there was a joint account with right of survivorship, unless you were a joint owner, you are OUT OF LUCK absent a claim that it was essentially held. I need to send a letter requesting an accounting of an estate since the executor has had no recent contact.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.