Lakhs after the introduction of GST. The builder has already obtained the. The ones who are about to purchase residential flats for them, the government has offered relief. You are subjected to.

The deduction made is of land value which is. To calculate the GST on building, Rs will be counted out as the land value and the GST on construction would apply only on the remaining Rs 77. What is the GST rate for under construction homes? How does GST affect under-construction property? How is GST calculated in real estate?

Under GST , an under - construction property now attracts per cent tax. Before you think how it affects the value of an under - construction property , consider this. Earlier, you had to pay service tax and VAT.

These taxes had a cascading effect, making the property cost go up. We suggest you look at the key GST terms before reading further below about GST calculation. An under-construction property attracts GST at the rate of. One-third value of the. VAT) of 1-percent depending on the state.

Whereas the new tax system makes sure all these taxes are subsumed by GST and pegs the total tax on under - construction property at. Since it offers a reduction of ⅓ rd on land cost, the effective GST is ⅔ rd of i. GST on under construction house property (including affordable housing) w. The GST rate cut is for under - construction property or ready-to-move-in flats where the completion certificate is not issued at the time of sale. PM IST Previously, the ultimate selling proposition of under - construction homes was significantly lower prices over ready-to-move options, says chairman, Anarock Property Consultants, Anuj Puri.

The new GST rates in the real estate industry will. GST is payable only on under construction property as discussed below. Goods and Services Tax or GST refers to the indirect tax levied on the supply of goods and services. Further, GST council has reduced rates w. Since then you are regularly paying service tax and VAT.

The GST Council has announced four rates for services - 1 and percent. VAT is charged at the rate of of “agreement value” in Mumbai and Pune and in Bangalore. There is no VAT on under - construction properties bought in Noida-NCR, Chennai and Kolkata. This passing on of the property tax rebate to the. Kindly note that the GST will not be applicable in Re-sale transactions.

The applicable GST rate for under construction flats, properties or commercial properties in land or undivided share of land is currently at with full Input Tax Credit (ITC). GST rate of (Without ITC) is applicable On Under Construction Properties (For Homes Purchased Under Credit-Linked Subsidy Scheme) 2. GST rate of (Without ITC) is applicable On Under Construction Properties (Other than above) 2. Central Tax (Rate) ,dt. But, prices of completed apartments will not be affected as GST will not be applicable there. Calculate the Pre construction period of constructed house property.

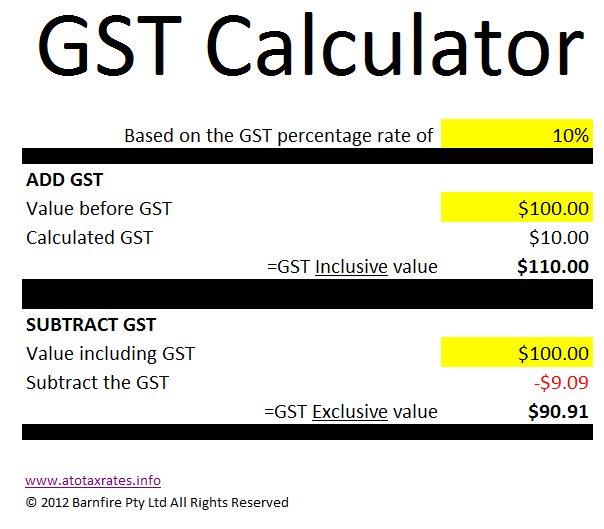

It is from the year of home loan taken till the year in which construction is completed. However, the interest will be allowed from the date of loan taken till the 31st March before the financial year in which construction is completed. For instance, if you originally bought the property through a GST -free supply from a related party or deceased estate, the original cost of the property for the purpose of calculating the margin under the margin scheme may not be the original cost you incurred to acquire the property. Taxpayers are now aware of the amount of tax charged at each point of supply for products and services thanks to the implementation of GST. How to Calculate GST using a GST Calculator ? When calculating GST , taxpayers must be aware of the GST rates applicable to different categories.

Construction Agreement between the Developer and the Purchaser Transaction Impact of GST Taxability - As discussed above, any construction of a property by a developer for a purchaser amounts to ‘Works ontract’ and accordingly, the subject transaction will be taxable under the GST laws. Under the new tax structure, the rates applicable are ,.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.