What is ACA hardship exemption? Under chapter of the bankruptcy code , you are only eligible to receive a financial hardship in-service withdrawal if you have unpaid medical expenses, a casualty loss, or unpaid legal fees incurred for a separation or divorce. How to apply for a hardship exemption. A hardship distribution is a withdrawal from a participant’s elective deferral account made because of an immediate and heavy financial nee and limited to the amount necessary to satisfy that financial need.

The money is taxed to the participant and is not paid back to the borrower’s account. See full list on irs. A plan distribution before you turn (or the plan’s normal retirement age, if earlier) may result in an additional income tax of of the amount of the withdrawal.

IRA withdrawals are considered early before you reach age 59½, unless you qualify for another exception to the tax. A retirement plan loan must be paid backto the borrower’s retirement account under the plan. A plan sponsor is not required to include loan provisions in its plan.

Profit-sharing, money purchase, 401(k), 403(b) and 457(b) plans may offer loans. Plans based on IRAs (SEP, SIMPLE IRA) do not offer loans. To determine if a plan offers loans, check with the plan sponsor or the Summary Plan Description. IRAs and IRA-based plans (SEP, SIMPLE IRA and SARSEP plans) cannot offer participant loans. A loan from an IRA or IRA-based plan would result in a prohibited transaction.

These plans use IRAs to hold participants’ retirement savings. However, a additional tax generally applies if you withdraw IRA or retirement plan assets before you reach age 59½, unless you qualify for another exception to the tax. You can withdraw money from your IRA at any time. Additional resources 1. Required Minimum Distributions 2. When can a retirement plan distribute benefits? Considering a loan from your 401(k) plan?

Rollovers to and from other retirement plans 6. Tax Matters - The Top Tax Defenders Blog Fill out the Necessary IRS Form. Retirement Topics - Hardship Distributions 7. Provide Your Last Return. This process cannot proceed without a copy of your last tax return.

As you submit this other. Hire a Professional Tax. The IRS lists the following as situations that might qualify for a 401(k) hardship. Certain medical expenses. Home-buying expenses for a principal residence.

Up to months’ worth of tuition and fees. Expenses to prevent being foreclosed on or evicted. Burial or funeral expenses. Some counties provide one-time financial hardship Licenses but Need That you apply for the Temporary Assistance for Needy Families Program, food stamps and other assistance programs. By applying for aid Start.

Some foundations may want evidence before considering you that you’ve been denied help. Foundation Center provides a database. Yes, the needy people have to apply hardship grants provide you fast cash program for it and wait until the application approved. Go to the official website, check the claim status, and contact them online or visit the office.

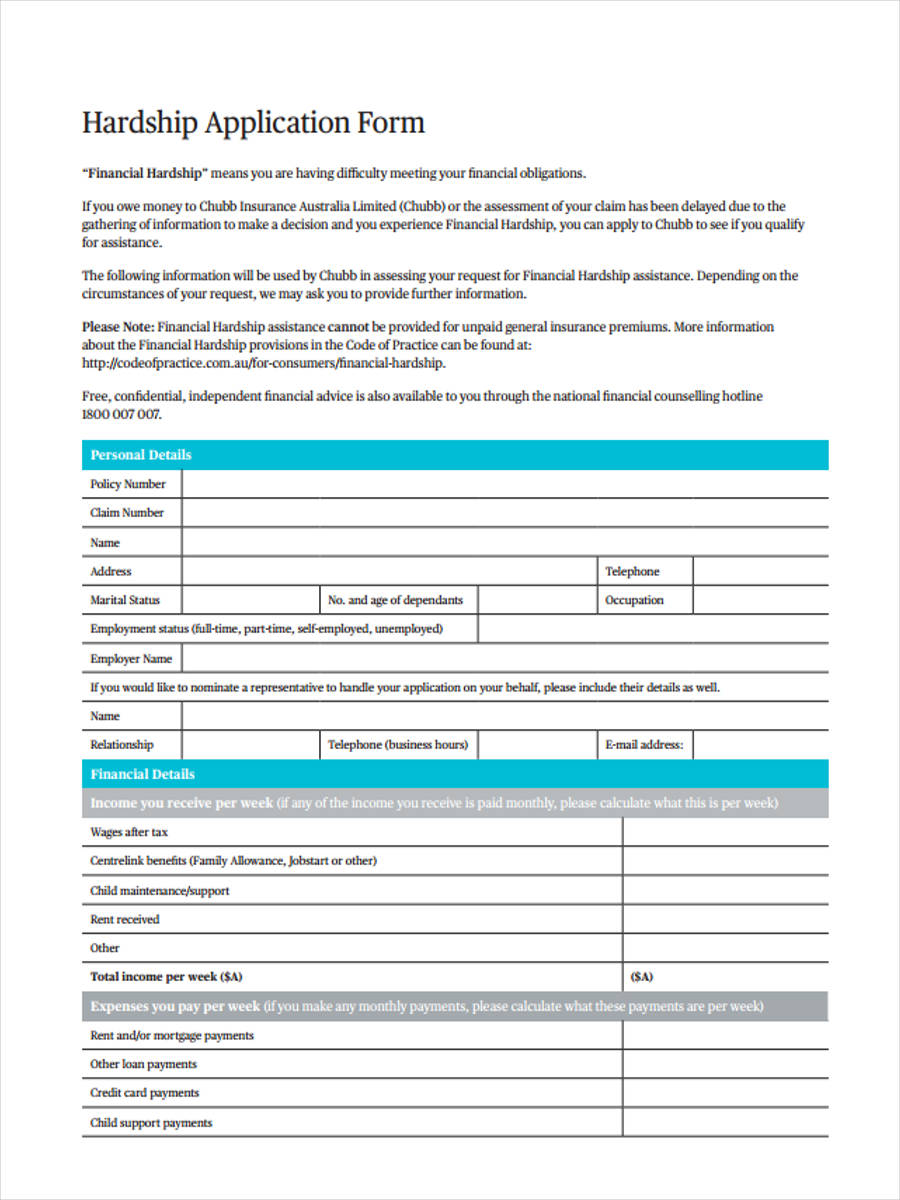

HOW TO APPLY FOR A HARDSHIP VARIATION UNDER THE CREDIT LAW? Try to strike a balance between what you can afford and trying to at least meet. Ask the lender to send out a financial statement for you to complete.

To request for special consideration, a person struggling with his or her finances uses a hardship letter known as a financial hardship letter. Commonly used by people who can’t make their credit card or mortgage payments, hardship letters are a way to seek leniency from lenders. Real Estate, Landlord Tenant, Estate Planning, Power of Attorney, Affidavits and More!

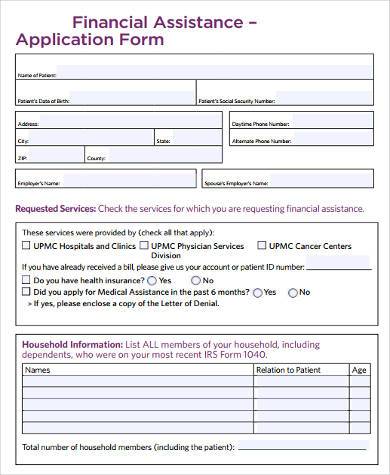

All Major Categories Covered. Include a letter that describes the financial difficulties that limit you from paying your copayment. This guide walks you through these programs, including what they are, how they work, how to apply , and their effect on your credit score.

And to manage this role, the government help her in all possible ways. Social assistance and financial assistance is offered by many other organizations, NGOs, non-profits, charities, and religious organizations for the family. Letter of Financial Hardship for Scholarship Sample. To: Scholarships Department, I am writing to request consideration for your Everybody Counts financial hardship scholarship for high school graduates.

I will shortly be applying to several colleges, but currently do not have the means to finance any courses. Submitting Your Severe Economic Hardship Application to USCIS. Applying during temporary financial hardship If you already get Child Care Subsidy, complete the following steps to apply for the temporary financial hardship subsidy. If you don’t currently get Child Care Subsidy for your chil you need to submit a claim for it online. Affordable Rental Housing.

Get help finding rental assistance or public housing. Learn about federal government programs, including unemployment benefits, and how to find which ones are available to you.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.