Should you add beneficiaries to your accounts? Do you have to have a beneficiary for a checking account? Does designating a beneficiary of a bank accoun? What does beneficiary on a bank account mean?

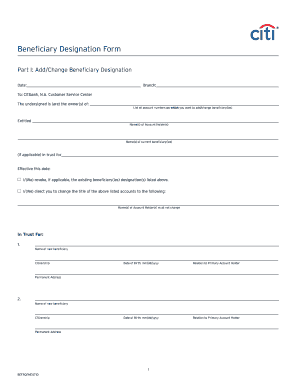

As a participant in the Plan, you will be asked to name a beneficiary (the person or persons or your estate that will receive benefits in the event of your death) and the percentage payable to that beneficiary. If you are married and you name someone other than your spouse as a beneficiary , an authorization form will be mailed to your home. United States and its territories. You must go to your bank in person to add the beneficiary to your account.

Bring along your photo I bank account information and beneficiary information. If you want to name multiple beneficiaries, you will need each beneficiary’s name and address. Your beneficiary does not have to be there, and there is nothing for the beneficiary to sign.

Enter the beneficiary ’s name and 20-digit Citibank account number, select the priority of payment, press “Next”, confirm by pressing “OK” 3. Checking accounts don’t require account holders to name a beneficiary. Sometimes your bank will ask for this information when you’re opening a new account, but they don’t always. And sometimes you can’t add or change beneficiaries online. If your bank has a brick-and-mortar branch, you may need to visit the personal banker with the beneficiary or with that person’s information, including address and Social Security number to add them to your account or change beneficiarie.

See full list on consumerismcommentary. Brokerages and banks will usually ask for a beneficiary when you open an investment account of any kind. Even if you don’t plan to save massive amounts of money in any given account, be sure you designate a beneficiary right away.

You never know how that account balance could grow between now and when you might pass away. Plus, a small account balance gives you even more incentive to name a beneficiary. In the case of accounts with a relatively small balance, probate fees could eat up the enti.

Policies like life insurance will obviously ask for a beneficiary right away since their point is to benefit your heirs should something happen to you. Still, you’ll want to be sure that these policies are kept up-to-date with your recent beneficiaries. You might think about skirting around the need for a beneficiary by naming a joint account owner , instead. In some cases, this can be appropriate. Naming your spouse as a co-owner on your accounts usually makes sense, but naming another person as co-owner may not.

Of course, you can designate a beneficiary on every one of your fifteen different bank accounts. For instance, adding an adult chi. But that doesn’t do a whole lot of good if your beneficiary doesn’t even know about the accounts after your death.

This is why it’s so important to keep a file — whether electronic or physical — of all of your personal financial information. Maintaining a money binder is an excellent way to keep all of your financial information together, including account log-in information. Just having a list of. One thing to keep in mind is that you’ll need to keep your beneficiaries up to date. Any major life event, such as a marriage or divorce, or the birth or death of a chil means you need to look over your account beneficiaries to make sure they’re still accurate.

Also, be sure that your account beneficiaries are listed in the appropriate order. This is important if you, for instance, want to account to pass first to your spouse but then to your child if your spouse has also passed away. As you move towards financial independence, you’ll begin to enter on to more complicated financial situations which might require true estate planning. After all, you don’t want to see all your hard work and careful planning go to waste when your beneficiaries are heavily taxed on what you leave behind!

Legal advice is a good idea, in less complicated cases you can save a fair amount on legal fees using one of the online estate planning services. While in more complicated cases such as multipl. Retirement Account or for the company’s 401(k) plan, we might name beneficiaries.

When we buy our home, we might decide to title the property so it would pass directly to our spouse or partner, assuming we die first. After your death, the account beneficiary can immediately claim ownership of the account. Before you set up your account , let’s examine the bank account beneficiary rules more closely. You’re in charge when it comes to.

The beneficiaries designated on your account will only need some basic paperwork to receive money left in that account following your death. Name and address of the beneficiary ’s bank. Set up online banking, open an account or lear.

To register the payee or to perform an ad-hoc funds transfer you will need to enter the One Time Password (OTP) that will be sent by SMS to the registered mobile number. Most people know they can have a bank account with more than one signer. In this situation, both people have access to the funds in the account. Beneficiary ’s account number or IBAN. A beneficiary designation, however, is different.

Access your payee list and change payee details easily with Citibank Online. Click Manage Your Payee in the sidebar. Find payees in the list or use the search function. To amend any details (like a new account number), click CHANGE PAYEE.

Want to delete a payee from the list? First, click MANAGE MY PAYEES. Then click Add Payee at the top of your payee list. You can add new payees to Citibank Online in a matter of minutes. Select the type of payee you wish to add from the drop-down menu.

For example, select to a Pay A Bill, search the category and click the organisation you would like to pay.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.