Should you add beneficiaries to your accounts? Do you have to have a beneficiary for a checking account? Does designating a beneficiary of a bank accoun? What does beneficiary on a bank account mean?

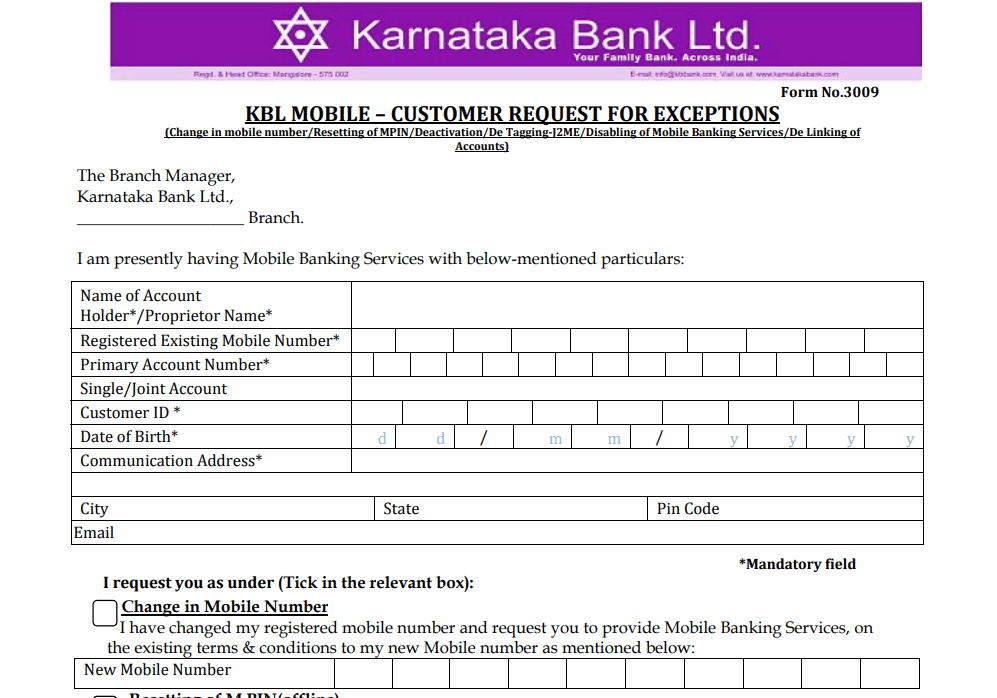

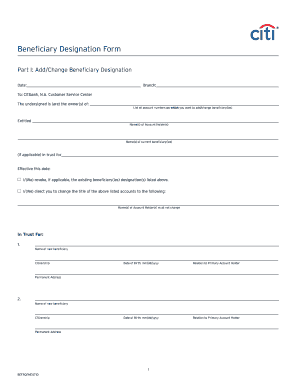

As a participant in the Plan, you will be asked to name a beneficiary (the person or persons or your estate that will receive benefits in the event of your death) and the percentage payable to that beneficiary. If you are married and you name someone other than your spouse as a beneficiary , an authorization form will be mailed to your home. United States and its territories. You must go to your bank in person to add the beneficiary to your account.

Bring along your photo I bank account information and beneficiary information. If you want to name multiple beneficiaries, you will need each beneficiary’s name and address. Your beneficiary does not have to be there, and there is nothing for the beneficiary to sign.

Enter the beneficiary ’s name and 20-digit Citibank account number, select the priority of payment, press “Next”, confirm by pressing “OK” 3. Checking accounts don’t require account holders to name a beneficiary. Sometimes your bank will ask for this information when you’re opening a new account, but they don’t always. And sometimes you can’t add or change beneficiaries online.