What is the Mtax form? Leave unused boxes blank. Do not use staples on anything you submit. Your First Name and Initial Last Name. In general, MEWAs are arrangements that offer health and other benefits to the employees of two or more different employers.

See full list on incometaxpro. The change affects those that received or paid alimony. Income Additions and Subtractions.

Register and subscribe day free trial to work on your state specific tax forms online. The written proof must contain the name and designation of the persons granting such authority. You must file yearly by April 17. MPlus is an annual membership that confers benefits for products and services offered by MFinance LLC and MSpend LLC, each a separate, affiliate and wholly-owned operating subsidiary of MHoldings Inc.

M” refers to MHoldings Inc. GIRO application will be updated in your account within working days. Welcome to the Minnesota Department of Revenue website.

We provide information to help you report and and pay Minnesota taxes, along with tax research, legislative information, and information for local governments. Please or Create an account to join the conversation. Monitor usages, subscribe for Value Added Services or view and pay bill easily. Endless Options Finally, a true Permobil quality solution for those users who require a more traditional rehab style seating system with limited to no power seat functions. Designed with adaptable seating and positioning needs in min the Moffers all the flexibility without the compromise.

Did the corporation file SEC Form 10-K for its income statement period ending with or within this tax year? List only the forms that report Minnesota income tax withheld. Round dollar amounts to the nearest whole dollar. The advanced tools of the editor will guide you through the editable PDF template.

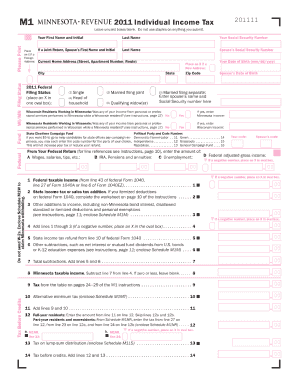

Enter your official identification and contact details. Schedule M1M may be used by taxpayers to add income additions and subtractions to their Minnesota income tax return. Minnesota Schedule M1M must be filed to determine what to write in lines and of the Minnesota Form M1.

The calculation for Schedule M-is done in reverse from the form itself. It’s called the Schedule M1. Schedule M-is required when the gross receipts of the partnership are greater than $2500 or the total assets are greater than $00000.

If you’ve got a partnership, it’s on page right underneath the balance sheet. Get the best value plans and offers. Enjoy a range of services with M, including SIM-only plan, Plan with Device, Prepai Fibre and other add-ons.

NOTE: Filed M-forms can be searched and viewed online once they’ve been reviewed and processed. Please allow week from the online filing date. Include this schedule with your Form M1.

If require include Schedules KPI, KS, and KF. The amount calculated by the program can be overridden on the Mscreen, line “Tax-to-book amortization adjustment. MHoldings is a technology company offering a range of financial products and services through its wholly-owne separate but affiliated operating subsidiaries, MFinance LLC and MSpend LLC.

A forum community dedicated to Mand M1A Rifle owners and enthusiasts.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.