To help homeowners deal with large assessment increases on their principal residence, state law has established the Homestead Property Tax Credit. Every county and municipality in Maryland is required to limit taxable assessment increases to or less each year. View a listing of homestead caps for each local government.

Technically, the Homestead Credit does not limit the market value of the pro. See full list on dat. Find the status of your Homestead eligibility by looking up your property on the Real Property database. The tax credit will be granted if the following conditions are met during the previous tax year: 1. The property was not transferred to new ownership. There was no change in the zoning classification requested by the homeowner resulting in an increase value of the property.

A substantial change did not occur in the use of the property. The previous assessment was not clearly erroneous. A further condition is that the dwelling must be the owner’s principal residence and the owner m. A final denial of a Homestead Tax Credit by the Central Office may be appealed within days to the Property Tax Assessment Appeal Board in the jurisdiction where the property is located. You (or your spouse, if married) are disable or.

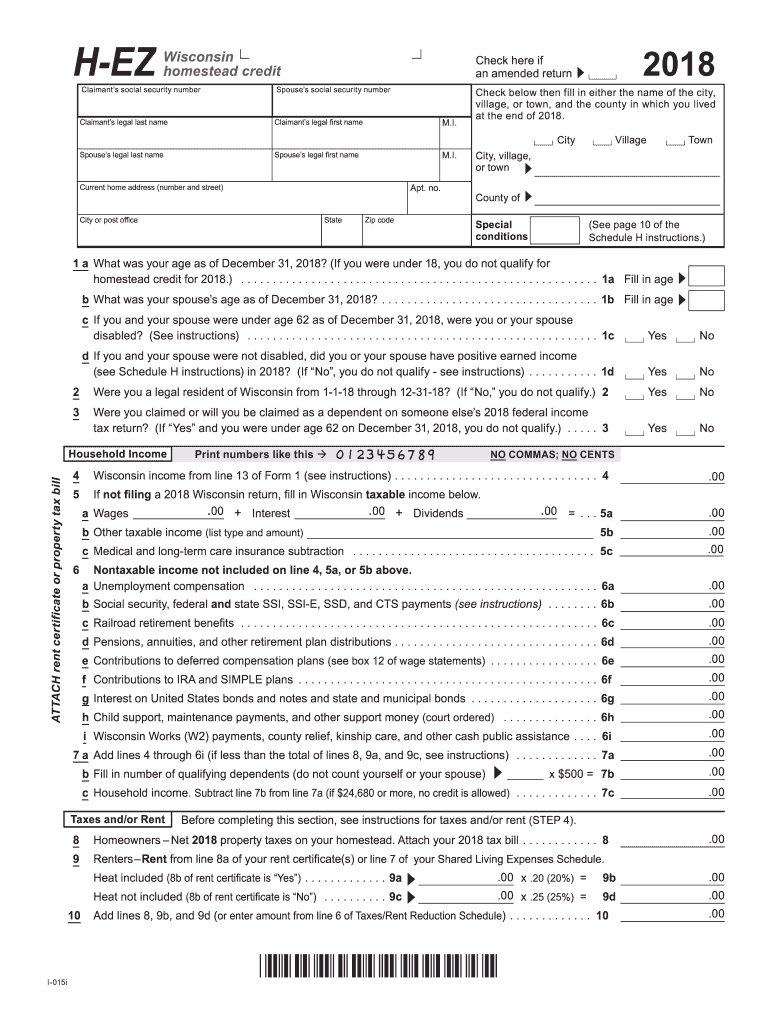

Get more information on Homestead Credit qualifications. The homestead credit program is designed to soften the impact of property taxes and rent on persons with lower incomes. A homestead credit claim may be filed using Schedule H or Schedule H-EZ. This fact sheet provides a general overview of the qualifications for claiming the credit , which schedule to file, and the credit computation.

What is the Homestead Tax Credit ? Provisions in Amendment will also freeze the current assessed value for taxpayers that are either disabled or years or older. The homestead property tax credit is a North Dakota property tax credit that reduces the property taxes of eligible individuals. Which home improvements are tax deductible? Can I get my overpaid property taxes back?

How to claim a Texas homestead credit? For most homeowners, the benefit is distributed to your municipality in the form of a credit , which reduces your property taxes. The Homestead Benefit program provides property tax relief to eligible homeowners. All Major Categories Covered. They’re called “homestead” exemptions because they apply to primary residences, not rental properties or investment properties.

You must live in the home to qualify for the tax break. The basic concept is that a homestead exemption permits you to pay property taxes against all but a set amount of your home’s assessed value. Put simply, there is a portion of your home’s value that you do not pay property taxes on if you have applied for and been approved for the exemption. Eligibility requirements: Individuals who are years of age or older, or individuals who are permanently and totally disabled. And if your income is $40or less per year.

The standard homestead deduction is either of your property’s assessed value or a maximum of $400 whichever is less. This credit can have a significant impact on your real estate taxes regardless of your property’s value or your income level. If you qualify, you can reduce the assessed value of your homestead up to $5000. There is a standard $20exemption plus an additional exemption up to $2000.

Property tax reduction will be through a “homestead or farmstead exclusion. Generally, most owner occupied homes and farms are eligible for property tax reduction. Only a primary residence is eligible for property tax relief.

Real Estate, Landlord Tenant, Estate Planning, Power of Attorney, Affidavits and More!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.