What do we mean by gstr-3b? How do you calculate gestation? The due date of your return is determined by your reporting period.

We can charge penalties and interest on any returns or amounts we have not received by the due date. Business Today on MSN. The GSTR due date of filing is 31st December of the next financial year. Addressing the press, Finance Minister Nirmala Sitharaman added that staggered filing will apply. Oct Provisional tax payments are due if you have a March balance date and use the ratio option.

Usually, a regular taxpayer has. If you use a registered tax or BAS agent, different dates may apply. Key dates If a due date falls on a weekend or public holiday, we can receive your return and payment on the next working day without a penalty being applied. GST Returns Due Date.

For persons with turnover in preceding financial year exceeding Rs. This is the second extension in as many months given. Filing Dates extended in view of COVID-pandemic GSTR-Taxpayers with annual aggregate turnover of more than Rs. How can I use the Returns Offline tool? Create, edit and fill out documents.

Send them for signing and automatically collect data. Returns , Due dates , Frequency of filing returns , brief details. After obtaining due clearances from the Election.

Central Board of Indirect Taxes and Customs (CBIC) tweeted. This now stands extended till October 31. Dear Friends, My self CA Vikas Sharma. I have introduced this channel for Accounts a. Pre-fill any document with your data in seconds.

Take advantage of automation Bots. No need to code, no additional skills required. Automate your worlkflow with airSlate. Vide Notification No. The said due dates are as per the Notification No.

E-invoicing will be voluntary in the beginning 77. While I announce th June as the date , specific regions. Due Dates for returns are NOT extended till June but the late fees are waived till the end of June. No: Due Date : Related to: Compliance to be made: 1: 11. Earlier, returns were to be filed by September 30.

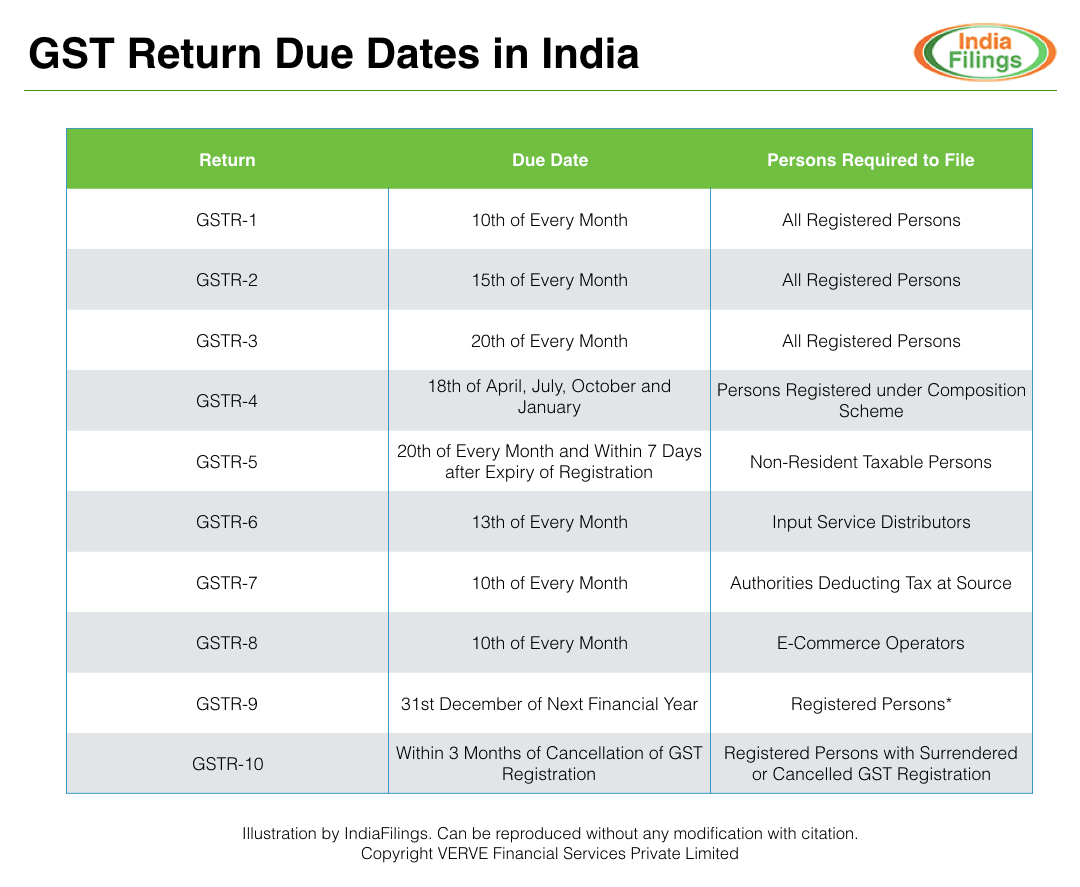

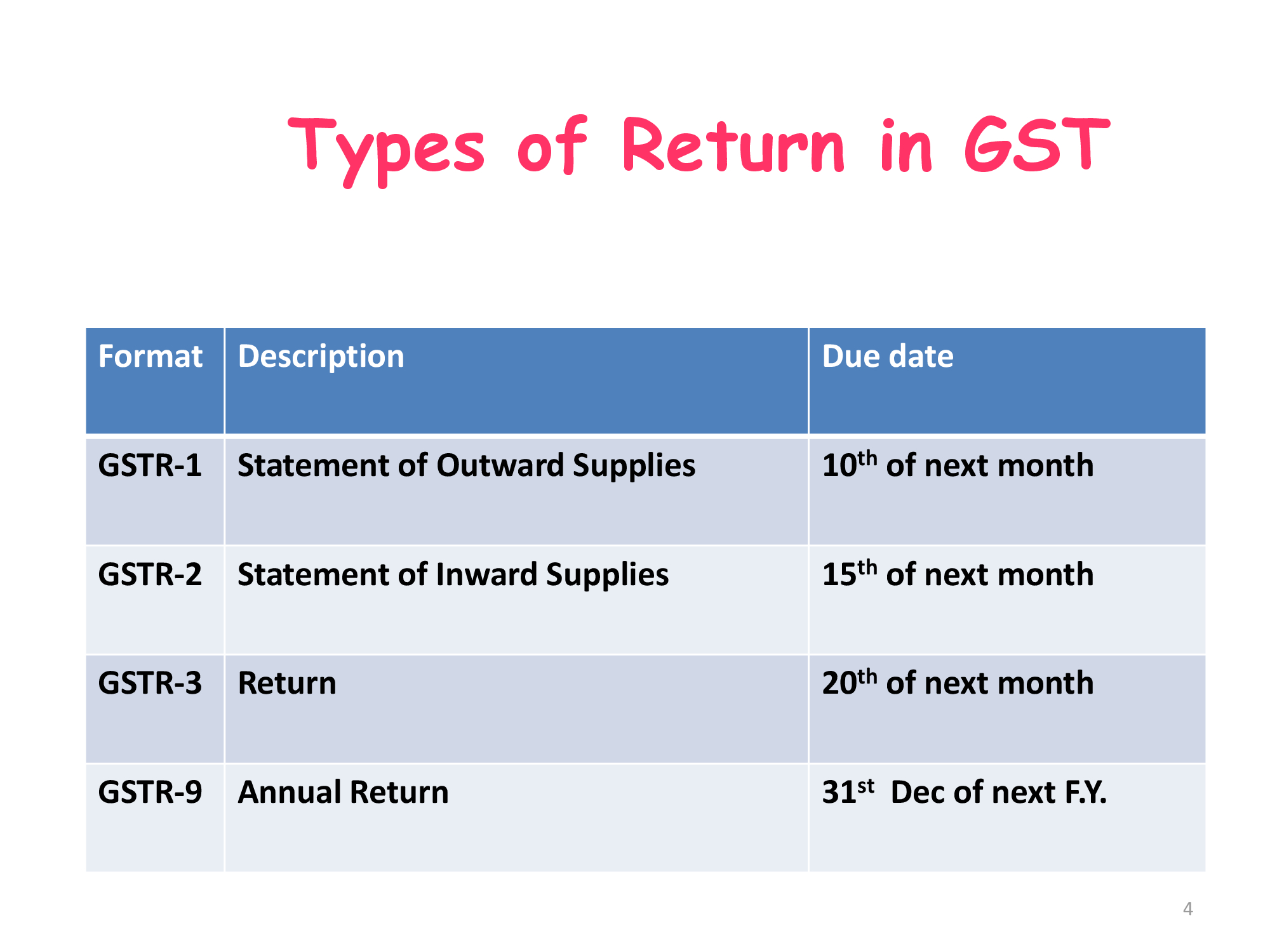

Till morning, taxpayers. In addition, regular late fee shall also be leviable for such delay along with liability for penalty. Let us discuss each return along with its due date. Note: GSTR stands for Goods and Services Tax Return. Government extending the GSTR due date , GSTR 3B due date and even the due dates for GSTR and GSTR 9C have been extended by the.

Interest, penalties, and additions to. Say, for example, a business is registered as ISD in Mumbai and have their branches spread across Bangalore, Hyderaba Gurgaon, and Kolkata. If the due date falls on a Saturday, Sunday, or legal holiday, file on the next business day.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.