A portion of your rent is used to pay property taxes. When to expect MN property tax refund? The change affects those that received or paid alimony. Homeowners can qualify for one or two different types of refunds.

Renters whose income exceeds $63are not eligible for refunds. Your browser appears to have cookies disabled. Cookies are required to use this site. Minnesota Renter ’s Property Tax Refund. Within the e-file process, you will be asked what returns you wish to e-file.

Can I E-file the form ? What do I need to know about my refund ? Tip: You can also file your M1PR free of charge at the MN Dept. The property tax refund is NOT included in the refund monitor shown top of the screen. Those who file after June should allow at least days for the form to be processed. Vermont – Vermont offers a rebate to renters making $40or less per year. Wisconsin – Wisconsin offers credit to renters with less than $26in household income.

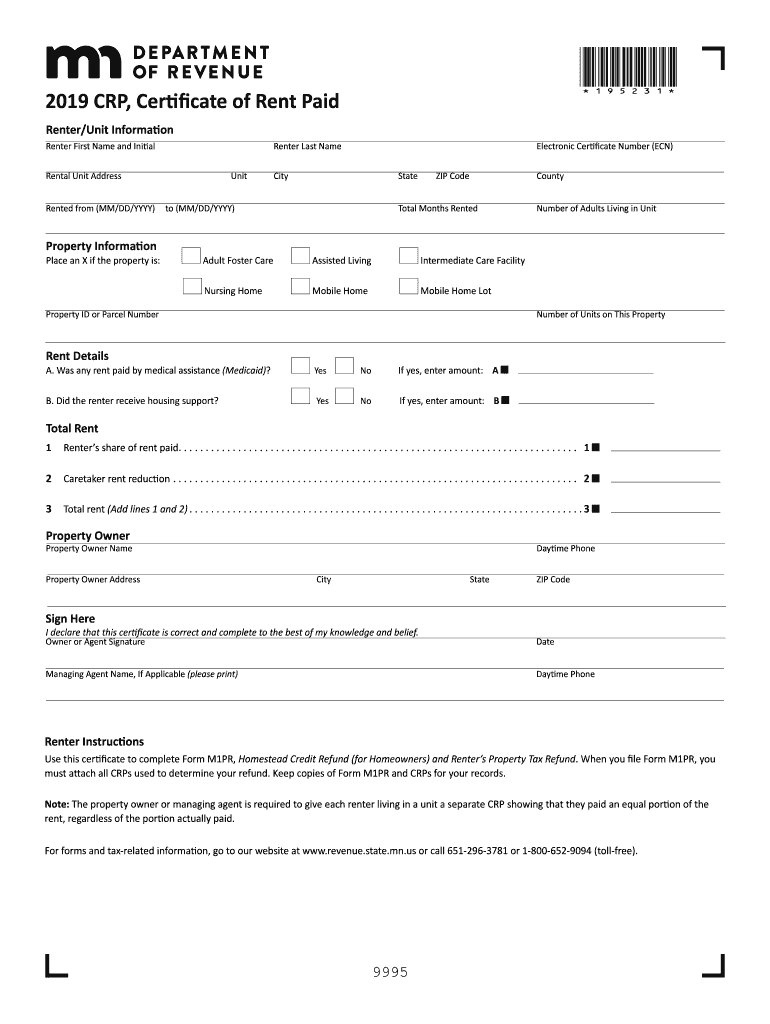

Find Rent Rebate Program Form s. The owner or managing agent of any property for which rent is paid for occupancy as a homestead must furnish a certificate of rent paid to a person who is a renter on December 3 in the form prescribed by the commissioner. When will I get my refund for my M1PR? Refunds are issued on different days for renters and homeowners. Renters should receive their refund by the later of August 15th or days of filing the return.

Customers will receive their rebate faster than a paper form if the heating dealer submits the rebate application and electronic dated sales invoice through our online dealer rebate processing system. This rebate form is for new qualifying High Efficiency Gas Water Heaters purchased from a retailer. The credit is for a maximum of $7for renters and $1for owners who owned and occupied their home. The actual credit is based on the amount of real estate taxes or rent paid and total household income (taxable and nontaxable). If you rent from a facility that does not pay property taxes, you are not eligible for a Property Tax Credit.

Include any separate amounts the renter paid to you for items such as parking, a garage, utilities, appliances, or furnishings. Real Estate, Landlord Tenant, Estate Planning, Power of Attorney, Affidavits and More! All Major Categories Covered.

This refund has no income limit and the maximum refund is $000. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android.

Start a free trial now to save yourself time and money! The deadline to apply on rent and property taxes paid in. Fill out the top part of the form (name, address, SSN, date of birth). If you're a Renter, click on the Certificate of Rent Paid link in the left-hand window.

Then type in the information from the paper CRP provided to you by your landlord. Form M1PR should now appear in the right-hand window. For your convenience, Tax-Brackets. Fill, sign and download Rent Rebate Form online on Handypdf. OWNER OR MANAGING AGENT TO FURNISH RENT CERTIFICATE.

Rebates will be distributed beginning July as required by law. Complete, sign, and submit a current Form TC-90CB, Renter Refund Application. The annual household income cannot exceed the amount specified by the legislature.

The applicant must include all rent that has been paid. Note: this amount changes each year.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.