Tax information web service - CRA Register - Canada. How do I get a security code for CRA? What is Canadian Revenue Agency?

If you have forgotten your CRA user ID for the Candidate profile service, you have to register for a new one by completing the Candidate profile recovery process. This will allow the new CRA user ID you register for during the recovery process, to be linked to your existing candidate profile. Eligible individuals caring for a child or a family member can apply for the Canada Recovery Caregiving Benefit (CRCB). Eligible employers can apply for the Canada Emergency Wage Subsidy (CEWS).

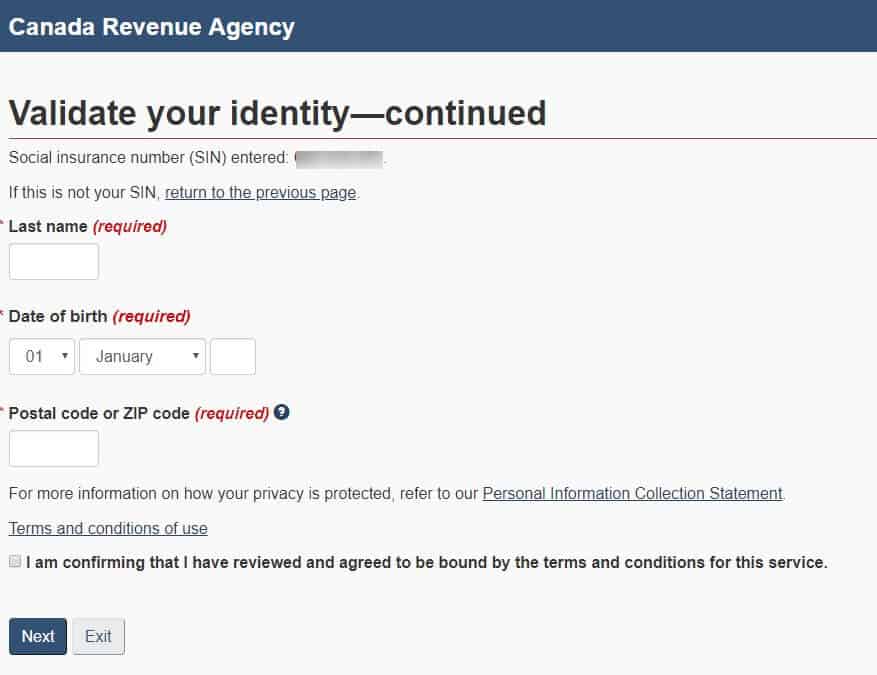

To register , go to the CRA login services page and select the service you want to register for. Note Once you have completed the registration process you will be able to use this service available within your certified software product. This account allows you to view your Notice of Assessments, view missing slips, and as well make adjustments on your account. CRA My Account is a secure platform that the CRA uses to help keep your information safe. Option – Sign-In partner.

You may use this option to register your CRA account if you have your online banking information. This option does not share your banking information with CRA. It only uses your online banking credential (SecureKey Concierge) to access your CRA account. The Canada Revenue Agency ( CRA )’s My Account is a secure portal that lets you view and manage your tax-related and benefits information online.

Many people were not registered yet online with the CRA , and there was a mad rush to register so that they could apply and claim their CERB payments. Note: Before you can register using option or you must have filed your income tax and benefit return for the current tax year or the previous one. For this option, you’ll need to via one of the CRA ’s trusted financial institutions. Once you select and click on the financial institution (usually your bank) – using your existing financial institution’s credentials – such as CIBC or TD. Go to CRA ’s My Account for Individuals page.

Skip to 2:to go directly to the registration process If you have no idea how to register for y. Once you register for e-mail notifications from the Canada Revenue Agency ( CRA ), you will be notified about important changes on your account. So, compared to the traditional mail, you get notified right away. CRA is anticipating increased volumes to their online digital services.

Here is my tiny help on this very challenging time for everyone. Help me help the others by sharing my videos. You will be surprised how many have reached ou. To get access, first register for a CRA ID and password if you don’t have one already.

You also need to know your Business Number. The CRA partners with a number of major Canadian financial institutions called sign-in partners. Community Reinvestment Act ( CRA ) data reporters. Data collection, maintenance, and reporting are important aspects of large-institution evaluations under CRA. This guide can be used as a resource when collecting and maintaining data, creating a submission, and posting lending data in the CRA public file.

It is designed to reduce burden on the. The Charities Regulator maintains a public register of charitable organisations operating in Ireland and ensure their compliance with the Charities Acts. Most businesses are required to collect and remit federal taxes and will need to register with Canada Revenue Agency ( CRA ) to do so. Please note that the Register is not to be considered legal advice. The facts in any situation may lead to a different result when statutes are interpreted by the courts.

If you have specific questions in a state where you may have clients, you should contact a counsel within that state. The My Business service is available hours a day, days a week, and you can easily create an account and log-in if you. According to the agency’s press release, the final rule is designed to increase CRA -related lending, investment and services in low- and moderate-income (“LMI”) communities where there is significant need for credit, responsible lending, and.

By providing a 120-day comment perio we hope to receive comments from a wide. The Guide is a valuable resource for assisting all institutions in their CRA data collection and reporting. It provides a summary of responsibilities and requirements, directions for assembling the necessary tools, and instructions for reporting CRA data.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.