However, the moment the flat’s lease falls below 6 to 5 he is only able to use. CPF for purchasing residential properties and HDB loan limits will take effect - for both HDB flats and private properties. A subscriber shall subscribe monthly to the Fund except during the period when he is under suspension. Subscription to Provident Fund are stopped three months prior to the date of superannuation. Rates of subscription shall not be less than of subscriber’s emoluments and not more than his total emoluments.

CPF Contribution for Employees pYour employer is required to pay your CPF contributions every month if you earn more than $per month. Information on Retirement Sum Scheme that provides CPF members a monthly income to support a basic standard of living during retirement. Information about CPF for retirement, housing and healthcare needs for employees and self-employed persons.

The VSB Clients’ Protection Fund Board is seeking public comment on proposed amendments to Clients’ Protection Fund rules. DollarsAndSense explains what these new rules are – and how they might affect you. If not, the use of CPF will be pro-rated. There is still a minimum lease requirement for the use of CPF for property purchases.

These amendments to the IFAB Laws of the Game applicable to CP Football (also known as Football 7-a-side) should be read in conjunction with the current issue of the IFAB Laws of the Game which are available. Current rules dictate that CPF money may be used to purchase older HDB flats, but there are restrictions as to the amount that can be used if the remaining lease of the flat is less than years. If you own a property and choose to pledge it or have a sufficient CPF property charge on your property, you will be able to withdraw your CPF savings in excess of your CPF Basic Retirement Sum. For purchase of vehicle, a central government employee can withdraw per cent of the amount at disposal in the GPF account or per cent of the cost of vehicle whichever is less.

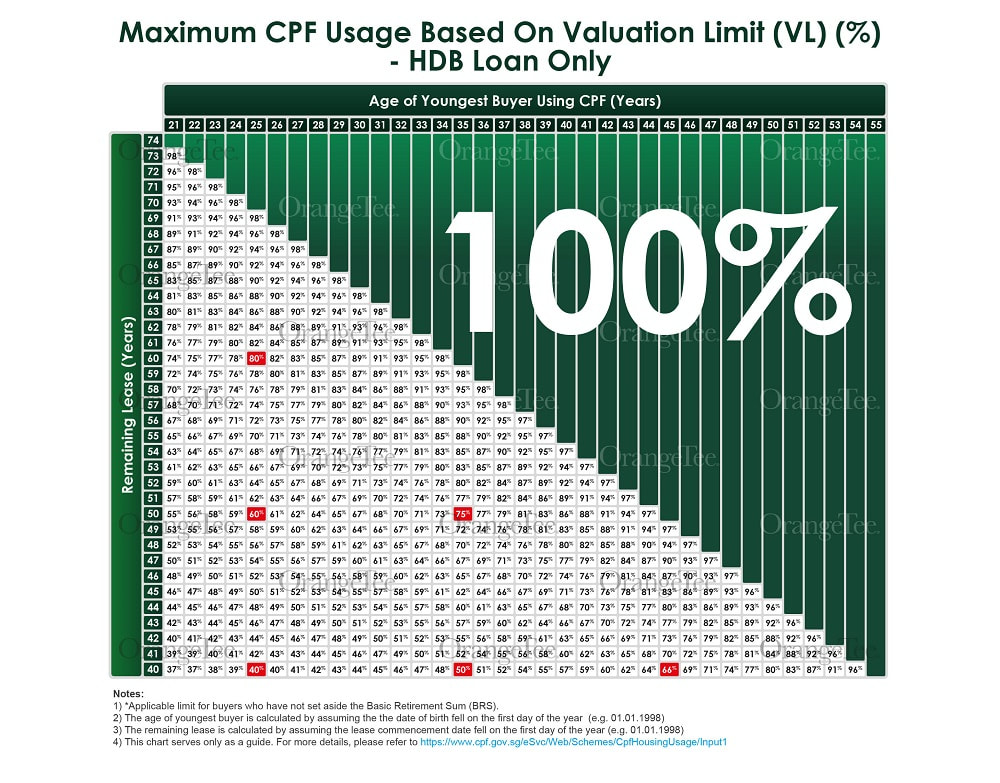

With the new rules, Singaporeans will now have more flexibility in using their Central Provident Fund (CPF) when purchasing older properties. The introduction of new rules on the use of Central Provident Fund (CPF) savings as well as Housing and Development Board (HDB) loan restrictions when acquiring a flat has given more hope to owners of ageing HDB flats who have been looking to sell their units for quite some time. Rules clinic provided by Johan Smith. Home buyers will be allowed to obtain maximum CPF usage and HDB housing loan (for HDB flat buyers) if the criteria is met, else the amount will be pro-rated.

The proposal would provide consumers with clear protections against harassment by debt collectors and straightforward options to address or dispute debts. Actually the focus should not be on the remaining lease of the flat. The Ministry of Manpower (MOM) is reviewing the payout duration of the Central Provident Fund ( CPF ) Retirement Sum Scheme (RSS), which currently can extend to pay members as old as years of age. His modified adjusted gross income is $12000. The Commission adopted a package of new rules and rule amendments to establish recordkeeping and reporting requirements under Title VII of the Dodd-Frank Act.

RECORDKEEPING AND REPORTING RULES FOR SBSDs, MSBSPs, AND. RULES OF THE CLIENTS’ PROTECTION FUNDOF THE VIRGINIA STATE BAR. This will change with the new CPF withdrawal rules. Proposed Clients Protection Fund Rules. Homebuyers looking to purchase older flats from May onwards will be able to benefit from new Central Provident Fund ( CPF ) rules and will announce details of changes to CPF rules soon.

Meanwhile as compared to the same period last year, the withdrawals from CPF members aged and above have gone down, which the total amount withdrawn has declined by near to per cent in. The final rule will mitigate the harmful impacts of Obamacare and empower states to regulate their insurance market. We spell out the limits and other IRS HSA rules that will help you save money. The aim of amending the rules was primarily to improve the demand for older flats, so that the value of older flats may be maintained for longer.

Loan Provsioi n Adopting Release. Previously, no CPF funds could be used to buy a flat below years old while. CPF payouts aim to benefit members.

SINGAPORE — Most younger buyers of resale flats with leases that expire before they turn will be able to use less of their Central Provident Fund ( CPF ) savings for housing, said the. Here are some of the areas where employers and payroll administrators can inadvertently go wrong. Employers in Singapore are increasingly introducing flexible benefits schemes as they compete to attract the scarce talents they need. In addition, CPF members aged and above will earn an additional interest on the first $30of their combined balances, and up to on the next $3000.

As a result, CPF members aged and above will earn up to interest per year on their retirement balance.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.