What is section of CGST Act? Who is required to take GST registration? When GST registration is required? Thus, there are no centralized registration under GST , person having multiple place of business in a state or union territory may be granted a separate registration for each such place of business subject to such conditions as may be prescribed. For states like Manipur, Mizoram, Nagaland and Tripura, the limit is Rs.

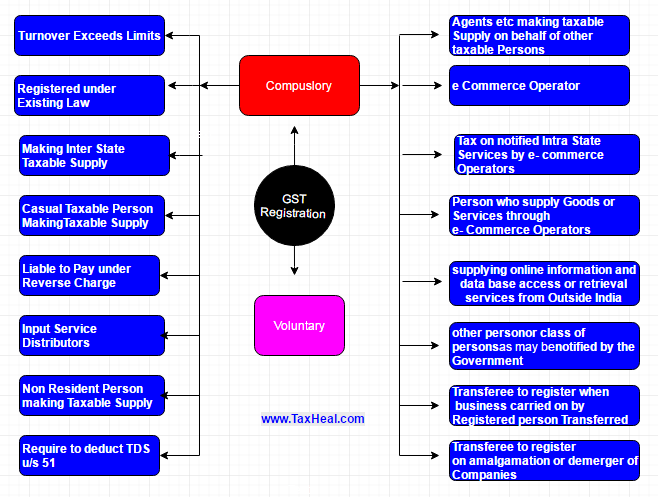

There are certain category of persons who are required to register under GST compulsorily. Apart from this, individuals who are mandatorily required to take registration under GST are defined in section of the GST Act. One who is required to obtain multiple registrations in different States or within one State would be considered as distinct person in each State. The current article explains both the aforesaid provisions. See section of CGST.

Notwithstanding anything contained in sub- section (1) of section 2 the following categories of persons shall be required to be registered under this Act. The provision of compulsory registration has been diluted in the wake of various relaxation granted in the GST councils meeting held recently. Subject to the provisions of sub- section (12) of section 2 where the application for grant of registration has been approved under rule a certificate of registration in FORM GST REG-showing the principal place of business and additional place or places of business shall be made available to the applicant on the common portal and a Goods. Persons engaged in making supplies of specified goods such as Ice cream and other edible ice, whether or not containing cocoa. A casual taxable person or a non-resident taxable person shall, at the time of submission of application for registration under sub- section (1) of section 2 make an advance deposit of tax in an amount equivalent to the estimated tax liability of such person for the period for which the registration is sought.

As per section (vii) of the CGST act, you need to compulsory registered under GST. Reproducing the section for you reference. Hence, if a small businessman is registered due to that, he will have to continue with the registration. Legally recognized person as supplier of goods or services.

Authorized to collect tax from the customers and deposit as per Rules. I am an agent do I need GST registration ? If person is making supply under Principal and agent basis then he need to get himself registered and prov of sec. I am service distributor, do I need GST registration ? They are the e-commerce operators.

Section -: Amendment of registration. Any non-resident taxable person making taxable supply. Taxable person carrying on interstate supplies. This list includes the following: Any person required to pay tax on reverse charge. State-vide liability for registration Under GST Exemption Limit vs.

Yes, registration is compulsory if you are selling goods online through E-commerce portals maintained by E-commerce operators. Registration Limit Threshold of Rs. In this case, registration has to be taken without any threshold limits. Persons who are mandatorily required to obtain compulsory registration under section of the CGST Act. Under this section , eleven category of persons are specified to take compulsory registration.

Entry no (vi) of Sec- (1) deals with registration requirement of persons who are required to deduct tax under section 5 whether or. Integrated Tax, dated. Person engaged in supply of Ice Cream, Other edible ice, Pan Masala, Tabacco, and Manufactured Tabacco substitutes. GST – Compulsory registration in certain cases.

GST registration is mandatory for particular businesses such as Export and Import, E-commerce, Casual Dealers, and also the Market Place Aggregator. Whether a supplier of goods or services supplying through e-commerce operator would be entitled to threshold exemption? Earlier as per section , Every E-commerce operator was compulsorily required to get registered under the GST Act.

Upon registration of business vertical is the same State, new GST Identification Number (GSTIN) will be allotted with a change in entity code. A complete guide to resolve your rejected GST application. Read more about the reasons for rejection of gst registration , downloading gst registration rejection order, reactivate cancelled GST and how to apply for gst registration after rejection. Nevertheless, a person needing to deduct tax under section may have, in lieu of a PAN, a tax deduction and collection account number issued under.

The amount payable under sub- section (5) shall be calculated in such manner as.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.