Ready To Get Started? Schedules – contains the information and schedules that companies might need to complete and attach to the tax return. General information – contains.

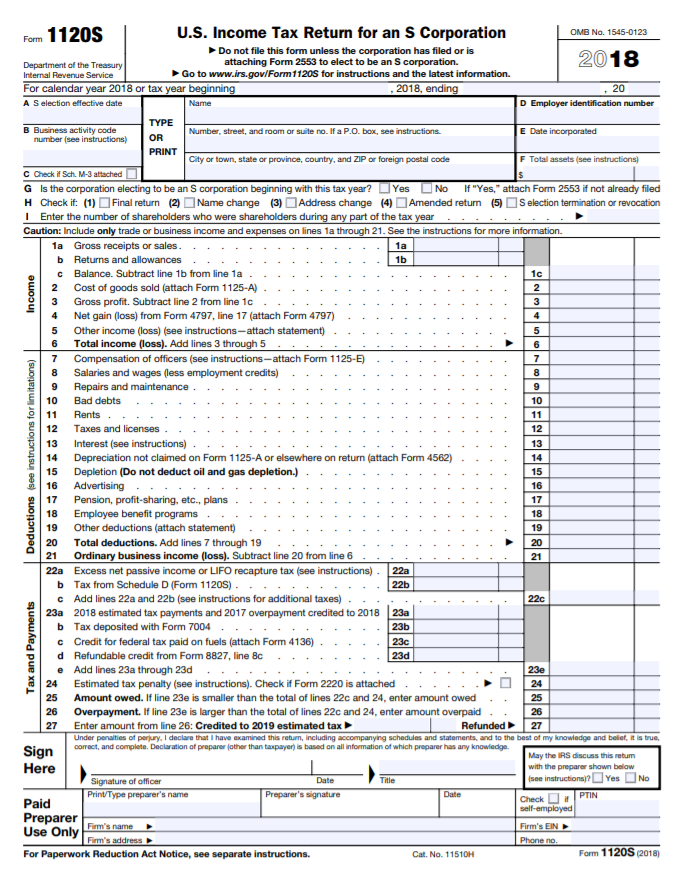

Corporation Income Tax Return. Life insurance companies. Foreign-owned domestic disregarded entities. This authorization applies only to the individual whose signature appears in the “Paid Preparer’s Use Only” section of the return.

Who needs to fill out IRS Form Schedule B? Who must file an IRS Form 706? What is a Schedule B IRS Form? Interposed entity election status.

If the company has an existing election, write the earliest income year specified. Unless exempt under section 50 all domestic corporations (including corporations in bankruptcy) must file an income tax return whether or not they have taxable income. Wherever You Are In The World. The authorized extension of time to file does not extend the time for payment of the income or franchise tax due.

Interest and penalty will apply on any underpayment of tax. The return should be mailed to: Department of Revenue P. If a federal income tax return was not file use the same accounting method that would have been used if a fed-eral return was filed. Riders If space is insufficient, include riders as PDFs in the.

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Most businesses must pay the $PBF tax. A unitary group of corporations must pay $for each corporation required to file in Idaho , whether the corporations file individually or the unitary group includes them in a group return. Arkansas corporation income tax.

Federal income tax purposes, Section 163(j) limits the deductibility of interest expense in the current tax year of certain U. K-120AS Instructions 15. GENERAL INSTRUCTIONS FILING FORM 500. Form 5must be filed electronically if the corporation plans. Form 500CR or the Heritage Structure Rehabilitation Tax Credit from Form 502S. Your Taxes Done With Ease.

Any tax not paid when due is subject to interest from the time the tax was originally due at the rates of per annum ( per month). Register and Subscribe now to work with legal documents online. Individual Income Tax Return.

C corporation returns are fi led on form TC-20. Please review the mandate before mailing a paper return. We may reject your paper return or. See the instructions for line 34.

Because of recent changes to federal Forms W-and W-4P, Oregon has a separate withholding statement for state personal income tax withholding. CT-51: Instructions on forCombined Filer Statement for Newly Formed Groups Only: CT-60: CT-60-I ( Instructions ) Affiliated. Estimated payments are broken into four equal payments of of the estimated tax. These payments are due April 1 June 1 September 1 and December 15. Do NOT submit disks, USB flash drives, or any other form of electronic media.

Electronic media cannot be processed and will be destroyed.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.