For best , download and open this form in Adobe Reader. You can view this form in:. Required Documents Important – If the following required documents are not provide your request will not be processed. Application processing fee of $50. Two completed fingerprint cards (FD-258).

Attach these to the application form in lieu of a Live Scan receipt. There is an additional $49. What is a clearance certificate template? Can I Lodge a clearance certificate?

How long does it take to complete a clearance certificate? The clearance certificate template is a document that is issued to provide a proof that an individual has paid all its tax liabilities. The certificate verifies that there is no amount of tax which is needed to pay.

The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!

At the top of the form, enter today’s date. Tax file number (TFN) or Australian business number (ABN) To assist prompt processing of this form, if available, provide the entity’s TFN or ABN. We will use the TFN to identify the entity in our records. By signing, applicants are attesting to their current residency status.

See full list on irs. In this situation, the applicant must sign the standalone submission under penalties of perjury, applying the rules in the. In this situation the taxpayer may have to provide additional forms to the IRS which authorizes the IRS to deal with the third party appointee. Partnerships and LLC(s) treated as partnerships for federal tax purposes 3. Corporate Subsidiaries 6. Exempt Organization 8. Disregarded entities 9. VAT imposed by a foreign country.

In connection with a VAT request the United States can certify only to certain matters in relation to your U. VAT exemption in a foreign country. Residency for Tax Treaty Purposes 2. Tax Treaties Note: This page contains one or more references to the Internal Revenue Code (IRC), Treasury Regulations, court cases, or other official tax guidance. References to these legal authorities are included for the convenience of those who would like to read the technical reference material. To access the applicable IRC. Get a clearance certificate.

Step 1: Find a contractor Search by account number or using advanced search. Open the PDF containing the signature. Open the Signatures panel, and select the signature.

On the Options menu, click Show Signature Properties, and then click Show Signer’s Certificate. Clearance certificate meeting requirements in (2)(a) above. An employee clearance form is not only provided for those employees who are resigning, but also for those who were terminated or transferred to a different department.

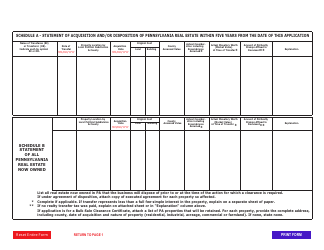

This is the last requirement that the employee should comply before leaving permanently. For each property, provide the complete address, including county, date of acquisition and nature of property (residential, industrial, acreage, commercial or farmland). Wait for the Barangay employee(s) to process your document.

Remember to review your Barangay clearance and see if authorized signatures are indicated and appropriate name, place and date are also correctly.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.