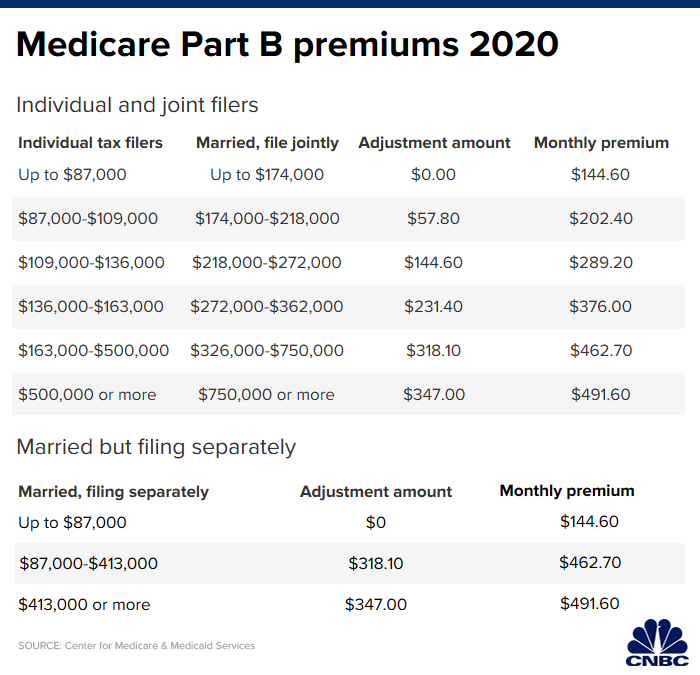

Medigap Plan G allows yous to keep your Doctor and Medigap G pays the. However, the amount of this premium can increase based on your income. Other articles from healthline. For those who fall in a higher income bracket, you could pay as much as $491.

Some examples of the costs that may be covered by Medigap. Health Insurance Enrollment is Now. Find Your Best Policy Today. Part B premiums went from $135. Get Your Free Quote Today!

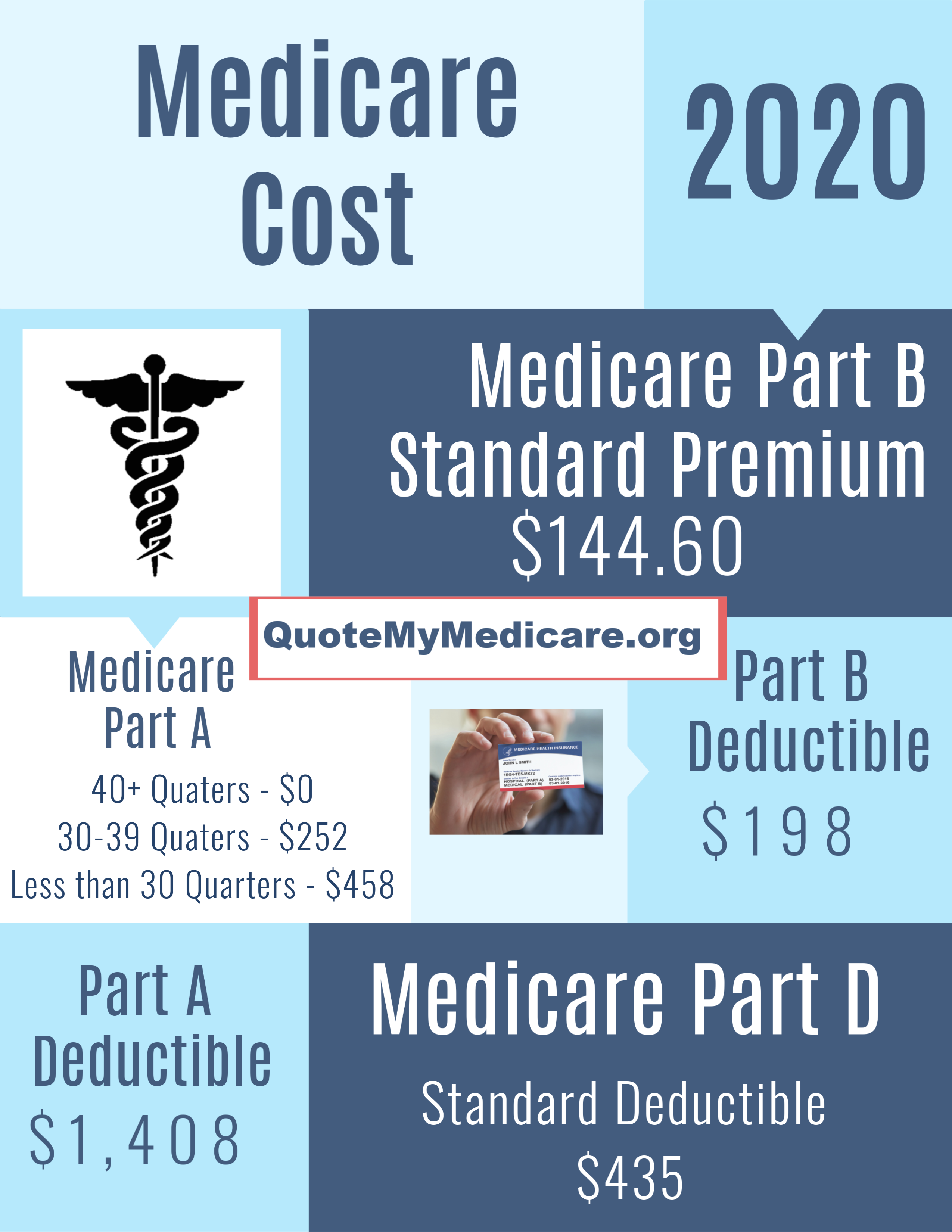

So a monthly increase between $and $in just one year would have been unusual — and difficult for many recipients to afford. Save when you join AARP and enroll in Automatic Renewal for first year. It covers medical treatments and comes with a monthly premium of $144. A small percentage of people will pay more than that amount, if reporting income greater than $8000. Preventive Care And Services Are Important, Make Sure Your Plan B Works For You.

We Will Walk You Through Plan B Enrollment, Call And Speak To A Live Agent Today. The $1annual deductible equates to $16. This means that a Plan G with a premium of no more than $16. Therefore, people from different income brackets pay varying premiums.

This policy covers outpatient and preventative services such as hospital visits and disease screenings. Medigap policies typically don’t have their own deductible. Manage Your Care Cost Effectively By Understanding Your Plan B Options. Back then, folks paid $a month for it.

If you are in a higher income bracket, though, you may pay have to pay more. The penalty could be as high as a increase in your premium for each 12-month period that you were eligible but not enrolled. Your premium may be a bit higher if you have a high income.

Which is Best for You? Most Comprehensive Plan. Less Expensive than Plan F. You Choose Best Bran for You. Plans, with Newest Coverage!

While this is expected to be the standard premium amount, premiums are based on income levels. It also comes with a $198. Medicare beneficiaries pay. Apply Online or Call Now To Save $! Some recipients won’t pay the full standard premium due to a “hold harmless” provision. That’s a nearly 7- increase if you’re paying the standard premium.

As always, if your income decreases, your premium may be reduced. For seniors living on a retirement income, it’s important to know where the increase in cost is coming from. You also may pay more — between $202.

The higher your income, the higher your premium. Social Security benefits will pay less due to the “hold harmless” provision.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.