What are the main features of GST payment process? Do I need to pay GST on advance payment? How to pay GST online? Every registered business and taxpayer is required to pay their taxes after setting off their Input Tax Credit (ITC ). Indian businesses are in for a learning curve — the payment process under Goods and Services Tax (GST) differs drastically from current procedures. The GST payment process.

Namely, each step of the process — like all other aspects of GST — now occur online within the GST portal. Under the GST rule, every taxpayer is required to pay any balance GST liability. GST payment is the difference between the input tax credit and outward tax liability.

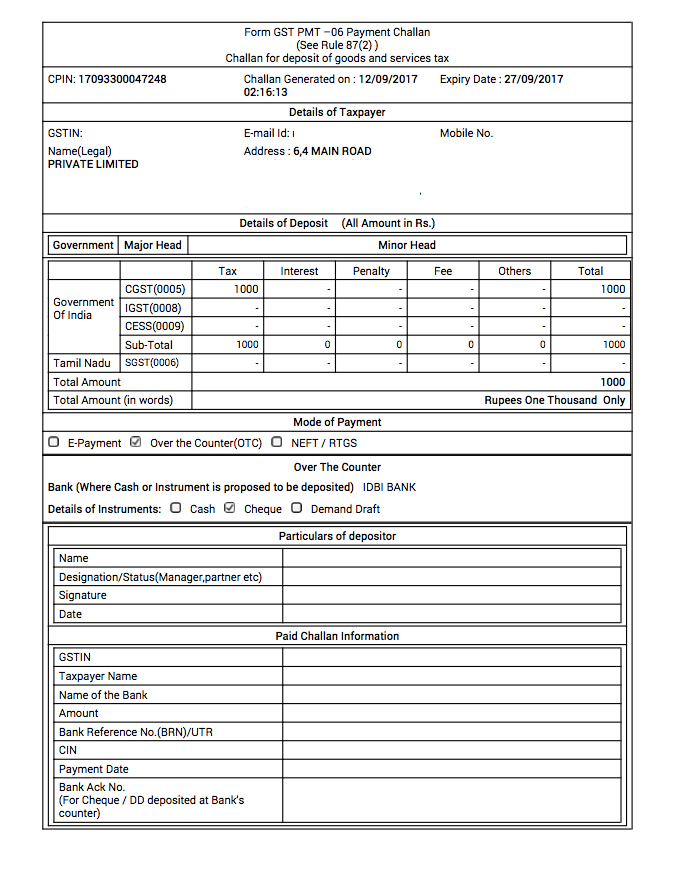

Know more about GST payment due and how to pay it. Taxpayer can make GST Payment either by using Internet banking or by use of credit or debit card. They also have an option to make payment through challan. Here, FAQs are prepared relating to GST Payment and rules relating to the same.

Online E-challan shall be generated from the GSTN Portal for all modes of tax payment. Firstly, ensure that you have filled all the details. We have written a blog on the process of GSTR-3B preparation which you can find here – Prepare and submit GSTR-3B. Once all that is done, click on PROCEED TO PAYMENT from below in the official GST Portal. Process involved in e- payment of GST.

Stakeholders involved in GST e- payments. Kuber System payment for GST. GST tax payment through internet banking, debit car credit card and authorized banks. Modes of payment for GST payments.

Features of GST payment process system. A taxpayer under GST can make payment of tax, interest, penalty, fees and other payments by creating a challan on the GST Portal i. GST portal has multiple options through which you can make tax payments : Over the Counter Payments. Over the counter (OTC) payments can be made if the GST payable is less than Rs. There are currently unique GST payment ledgers: There are currently unique GST payment ledgers: Electronic Tax Liability Register – This GST payment ledger features all the GST and GST -related liabilities of individual taxpayers such as tax, interest, penalty, late.

Electronically generated challan from GSTN Common Portal in all modes of payment and no use of manually prepared challan 2. Status of the payment will be updated on the GST Portal after confirmation from the Bank and RBI to GST portal xiv. Login to the GST Portal with valid credentials ii. Before GST , there were three major types of taxes in India. CST was applicable for all interstate movements of goods and there was no input tax credit option for this tax. I need your help for making payment of GST for the month of July and onward.

Excise duty applied on the capital goods. I am using following steps for making payment. Here is the step by step procedure explaining how to create DRC challan for making payment. Interest, late fee, penalty and others are to be paid separately for central tax and state tax. Composition Scheme is a simple process under the GST law for all the taxpayers, so that they can get rid of the difficult formalities and have to pay the GST at a fixed rate based on the turnover.

This scheme is opted by the taxpayer whose turnover is less than Rs 1. Post redirection to GST portal following screen shall appear. Lodge your Grievance using self-service Help Desk Portal.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.