Goods And Services Tax. My Payment lets individuals and businesses make payments online from an account at a participating financial institution, using the CRA website. For more information, go to My Payment.

Another online option is to authorize the CRA to withdraw a pre-determined payment from your bank account to pay tax on specific dates. Attention CBIC Officer: The facility to log a web ticket for CBIC officer has been migrated to CBIC-ACES- GST application. How to pay GST online? What is gstin number? If your due date is a Saturday, Sunday or public holiday recognized by the CRA, your payment is on time if we receive it on the next business day.

It may also include payments from provincial and territorial programs. My Payment is an electronic service that lets you make payments directly to the Canada Revenue Agency (CRA) using your bank access card. You cannot use credit cards with My Payment.

Steps for GST payments - Online Log on for GSTN PORTAL and select echallan and Register yourself for the first time. Login With User ID and Password. Status of the payment will be updated on the GST Portal after confirmation from the Bank. Select PNB Bank Menu from Epayment Option. Confirm and Submit for making payment.

First of all, you are login GST portal by using user id or password for creating a payment challan and if you want to create challan before login then you should use this process. To make the GST payment in pre- login mode, perform the following steps: 1. Thus it is essential that every business is aware of the required GST payment formats, calculate the correct GST payment , follow the GST payment dates and accordingly pass the GST payment voucher in their books, so that GST payment can be. Please DELETE the same. CGRO on 9th floor, G-Wing, GST Bhavan, Mazgaon, Mumbai.

Your GST payment is due on the same day as your GST return. This is the 28th of the month after the end of your taxable period. For example, the taxable period ending May is due June.

Block will be used to display browser versions to be supported by portal. Taxable period ending November is due January. Supports: Firefox 10. Internet Explorer 10.

Payment of Octroi Duty - HDFC Bank allows to make online payment of MCGM Octroi Duty using NetBanking service. Now pay Octroi Duty to MCGM online! You were liable to pay a variety of taxes like service tax, value-added tax, and several other indirect taxes charged by the Central and the State government.

Click on services – payments – create challan option – enter you details. The Payment Slip is issued together with your Tax Bill if you are not on a GIRO payment plan. For Individual Income Tax payments , select IRAS-INCOME TAX and enter the NRIC or FIN Number. The GST Voucher is given in three components - Cash, Medisave and U-Save. Citizens may check their eligibility details and update their payment instruction at the GST Voucher website.

Now lets move to the major features of the proposed payments procedures under GST are as. Electronic Payment Modes. Generate challan online as a proof of GST payment.

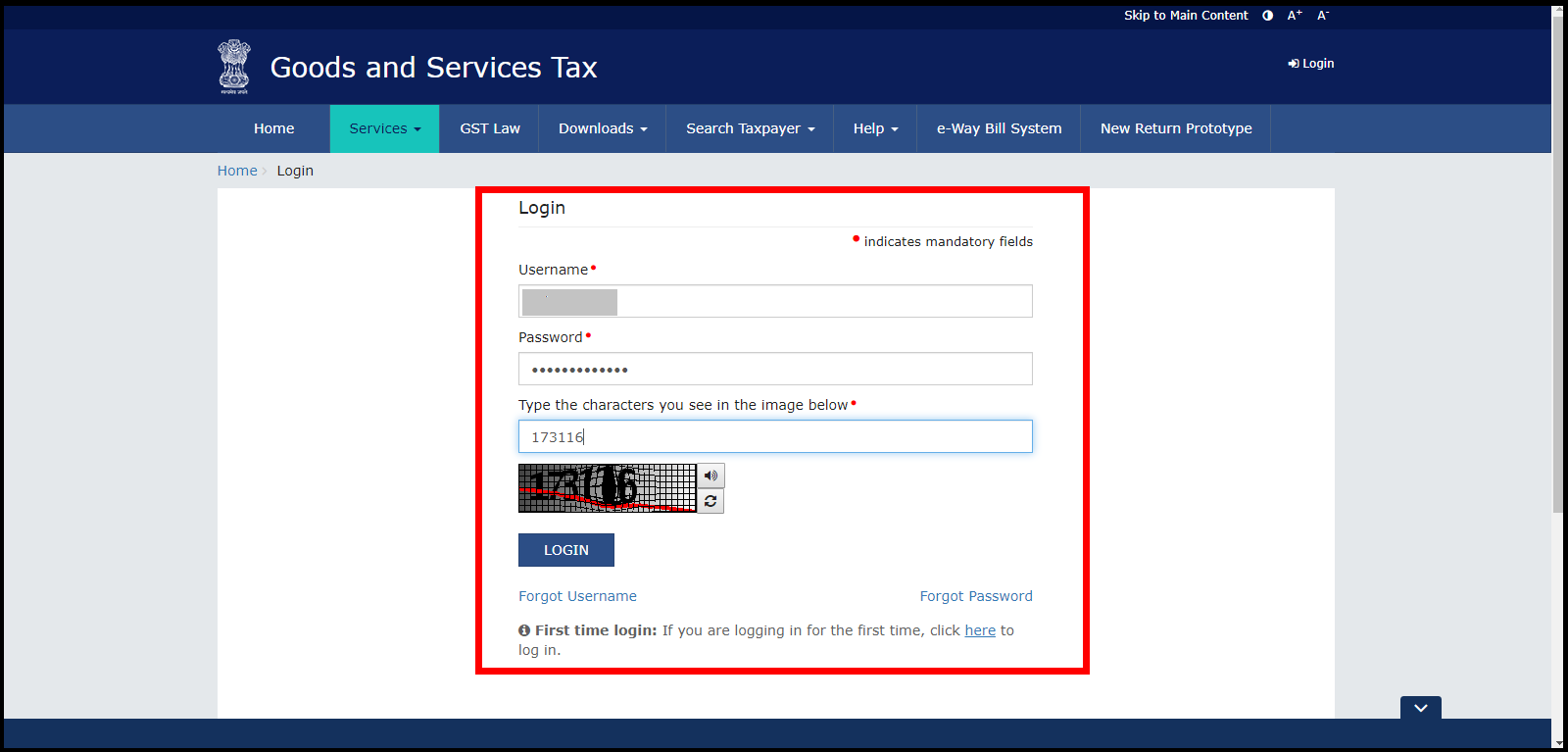

Steps To Follow to Make a GST Payment Go to the official GST website and enter your username, passwor and the given captcha code and login to your account on the GST Portal. Whether digital payment tokens or fiat currency are used to purchase goods and services, GST is chargeable only on the supply of goods and services, unless the supply is an.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.